Answered step by step

Verified Expert Solution

Question

1 Approved Answer

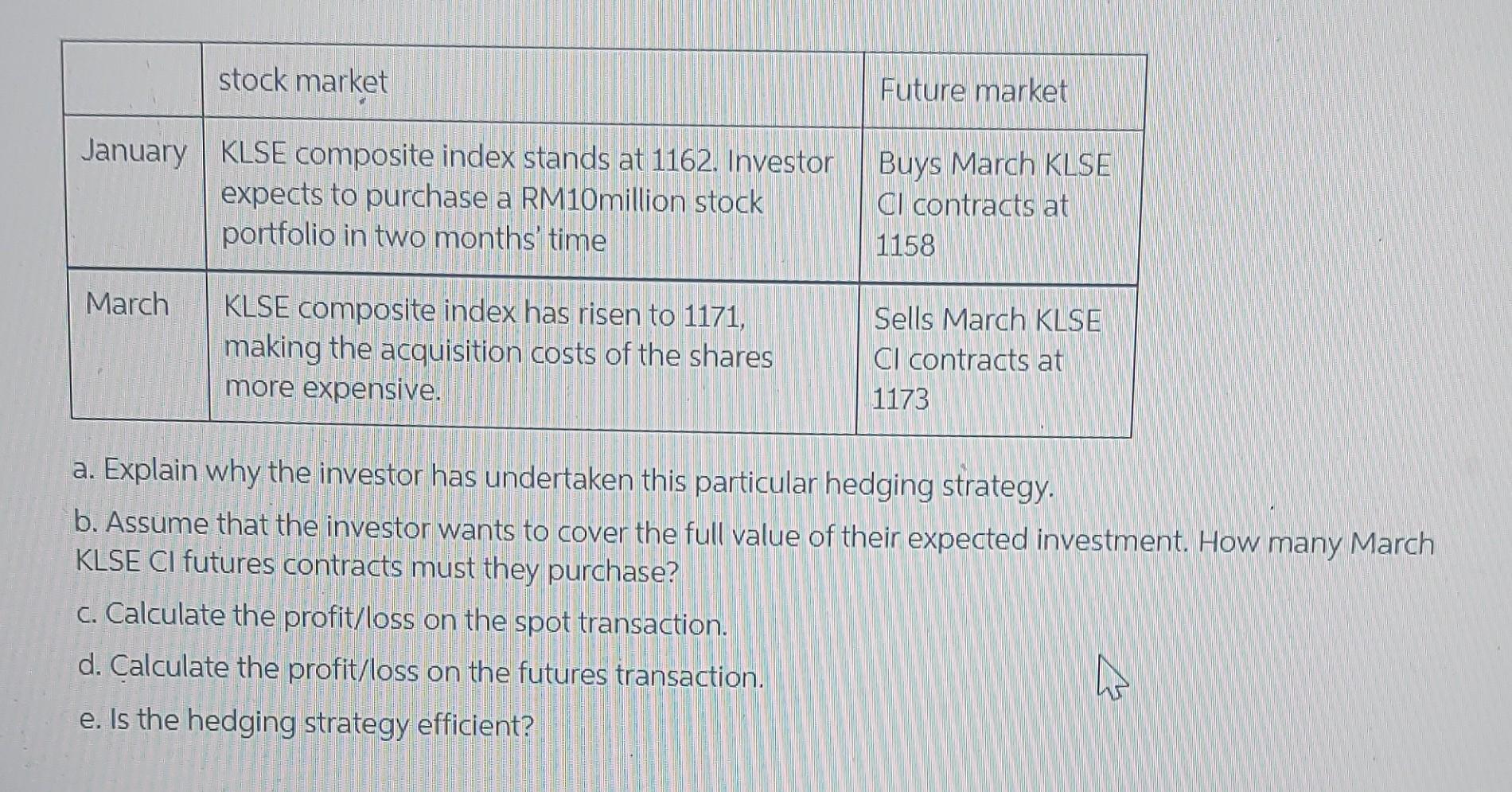

stock market Future market January KLSE composite index stands at 1162. Investor expects to purchase a RM10million stock portfolio in two months' time Buys March

stock market Future market January KLSE composite index stands at 1162. Investor expects to purchase a RM10million stock portfolio in two months' time Buys March KLSE Ci contracts at 1158 March KLSE composite index has risen to 1171, making the acquisition costs of the shares more expensive. Sells March KLSE Cl contracts at 1173 a. Explain why the investor has undertaken this particular hedging strategy. b. Assume that the investor wants to cover the full value of their expected investment. How many March KLSE CI futures contracts must they purchase? C. Calculate the profit/loss on the spot transaction. d. Calculate the profit/loss on the futures transaction. e. Is the hedging strategy efficient? ho

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started