Question

Stock price on Dec 31, 2014$60.00 Number of common shares outstanding on Dec 31, 2014...1,000 11. What was Joes average, or effective tax rate in

Stock price on Dec 31, 2014$60.00

Number of common shares outstanding on Dec 31, 2014...1,000

11. What was Joes average, or effective tax rate in 2014?

12. What was Joes NOPAT in 2014?

13. What was Joes Free Cash Flow (FCF) in 2014? (Note: For this question, assume Joe obtained no new plant and equipment or additional net working capital in 2014. Thus his Net Investment in Operating Capital (NIOC) for 2014 is $0.00.)

14. Suppose you were an investor and you were considering whether to buy a corporate bond from Joes Corporation or a Municipal Bond from the city of St. Louis. Joes corporate bond has a yield of 6%. The St Louis city bond has a yield of 4%. The income from Joes bond is taxable. The income from the St Louis city bond is tax-free. If your effective tax rate is 36%, which bond would give you the higher after-tax yield?

15. What was Joes Net Worth at the end of 2014?

16. Why is the market value of a firms stock almost always higher than the book value of the firms stock as shown on the balance sheet?

Chapter 3:

17. a. Calculate Joes ROE for 2014.

b Construct a Du Pont equation (use the extended, or modified version shown in the Week 1, chapters 2 & 3 lesson notes) and comment on the sources of Joes ROE as revealed by the equation.

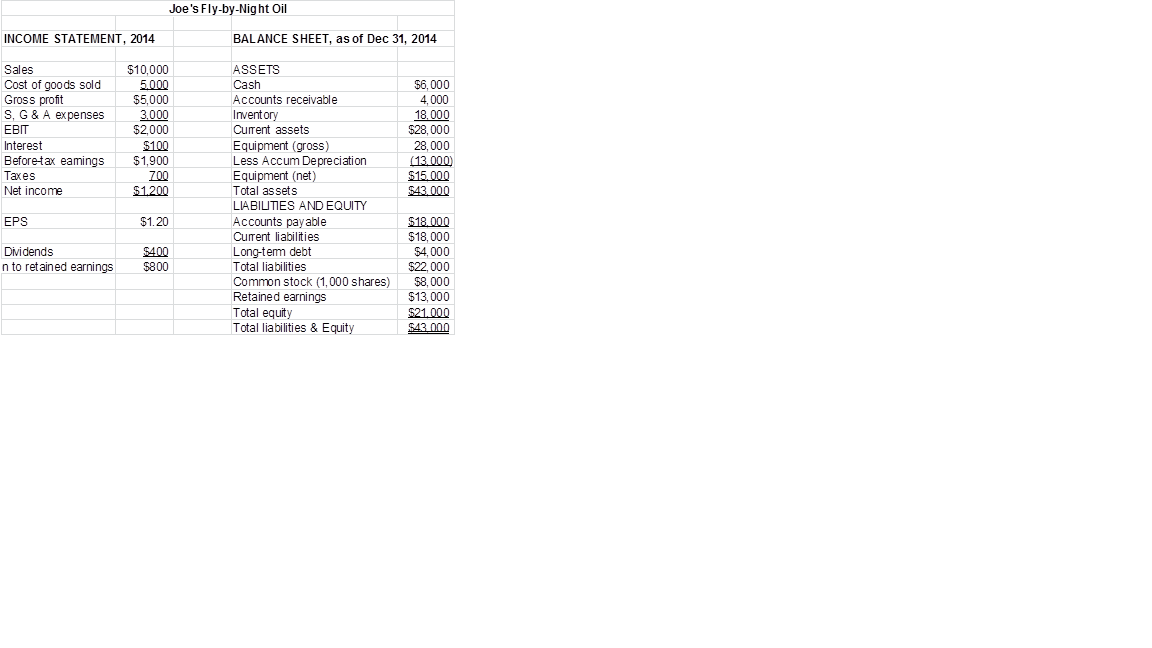

Joe's Fly-by-Night Oil INCOME STATEMENT, 2014 BALANCE SHEET, as of Dec 31, 2014 ASSETS Cash Accounts receivable Inventory Current assets Equipment (gross) Less Accum Depreciation Equipment (net) Total assets LIA BILITIES AND EQUITY Accounts payable Cuent liabilities Long-tem debt Total liabilities Common stock (1,000 shares) Retained earnings Total equity Total liabilities & Equity $10,000 Sales Cost of goods sold Gross proft S, G&A expenses EBIT Interest Beforetax eamings Taxes Net income $6,000 4,000 $5,000 3,000 $2,000 $28,000 28,000 $1,900 EPS $1.20 $18,000 $4,000 $22,000 $8,000 $13,000 $21000 Dividends n to retained earnings e $800Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started