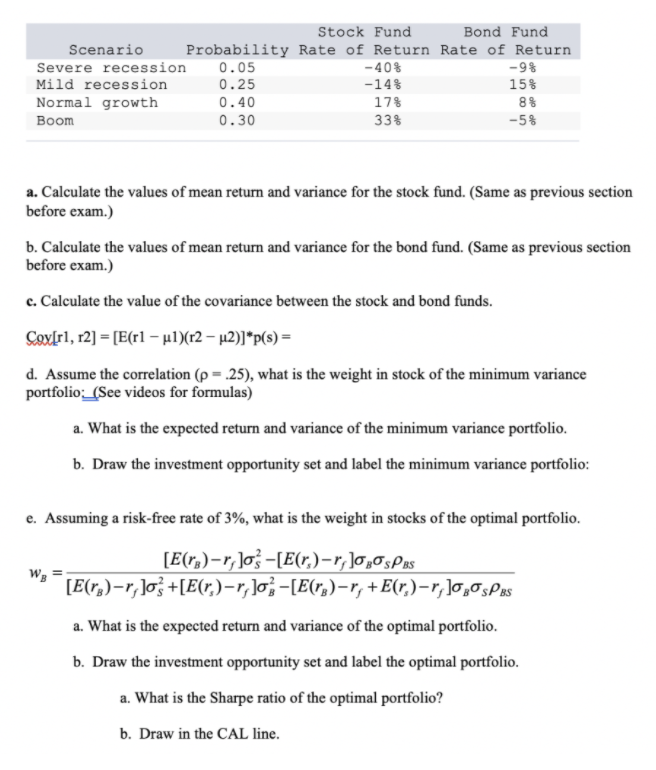

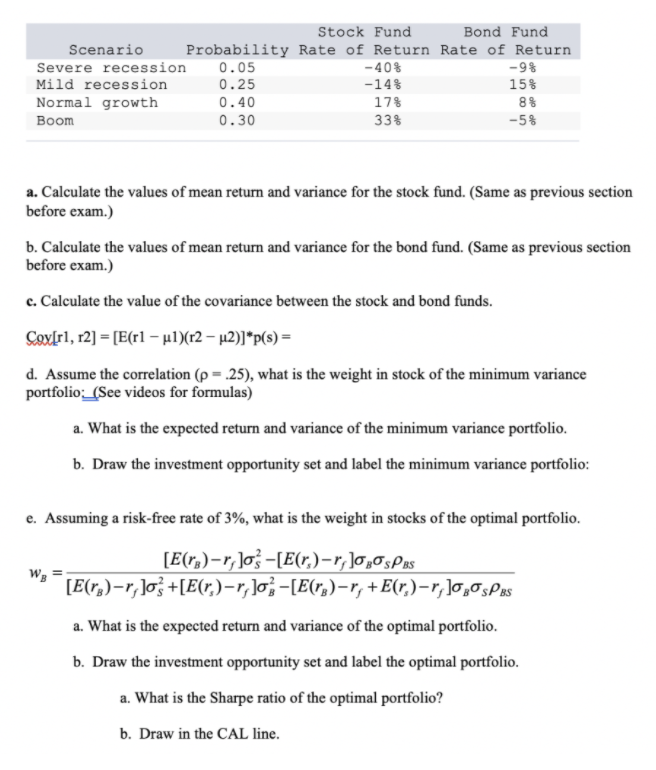

Stock Fund Bond Fund Scenario Probability Rate of Return Rate of Return Severe recession 0.05 -40% -98 Mild recession 0.25 -14% Normal growth 17% 8% Boom 0.30 158 0.40 % a. Calculate the values of mean return and variance for the stock fund. (Same as previous section before exam.) b. Calculate the values of mean return and variance for the bond fund. (Same as previous section before exam.) c. Calculate the value of the covariance between the stock and bond funds. Cox[r1, 12] = [E(rl-ul)(2-2)]*p() = d. Assume the correlation (p= .25), what is the weight in stock of the minimum variance portfolio:_(See videos for formulas) a. What is the expected return and variance of the minimum variance portfolio. b. Draw the investment opportunity set and label the minimum variance portfolio: e. Assuming a risk-free rate of 3%, what is the weight in stocks of the optimal portfolio. Ws [E(rs)-r, lo -[E(r)-r, 1005PBS [E(rp)-r, los +[E(r.)- r;103 -[E(rp)-r, +E(r.)-r, 10:05PBS a. What is the expected return and variance of the optimal portfolio. b. Draw the investment opportunity set and label the optimal portfolio. a. What is the Sharpe ratio of the optimal portfolio? b. Draw in the CAL line. Stock Fund Bond Fund Scenario Probability Rate of Return Rate of Return Severe recession 0.05 -40% -98 Mild recession 0.25 -14% Normal growth 17% 8% Boom 0.30 158 0.40 % a. Calculate the values of mean return and variance for the stock fund. (Same as previous section before exam.) b. Calculate the values of mean return and variance for the bond fund. (Same as previous section before exam.) c. Calculate the value of the covariance between the stock and bond funds. Cox[r1, 12] = [E(rl-ul)(2-2)]*p() = d. Assume the correlation (p= .25), what is the weight in stock of the minimum variance portfolio:_(See videos for formulas) a. What is the expected return and variance of the minimum variance portfolio. b. Draw the investment opportunity set and label the minimum variance portfolio: e. Assuming a risk-free rate of 3%, what is the weight in stocks of the optimal portfolio. Ws [E(rs)-r, lo -[E(r)-r, 1005PBS [E(rp)-r, los +[E(r.)- r;103 -[E(rp)-r, +E(r.)-r, 10:05PBS a. What is the expected return and variance of the optimal portfolio. b. Draw the investment opportunity set and label the optimal portfolio. a. What is the Sharpe ratio of the optimal portfolio? b. Draw in the CAL line