Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stock A has an expected return of 5%, and a standard deviation of returns of 10%. Stock b has an expected return of 15% and

- Stock A has an expected return of 5%, and a standard deviation of returns of 10%. Stock b has an expected return of 15% and a standard deviation of returns of 20%. The correlation between the two stocks returns in 0.90. The standard deviation of an equally-weighted portfolio comprised of the two stocks will be:

| B) LESS THAN 15% |

|

|

- If one were to use calculus and algebra to find the efficient frontier among 100 stocks one would need to calculate __________ covariances and _______________ variances.

| B) 4,950; 100 |

|

|

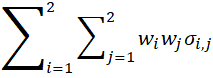

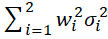

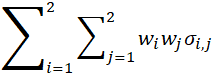

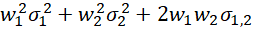

- Which of the following is the formula for the variance of a two-security portfolio:

- i=12j=12wiwji,j

- i=12wi2i2

+i=12j=12wiwji,j

+i=12j=12wiwji,j for all j i

for all j i

- w1212+w2222+2w1w21,2

- All of the above are correct.

- In portfolio optimization, the variable that the portfolio managers has a choice about are:

| B) the variances of the stock returns |

|

|

- Stock A has an expected return of 5%, and a standard deviation of returns of 10%. Stock b has an expected return of 15% and a standard deviation of returns of 20%. The correlation between the two stocks returns in 0.90. The expected return of an equally-weighted portfolio comprised of the two stocks will be:

| B) LESS THAN 7.5% |

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started