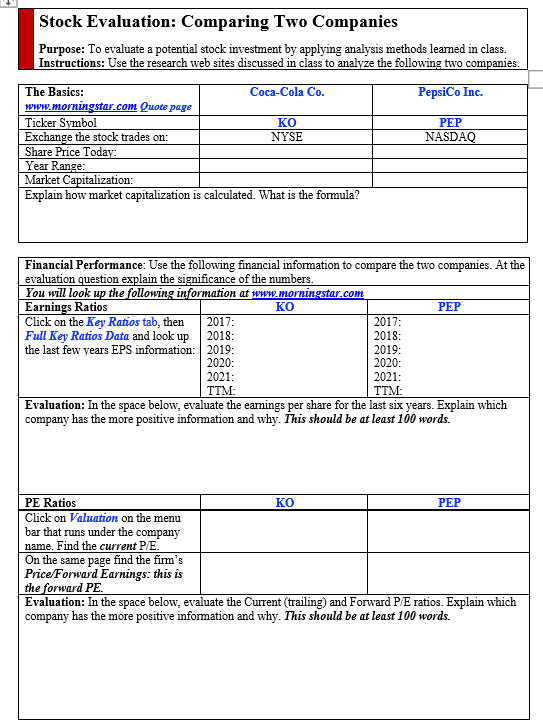

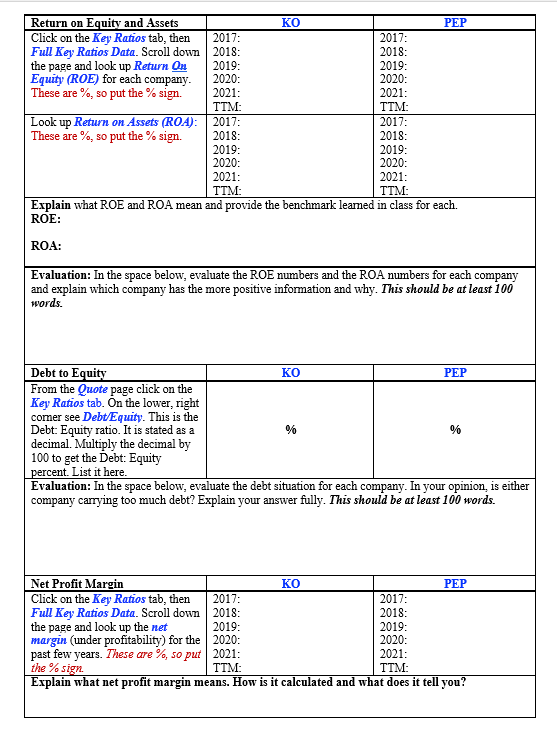

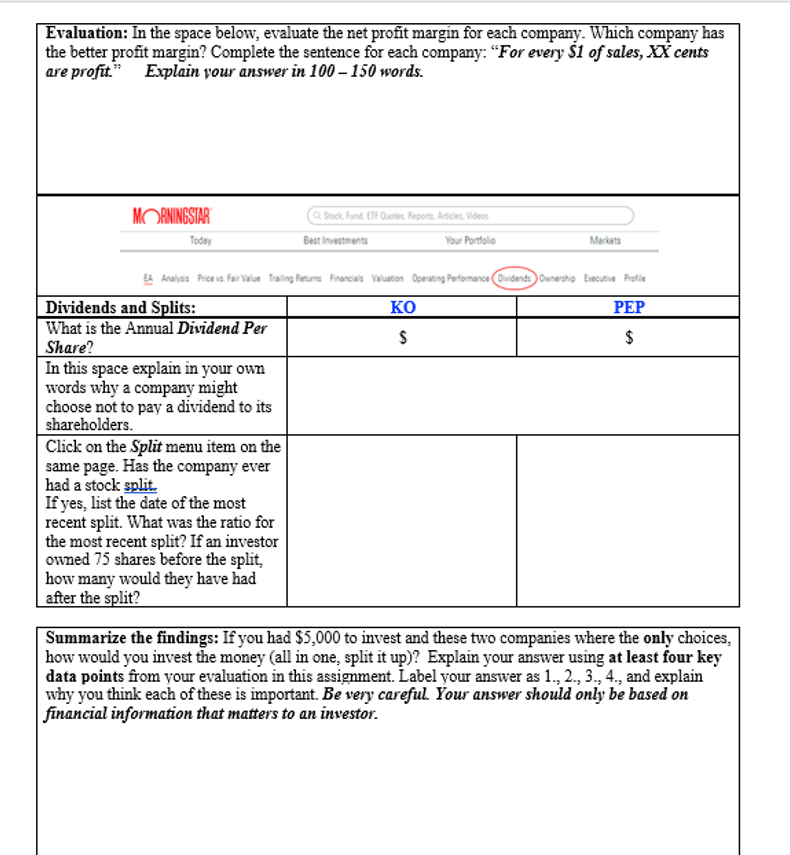

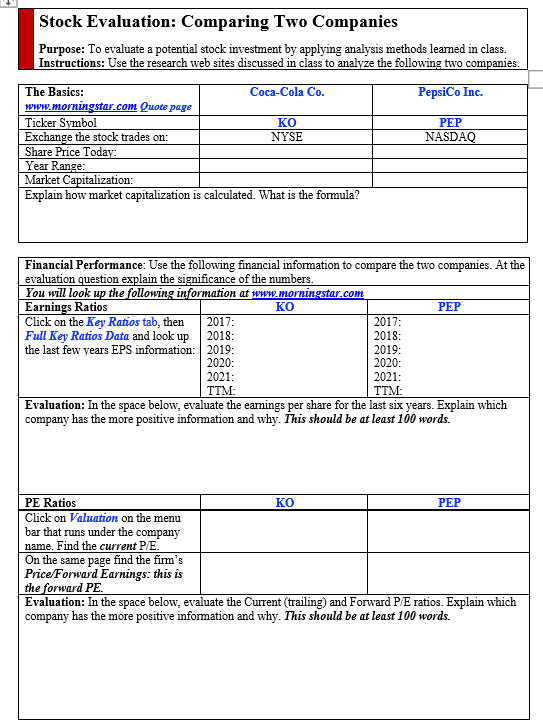

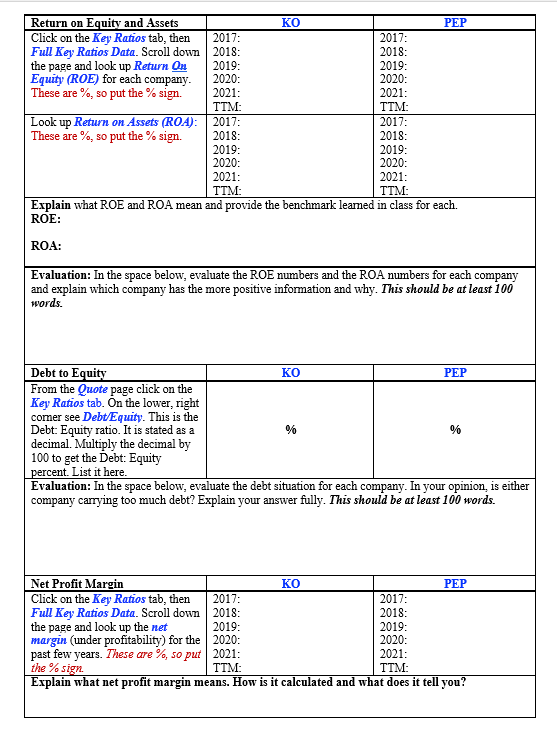

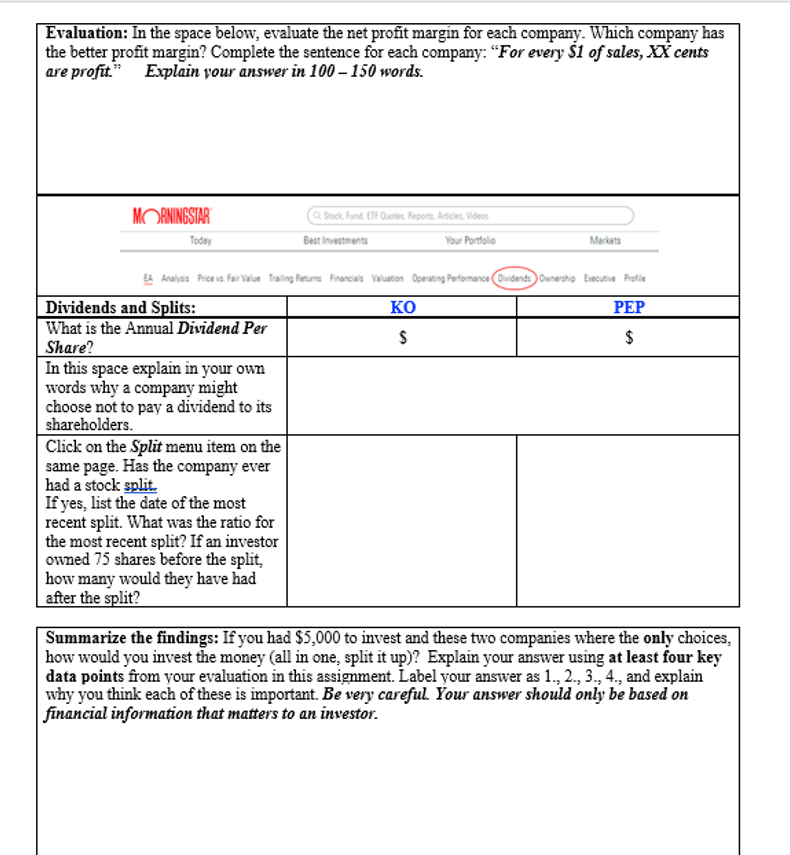

Stock Evaluation: Comparing Two Companies Purpose: To evaluate a potential stock investment by applying analysis methods leamed in class. Instructions: Use the research web sites discussed in class to analyze the following two companies. The Basics: Coca-Cola Co. PepsiCo Inc. www.morningstar.com Quote page Ticker Symbol KO PEP Exchange the stock trades on: NYSE NASDAQ Share Price Today: Year Range: Market Capitalization: Explain how market capitalization is calculated. What is the formula? Financial Performance: Use the following financial information to compare the two companies. At the evaluation question explain the significance of the numbers. You will look up the following information at www.morningstar.com Earnings Ratios KO PEP Click on the Key Ratios tab, then 2017: 2017: Full Key Ratios Data and look up 2018: 2018: the last few years EPS information: 2019: 2019: 2020: 2020: 2021: 2021: TTM: TTM Evaluation: In the space below, evaluate the eamings per share for the last six years. Explain which company has the more positive information and why. This should be at least 100 words. PE Ratios KO PEP Click on Valuation on the menu bar that runs under the company name. Find the current P/E. On the same page find the firm's Price/Forward Earnings: this is the forward PE. Evaluation: In the space below, evaluate the Current (trailing) and Forward P/E ratios. Explain which company has the more positive information and why. This should be at least 100 words. Return on Equity and Assets KO PEP Click on the Key Ratios tab, then 2017: 2017: Full Key Ratios Data. Scroll down 2018: 2018: the page and look up Return on 2019: 2019: Equity (ROE) for each company. 