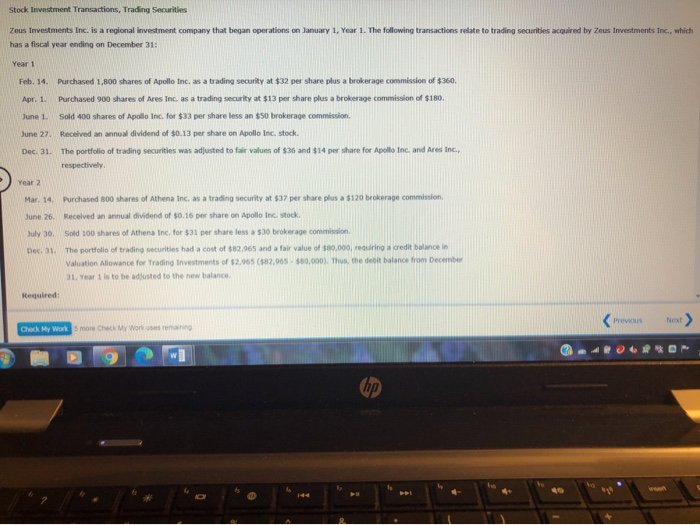

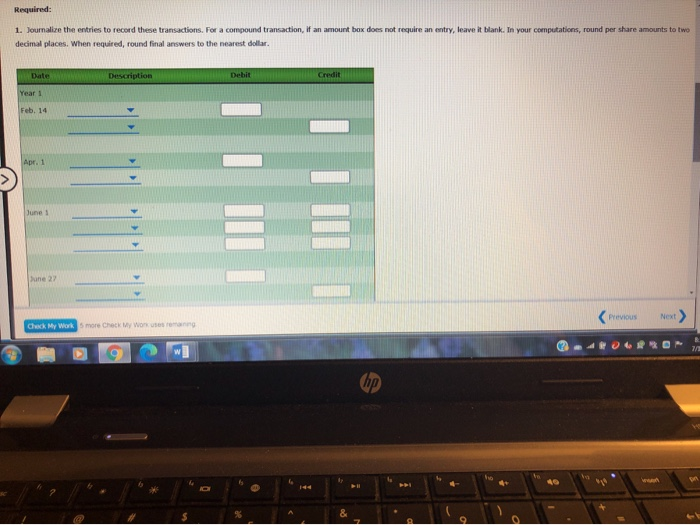

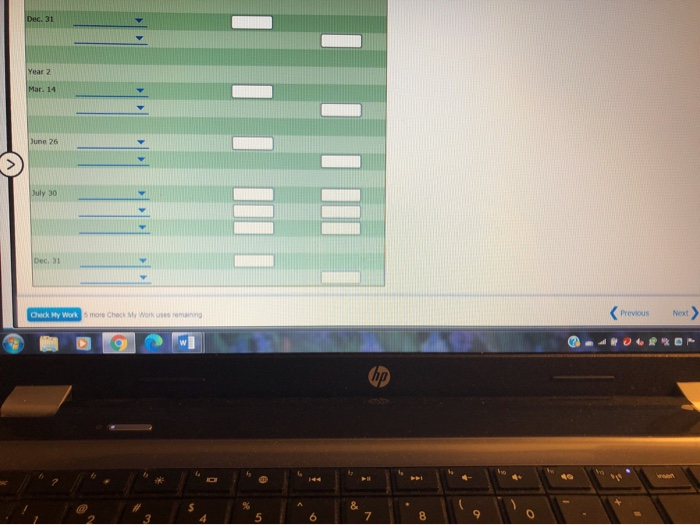

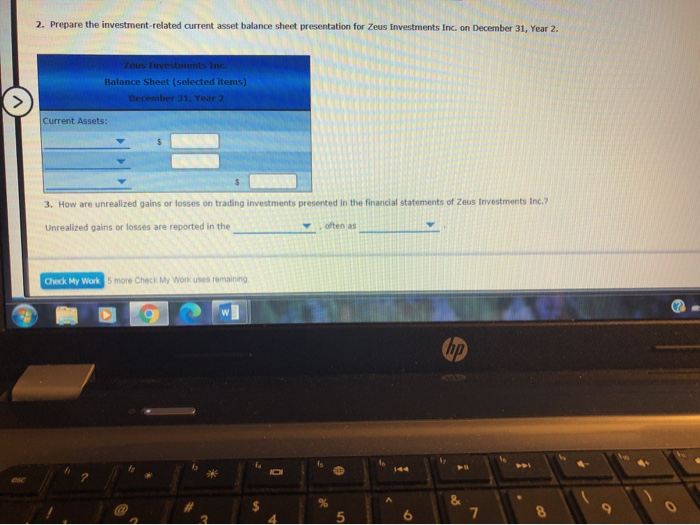

Stock Investment Transactions, Trading Securities Zeus Investments Inc. is a regional investment company that began operations on January 1, Year 1. The following transactions relate to trading securities acquired by Zeus Investments Inc., which has a fiscal year ending on December 31: Year 1 Feb. 14 Apr. 1. Purchased 1,800 shares of Apollo Inc. as a trading security at $32 per share plus a brokerage commission of $360, Purchased 900 shares of Ares Inc. as a trading security at $13 per share plus a brokerage commission of $180. June 1 Sold 400 shares of Apollo Inc. for $33 per share less an $50 brokerage commission June 27. Received an annual dividend of $0.13 per share on Apollo Inc. stock. The portfolio of trading securities was adjusted to fair values of $36 and $10 per share for Apollo Inc. and Area Inc, respectively Dec. 31. Year 2 Mar. 14. Purchased 800 shares of Athena Inc. as a trading security at $37 per share plus a $120 brokerage commission June 26. Received an annual dividend of $0.16 per share on Apollo Inc. stock July 30 Sold 100 shares of Athena Inc, for $31 per share less a $30 brokerage commission Dec. 31 The portfolio of trading securities had a cost of $82,065 and a fair value of $90,000, reduring credit balance in Valuation Allowance for Trading Investments of $2,065 (12,965 $80,000). Thus, the del balance from Decem 31. Year 1 is to be adjusted to the new balance Required Pros Next > Check My Workmore Check My Workesan hp Required: 1. Journalize the entries to record these transactions. For a compound transaction, if an amount box does not require an entry, leave it blank. In your computations, round per share amounts to two decimal places. When required, round final answers to the nearest dollar. Date Description Debit Credit Year 1 Feb. 14 (Apr. 1 June 1 June 27 Previous Next Check My Workmore Check My Woman 72 Dec. 31 Year 2 Mar. 14 June 26 July 30 Dec, al Check My Workmore Check My Workesroman Previous Next 6 7 8 2. Prepare the investment-related current asset balance sheet presentation for Zeus Investments Inc. on December 31, Year 2. Zeus Investments inc. Balance Sheet (selected items) December 31. Year 2 Current Assets: 3. How are unrealized gains or losses on trading investments presented in the financial statements of Zeus investments Inc.? Unrealized gains or losses are reported in the often as Check My Work 5 more Check My Work uses remaining hp $ 5 7