Question

Stock Investment Transactions, Equity Method and Available-for-Sale Securities Roman Products, Inc., is a wholesaler of men's hair products. The company began operations on January 1,

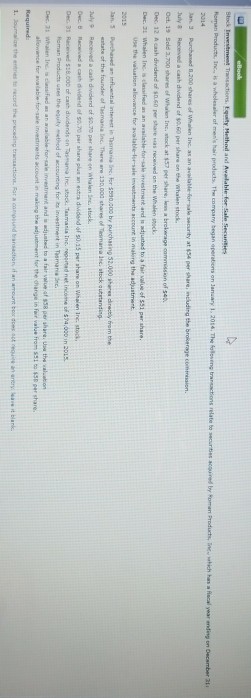

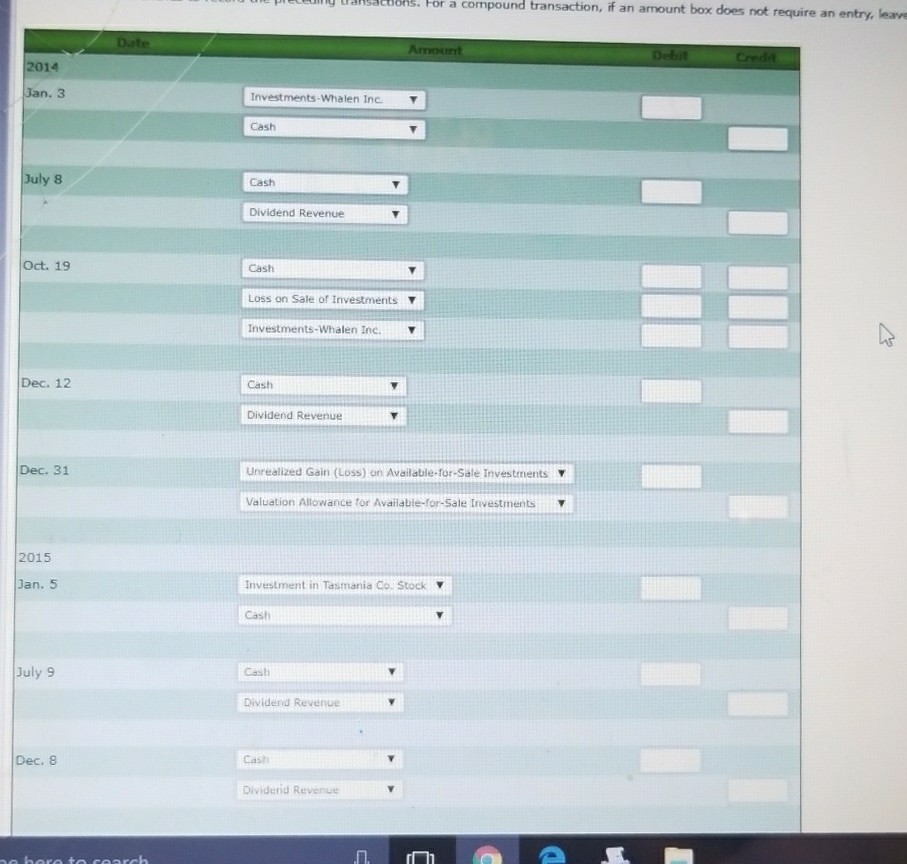

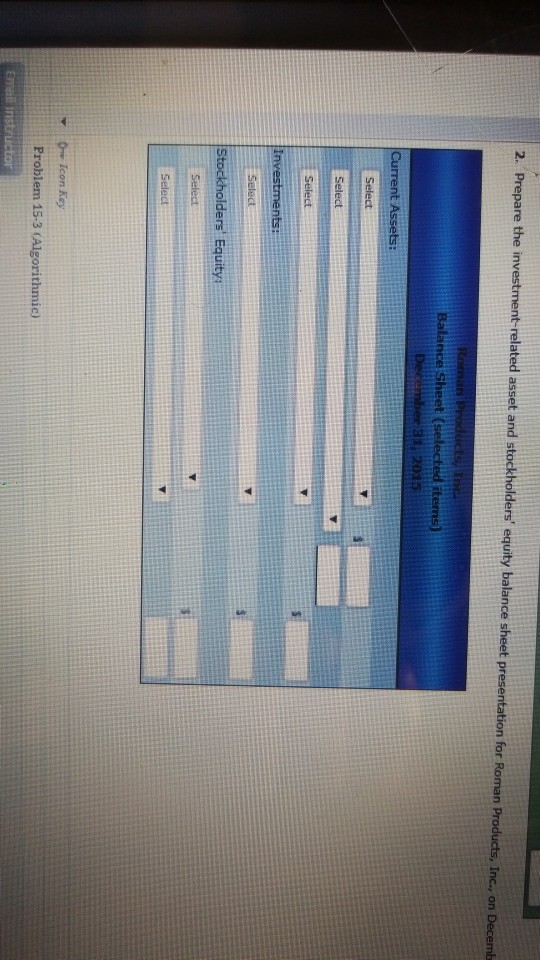

Stock Investment Transactions, Equity Method and Available-for-Sale Securities Roman Products, Inc., is a wholesaler of men's hair products. The company began operations on January 1, 2014. The following transactions relate to securities acquired by Roman Products, Inc., which has a fiscal year ending on December 31: 2014 Jan. 3 Purchased 8,200 shares of Whalen Inc. as an available-for-sale security at $54 per share, including the brokerage commission. July 8 Received a cash dividend of $0.60 per share on the Whalen stock. Oct. 19 Sold 3,700 shares of Whalen Inc. stock at $57 per share, less a brokerage commission of $40. Dec. 12 A cash dividend of $0.60 per share was received on the Whalen stock. Dec. 31 Whalen Inc. is classified as an available-for-sale investment and is adjusted to a fair value of $51 per share. Use the valuation allowance for available-for-sale investments account in making the adjustment. 2015 Jan. 5 Purchased an influential interest in Tasmania Inc. for $590,000 by purchasing 52,000 shares directly from the estate of the founder of Tasmania Inc. There are 130,000 shares of Tasmania Inc. stock outstanding. July 9 Received a cash dividend of $0.70 per share on Whalen Inc. stock. Dec. 8 Received a cash dividend of $0.70 per share plus an extra dividend of $0.15 per share on Whalen Inc. stock. Dec. 31 Received $18,000 of cash dividends on Tasmania Inc. stock. Tasmania Inc. reported net income of $74,000 in 2015. Roman Products uses the equity method of accounting for its investment in Tasmania Inc. Dec. 31 Whalen Inc. is classified as an available-for-sale investment and is adjusted to a fair value of $58 per share. Use the valuation allowance for available-for-sale investments account in making the adjustment for the change in fair value from $51 to $58 per share. Required: 1. Journalize the entries to record the preceding transactions. For a compound transaction, if an amount box does not require an entry, leave it blank.

Transcribed image text

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started