Answered step by step

Verified Expert Solution

Question

1 Approved Answer

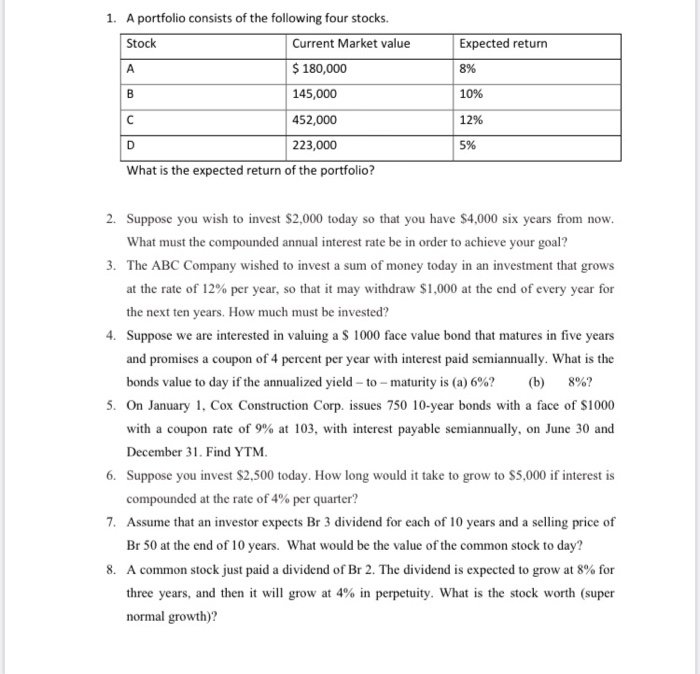

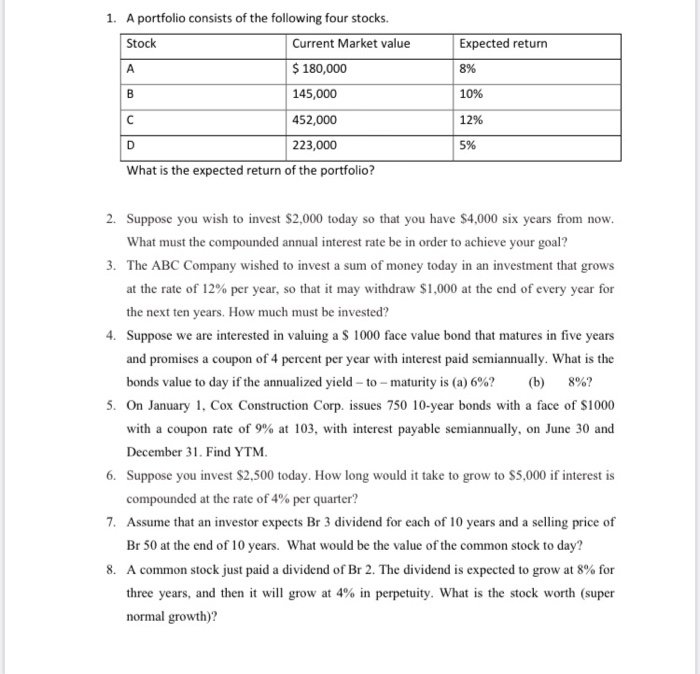

Stock Expected return 8% 1. A portfolio consists of the following four stocks. Current Market value A $ 180,000 B 145,000 452,000 D 223,000 What

Stock Expected return 8% 1. A portfolio consists of the following four stocks. Current Market value A $ 180,000 B 145,000 452,000 D 223,000 What is the expected return of the portfolio? 10% 12% 5% 2. Suppose you wish to invest $2,000 today so that you have $4,000 six years from now. What must the compounded annual interest rate be in order to achieve your goal? 3. The ABC Company wished to invest a sum of money today in an investment that grows at the rate of 12% per year, so that it may withdraw $1,000 at the end of every year for the next ten years. How much must be invested? 4. Suppose we are interested in valuing a $ 1000 face value bond that matures in five years and promises a coupon of 4 percent per year with interest paid semiannually. What is the bonds value to day if the annualized yield to maturity is (a) 6%? (b) 8%? 5. On January 1, Cox Construction Corp. issues 750 10-year bonds with a face of $1000 with a coupon rate of 9% at 103, with interest payable semiannually, on June 30 and December 31. Find YTM 6. Suppose you invest $2,500 today. How long would it take to grow to $5,000 if interest is compounded at the rate of 4% per quarter? 7. Assume that an investor expects Br 3 dividend for each of 10 years and a selling price of Br 50 at the end of 10 years. What would be the value of the common stock to day? 8. A common stock just paid a dividend of Br 2. The dividend is expected to grow at 8% for three years, and then it will grow at 4% in perpetuity. What is the stock worth (super normal growth)

Stock Expected return 8% 1. A portfolio consists of the following four stocks. Current Market value A $ 180,000 B 145,000 452,000 D 223,000 What is the expected return of the portfolio? 10% 12% 5% 2. Suppose you wish to invest $2,000 today so that you have $4,000 six years from now. What must the compounded annual interest rate be in order to achieve your goal? 3. The ABC Company wished to invest a sum of money today in an investment that grows at the rate of 12% per year, so that it may withdraw $1,000 at the end of every year for the next ten years. How much must be invested? 4. Suppose we are interested in valuing a $ 1000 face value bond that matures in five years and promises a coupon of 4 percent per year with interest paid semiannually. What is the bonds value to day if the annualized yield to maturity is (a) 6%? (b) 8%? 5. On January 1, Cox Construction Corp. issues 750 10-year bonds with a face of $1000 with a coupon rate of 9% at 103, with interest payable semiannually, on June 30 and December 31. Find YTM 6. Suppose you invest $2,500 today. How long would it take to grow to $5,000 if interest is compounded at the rate of 4% per quarter? 7. Assume that an investor expects Br 3 dividend for each of 10 years and a selling price of Br 50 at the end of 10 years. What would be the value of the common stock to day? 8. A common stock just paid a dividend of Br 2. The dividend is expected to grow at 8% for three years, and then it will grow at 4% in perpetuity. What is the stock worth (super normal growth)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started