Answered step by step

Verified Expert Solution

Question

1 Approved Answer

stock investments with insignitcant influence. April16July7July20August15August28October1ecember15ecember31Purchased4,500sharesofCVFCompanystockat$27pershare.Purchased3,000sharesofCMOCompanystockat$52pershare.Purchased1,400sharesofKendallCompanystockat$19pershare.Receivedan$1.10persharecashdividendontheCVFCompanystock.Sold2,700sharesofCVFCompanystockat$30pershare.Receiveda$3.70persharecashdividendontheCMOCompanyshares.Receiveda$1.30persharecashdividendontheremainingCVFCompanyshares.Receiveda$3.10persharecashdividendontheCMOCompanyshares. April 16 Purchased 4,500 shares of CVF Company stock at $27 per share. July 7 Purchased 3,000 shares of

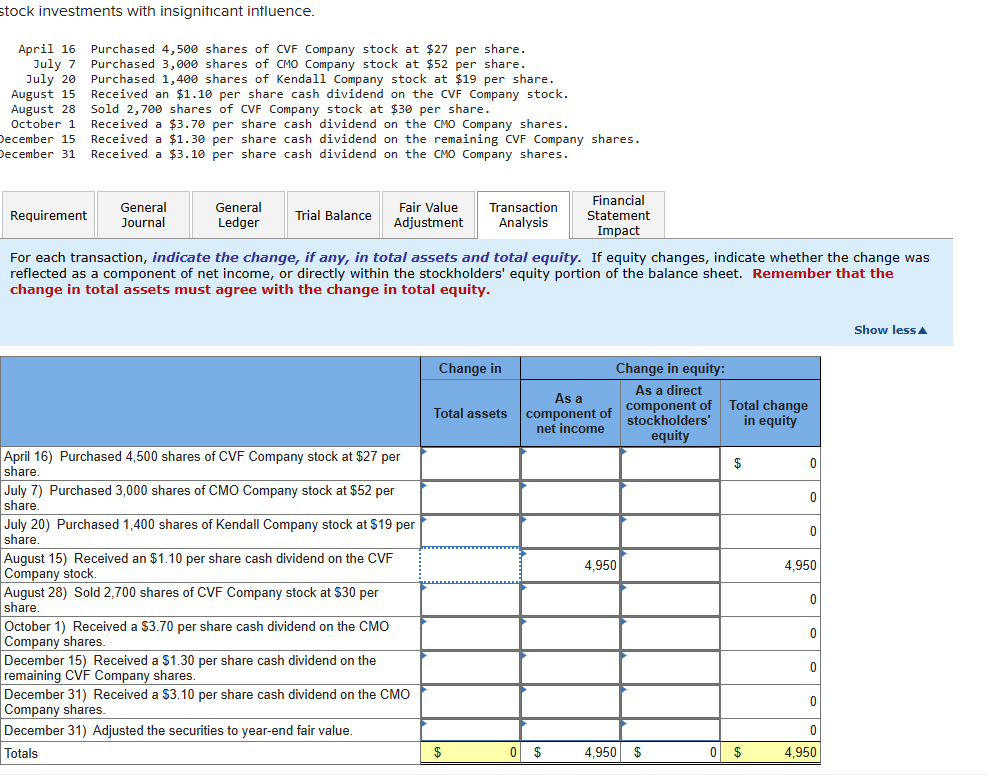

stock investments with insignitcant influence. April16July7July20August15August28October1ecember15ecember31Purchased4,500sharesofCVFCompanystockat$27pershare.Purchased3,000sharesofCMOCompanystockat$52pershare.Purchased1,400sharesofKendallCompanystockat$19pershare.Receivedan$1.10persharecashdividendontheCVFCompanystock.Sold2,700sharesofCVFCompanystockat$30pershare.Receiveda$3.70persharecashdividendontheCMOCompanyshares.Receiveda$1.30persharecashdividendontheremainingCVFCompanyshares.Receiveda$3.10persharecashdividendontheCMOCompanyshares. April 16 Purchased 4,500 shares of CVF Company stock at $27 per share. July 7 Purchased 3,000 shares of CMO Company stock at $52 per share. July 20 Purchased 1,400 shares of Kendall Company stock at $19 per share. August 15 Received an $1.10 per share cash dividend on the CVF Company stock. August 28 Sold 2,700 shares of CVF Company stock at $30 per share. October 1 Received a $3.70 per share cash dividend on the CMO Company shares. ecember 15 Received a $1.30 per share cash dividend on the remaining CVF Company shares. ecember 31 Received a $3.10 per share cash dividend on the CMO Company shares. For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. stock investments with insignitcant influence. April16July7July20August15August28October1ecember15ecember31Purchased4,500sharesofCVFCompanystockat$27pershare.Purchased3,000sharesofCMOCompanystockat$52pershare.Purchased1,400sharesofKendallCompanystockat$19pershare.Receivedan$1.10persharecashdividendontheCVFCompanystock.Sold2,700sharesofCVFCompanystockat$30pershare.Receiveda$3.70persharecashdividendontheCMOCompanyshares.Receiveda$1.30persharecashdividendontheremainingCVFCompanyshares.Receiveda$3.10persharecashdividendontheCMOCompanyshares. April 16 Purchased 4,500 shares of CVF Company stock at $27 per share. July 7 Purchased 3,000 shares of CMO Company stock at $52 per share. July 20 Purchased 1,400 shares of Kendall Company stock at $19 per share. August 15 Received an $1.10 per share cash dividend on the CVF Company stock. August 28 Sold 2,700 shares of CVF Company stock at $30 per share. October 1 Received a $3.70 per share cash dividend on the CMO Company shares. ecember 15 Received a $1.30 per share cash dividend on the remaining CVF Company shares. ecember 31 Received a $3.10 per share cash dividend on the CMO Company shares. For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity

