Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stock: Gamestop (GME) Please help me with this part of my assignment based on the stock: GAMESTOP (GME). please complete the question fully and if

Stock: Gamestop (GME)

Please help me with this part of my assignment based on the stock: GAMESTOP (GME). please complete the question fully and if you can explain it please, i would really appreciate it as i am fully lost thank you.

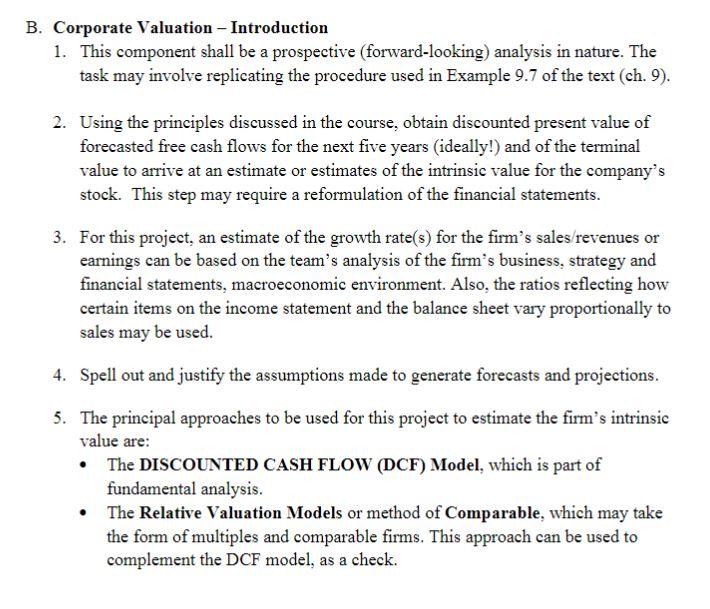

B. Corporate Valuation - Introduction 1. This component shall be a prospective (forward-looking) analysis in nature. The task may involve replicating the procedure used in Example 9.7 of the text (ch. 9). 2. Using the principles discussed in the course, obtain discounted present value of forecasted free cash flows for the next five years (ideally!) and of the terminal value to arrive at an estimate or estimates of the intrinsic value for the company's stock. This step may require a reformulation of the financial statements. 3. For this project, an estimate of the growth rate(s) for the firm's sales revenues or earnings can be based on the team's analysis of the firm's business, strategy and financial statements, macroeconomic environment. Also, the ratios reflecting how certain items on the income statement and the balance sheet vary proportionally to sales may be used. 4. Spell out and justify the assumptions made to generate forecasts and projections. 5. The principal approaches to be used for this project to estimate the firm's intrinsic value are: The DISCOUNTED CASH FLOW (DCF) Model, which is part of fundamental analysis. The Relative Valuation Models or method of Comparable, which may take the form of multiples and comparable firms. This approach can be used to complement the DCF model, as a check. B. Corporate Valuation - Introduction 1. This component shall be a prospective (forward-looking) analysis in nature. The task may involve replicating the procedure used in Example 9.7 of the text (ch. 9). 2. Using the principles discussed in the course, obtain discounted present value of forecasted free cash flows for the next five years (ideally!) and of the terminal value to arrive at an estimate or estimates of the intrinsic value for the company's stock. This step may require a reformulation of the financial statements. 3. For this project, an estimate of the growth rate(s) for the firm's sales revenues or earnings can be based on the team's analysis of the firm's business, strategy and financial statements, macroeconomic environment. Also, the ratios reflecting how certain items on the income statement and the balance sheet vary proportionally to sales may be used. 4. Spell out and justify the assumptions made to generate forecasts and projections. 5. The principal approaches to be used for this project to estimate the firm's intrinsic value are: The DISCOUNTED CASH FLOW (DCF) Model, which is part of fundamental analysis. The Relative Valuation Models or method of Comparable, which may take the form of multiples and comparable firms. This approach can be used to complement the DCF model, as a checkStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started