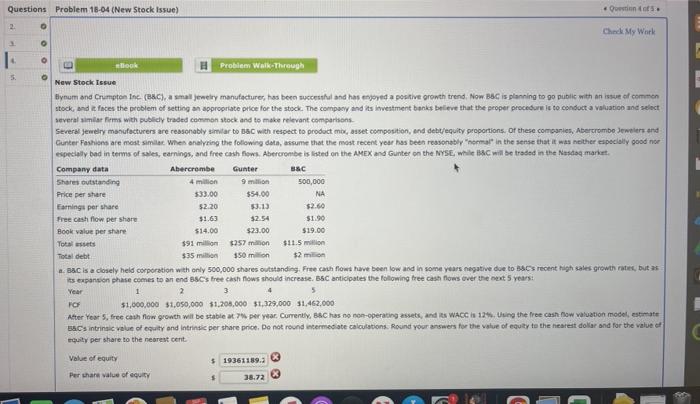

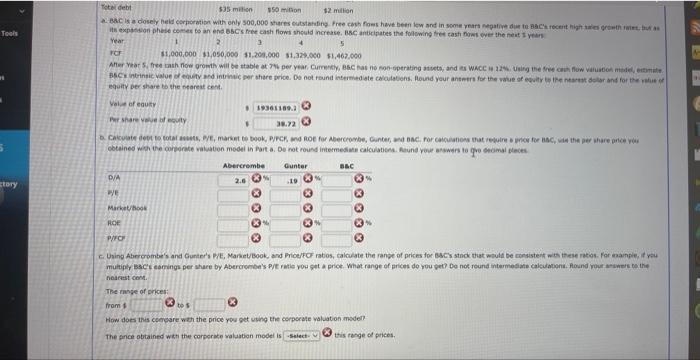

stock, and it faces the problem of setting an appropriate price for the stodk. The company and its investment banks believe that the peoper procedure it to condoct a valuation and select several aimiar firms with pualidy traded common stock and to moke relevant compartsons. Cunter Fashions afe most simate Whes onelyring the folowing dota, assume that the most recent year has beet ressonably "nenmal" in the sense that if was nother efpecialy good nor a. aac is a closely held corporation weth only 500,000 shares outstanding. Frre cauh flowt have been low and in some yoars negative doe to Bscs recent tigh sales growth ratek, but as its expansion shase comes to an end escs tree cash fows should increase. 65C anticipates the folloming thee cash fows ever the neet 5 years: BsCs intrinaic value of equity and intrintic per share price. Do not round efermaciate calculations. Round your answers for the value of equay to the heareit doliar and for the value ef ehaity per share to the nearest cent. equity ber ghare to the teareat cent. noafust cont. The range of srices: from 1 (4) to 5 How does this cceceare wer the price you set whing the corpscate waluaton model? The gence obtained wati the corperice valuation model is (9) this renge of prices. stock, and it faces the problem of setting an appropriate price for the stodk. The company and its investment banks believe that the peoper procedure it to condoct a valuation and select several aimiar firms with pualidy traded common stock and to moke relevant compartsons. Cunter Fashions afe most simate Whes onelyring the folowing dota, assume that the most recent year has beet ressonably "nenmal" in the sense that if was nother efpecialy good nor a. aac is a closely held corporation weth only 500,000 shares outstanding. Frre cauh flowt have been low and in some yoars negative doe to Bscs recent tigh sales growth ratek, but as its expansion shase comes to an end escs tree cash fows should increase. 65C anticipates the folloming thee cash fows ever the neet 5 years: BsCs intrinaic value of equity and intrintic per share price. Do not round efermaciate calculations. Round your answers for the value of equay to the heareit doliar and for the value ef ehaity per share to the nearest cent. equity ber ghare to the teareat cent. noafust cont. The range of srices: from 1 (4) to 5 How does this cceceare wer the price you set whing the corpscate waluaton model? The gence obtained wati the corperice valuation model is (9) this renge of prices