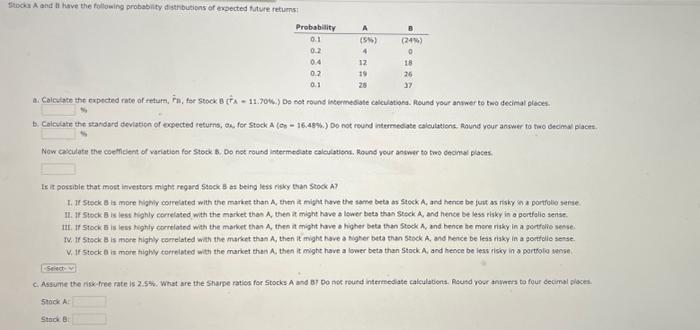

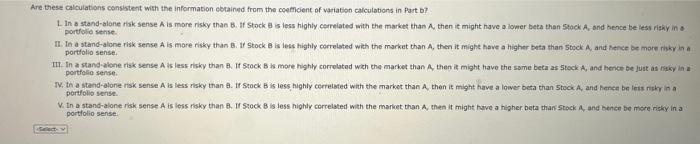

Stock A and A have the following probabilty dlatr butions of expected future retums: Is if possibie that moet inveiters might regard Stock 8 as being less risky than stock a? 1. Ir stock i is more highly correuted with the market than A, then it might have the same beta as stock A, and hence be jurt as risky in a portfolio serse. II. If Stock B is less highly correlated with the market thas A, then it might have a lawer beta than Stock A, and hence be less elsky in a gortfalio sense II. If stock a is less highily cocrelated with the merket than A, then it might hwe a higher beta then Stock A, and bence be more risky in a gortolie seose. I. If Stock 8 is more highly correlated with the market than A, then it might have a Avgher beta than stock A, and heice be less riaky in a gortfile sense. c. Assume the nick-free rate is 2.5\%. What are the Sharpe ratios for Stocks A and Br Do not round intermedlate calculations. Rautd ros ansers to four cecimat slacei. stain Bi Are these Galculations consistent with the information cotained from the coefncient of variabon calculations in Part b? L. in a stand-blone thak sense A is more risky than B. If Stock B is less highly cerrelated with the market than A, then it might have a lower beta than 5 stock A, and hence be iess riaky in a portelene sense. 11. In a stand-alone risk sense A is more risky than B. If Stock B is less highliy correlated with the market than A, then it mighe heve a higher beta than 5 bock A, and hence be more risky in a portholio sense. III In a stand-alone risk sense A is less risky than B. If Stock B as more highly correlated wzeh the market than A, then is might have the same beta as 5 tock A, and hence be fuit as fukby in a portfolio sense. IN, in a stand-alone risk sense A is less risky than 8 . Ir Stock B is less highly cerrebted with the market than A, then it might have a lower beta than 5 tock A, and hence be leis nish in a portflis sense. V. In a stand-alone risk sense A is less roiky than 8 , Ir 5 sock B is less highty correisted with the market than A, then it might have a higher beta than stock A, and bence be more risky in a portiolio sense