2020: 2020: These are %, so put the % sign. 2021: 2021: TTM: TTM: Look up Return on Assets (ROA): 2017: 2017: These are %, so put the % sign. 2018: 2018: 2019: 2019: 2020: 2020: 2021: 2021: TTM: TTM: Explain what ROE and ROA mean and provide the benchmark leamed in class for each. ROE: ROA: Evaluation: In the space below, evaluate the ROE numbers and the ROA numbers for each company and explain which company has the more positive information and why. This should be at least 100 words. Debt to Equity KO PEP From the Quote page click on the Key Ratios tab. On the lower right comer see Debt/Equity. This is the Debt: Equity ratio. It is stated as a % % decimal. Multiply the decimal by 100 to get the Debt: Equity percent. List it here. Evaluation: In the space below, evaluate the debt situation for each company. In your opinion, is either company carrying too much debt? Explain your answer fully. This should be at least 100 words. Net Profit Margin KO PEP Click on the Key Ratios tab, then 2017: 2017: Full Key Ratios Data. Scroll down 2018: 2018: the page and look up the net 2019: 2019: margin (under profitability) for the 2020: 2020: past few years. These are %, so put 2021: 2021: the % sign TTM: TTM: Explain what net profit margin means. How is it calculated and what does it tell you? Evaluation: In the space below, evaluate the net profit margin for each company. Which company has the better profit margin? Complete the sentence for each company: "For every $1 of sales, XX cents are profit." Explain your answer in 100-150 words. MORNINGSTAR Stock Fund. ETF O Reports Artes Videos Today Best Investments Your Portfolio Market El Analysis Price vs. FairValue Trailing Forums Financials Valuation Operating Performance Dividend Ounership Executive Proble Dividends and Splits: KO PEP What is the Annual Dividend Per $ $ Share? In this space explain in your own words why a company might choose not to pay a dividend to its shareholders. Click on the Split menu item on the same page. Has the company ever had a stock split. If yes, list the date of the most recent split. What was the ratio for the most recent split? If an investor owned 75 shares before the split, how many would they have had after the split? Summarize the findings: If you had $5,000 to invest and these two companies where the only choices, how would you invest the money (all in one, split it up)? Explain your answer using at least four key data points from your evaluation in this assignment. Label your answer as 1., 2., 3., 4., and explain why you think each