stock investments with insignitcant influence. April16July7July20August15August28October1ecember15ecember31Purchased4,500sharesofCVFCompanystockat$27pershare.Purchased3,000sharesofCMOCompanystockat$52pershare.Purchased1,400sharesofKendallCompanystockat$19pershare.Receivedan$1.10persharecashdividendontheCVFCompanystock.Sold2,700sharesofCVFCompanystockat$30pershare.Receiveda$3.70persharecashdividendontheCMOCompanyshares.Receiveda$1.30persharecashdividendontheremainingCVFCompanyshares.Receiveda$3.10persharecashdividendontheCMOCompanyshares. April 16 Purchased 4,500 shares of CVF Company stock at $27 per share. July 7 Purchased 3,000 shares of CMO Company stock at $52 per share. July 20 Purchased 1,400 shares of Kendall Company stock at $19 per share. August 15 Received an $1.10 per share cash dividend on the CVF Company stock. August 28 Sold 2,700 shares of CVF Company stock at $30 per share. October 1 Received a $3.70 per share cash dividend on the CMO Company shares. ecember 15 Received a $1.30 per share cash dividend on the remaining CVF Company shares. ecember 31 Received a $3.10 per share cash dividend on the CMO Company shares. For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity. stock investments with insignitcant influence. April16July7July20August15August28October1ecember15ecember31Purchased4,500sharesofCVFCompanystockat$27pershare.Purchased3,000sharesofCMOCompanystockat$52pershare.Purchased1,400sharesofKendallCompanystockat$19pershare.Receivedan$1.10persharecashdividendontheCVFCompanystock.Sold2,700sharesofCVFCompanystockat$30pershare.Receiveda$3.70persharecashdividendontheCMOCompanyshares.Receiveda$1.30persharecashdividendontheremainingCVFCompanyshares.Receiveda$3.10persharecashdividendontheCMOCompanyshares. April 16 Purchased 4,500 shares of CVF Company stock at $27 per share. July 7 Purchased 3,000 shares of CMO Company stock at $52 per share. July 20 Purchased 1,400 shares of Kendall Company stock at $19 per share. August 15 Received an $1.10 per share cash dividend on the CVF Company stock. August 28 Sold 2,700 shares of CVF Company stock at $30 per share. October 1 Received a $3.70 per share cash dividend on the CMO Company shares. ecember 15 Received a $1.30 per share cash dividend on the remaining CVF Company shares. ecember 31 Received a $3.10 per share cash dividend on the CMO Company shares. For each transaction, indicate the change, if any, in total assets and total equity. If equity changes, indicate whether the change was reflected as a component of net income, or directly within the stockholders' equity portion of the balance sheet. Remember that the change in total assets must agree with the change in total equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started