of these is important. Be very careful Your answer should only be based on financial information that matters to an investor. Stock Evaluation: Comparing Two Companies Purpose: To evaluate a potential stock investment by applying analysis methods leamed in class. Instructions: Use the research web sites discussed in class to analyze the following two companies. The Basics: Coca-Cola Co. PepsiCo Inc. www.morningstar.com Quote page Ticker Symbol KO PEP Exchange the stock trades on: NYSE NASDAQ Share Price Today: Year Range: Market Capitalization: Explain how market capitalization is calculated. What is the formula? Financial Performance: Use the following financial information to compare the two companies. At the evaluation question explain the significance of the numbers. You will look up the following information at www.morningstar.com Earnings Ratios KO PEP Click on the Key Ratios tab, then 2017: 2017: Full Key Ratios Data and look up 2018: 2018: the last few years EPS information: 2019: 2019: 2020: 2020: 2021: 2021: TTM: TTM Evaluation: In the space below, evaluate the eamings per share for the last six years. Explain which company has the more positive information and why. This should be at least 100 words. PE Ratios KO PEP Click on Valuation on the menu bar that runs under the company name. Find the current P/E. On the same page find the firm's Price/Forward Earnings: this is the forward PE. Evaluation: In the space below, evaluate the Current (trailing) and Forward P/E ratios. Explain which company has the more positive information and why. This should be at least 100 words. Return on Equity and Assets KO PEP Click on the Key Ratios tab, then 2017: 2017: Full Key Ratios Data. Scroll down 2018: 2018: the page and look up Return on 2019: 2019: Equity (ROE) for each company. 2020: 2020: These are %, so put the % sign. 2021: 2021: TTM: TTM: Look up Return on Assets (ROA): 2017: 2017: These are %, so put the % sign. 2018: 2018: 2019: 2019: 2020: 2020: 2021: 2021: TTM: TTM: Explain what ROE and ROA mean and provide the benchmark leamed in class for each. ROE: ROA: Evaluation: In the space below, evaluate the ROE numbers and the ROA numbers for each company and explain which company has the more positive information and why. This should be at least 100 words. Debt to Equity KO PEP From the Quote page click on the Key Ratios tab. On the lower right comer see Debt/Equity. This is the Debt: Equity ratio. It is stated as a % % decimal. Multiply the decimal by 100 to get the Debt: Equity percent. List it here. Evaluation: In the space below, evaluate the debt situation for each company. In your opinion, is either company carrying too much debt? Explain your answer fully. This should be at least 100 words. Net Profit Margin KO PEP Click on the Key Ratios tab, then 2017: 2017: Full Key Ratios Data. Scroll down 2018: 2018: the page and look up the net 2019: 2019: margin (under profitability) for the 2020: 2020: past few years. These are %, so put 2021: 2021: the % sign TTM: TTM: Explain what net profit margin means. How is it calculated and what does it tell you? Evaluation: In the space below, evaluate the net profit margin for each company. Which company has the better profit margin? Complete the sentence for each company: "For every $1 of sales, XX cents are profit." Explain your answer in 100-150 words. MORNINGSTAR Stock Fund. ETF O Reports Artes Videos Today Best Investments Your Portfolio Market El Analysis Price vs. FairValue Trailing Forums Financials Valuation Operating Performance Dividend Ounership Executive Proble Dividends and Splits: KO PEP What is the Annual Dividend Per $ $ Share? In this space explain in your own words why a company might choose not to pay a dividend to its shareholders. Click on the Split menu item on the same page. Has the company ever had a stock split. If yes, list the date of the most recent split. What was the ratio for the most recent split? If an investor owned 75 shares before the split, how many would they have had after the split? Summarize the findings: If you had $5,000 to invest and these two companies where the only choices, how would you invest the money (all in one, split it up)? Explain your answer using at least four key data points from your evaluation in this assignment. Label your answer as 1., 2., 3., 4., and explain why you think each of these is important. Be very careful Your answer should only be based on financial information that matters to an investor