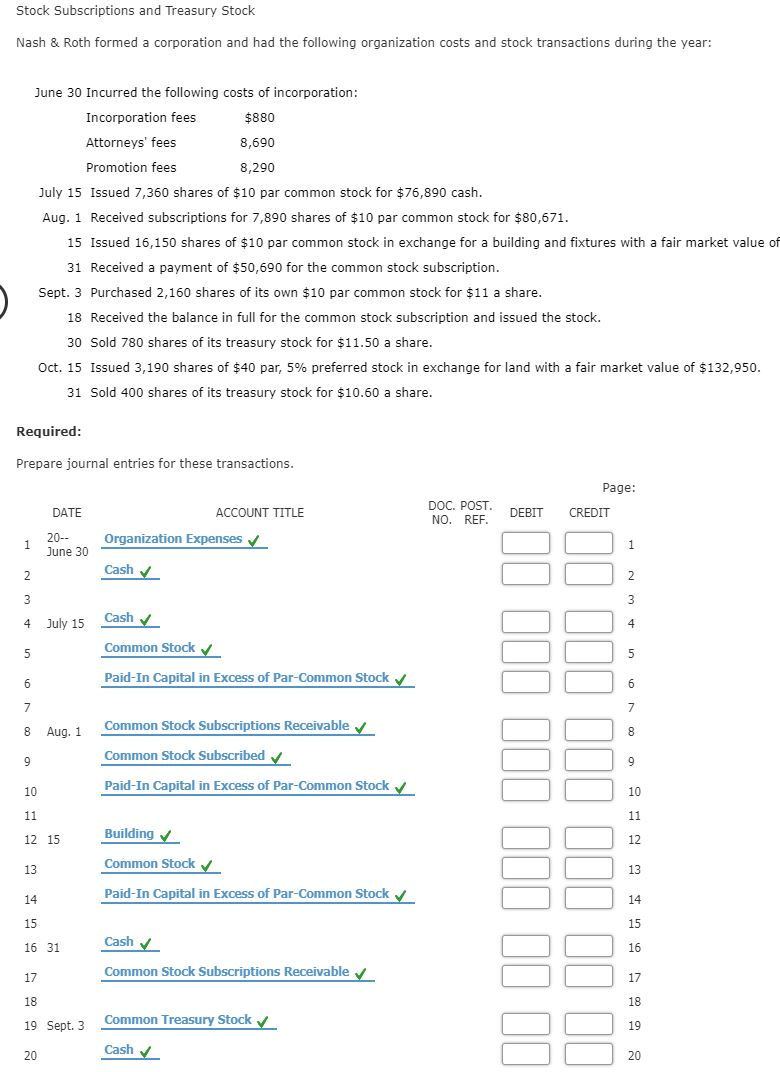

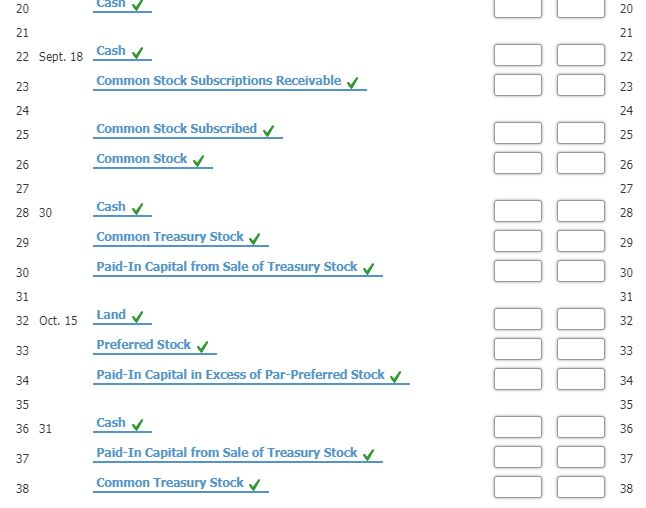

Stock Subscriptions and Treasury Stock Nash & Roth formed a corporation and had the following organization costs and stock transactions during the year: June 30 Incurred the following costs of incorporation: Incorporation fees $880 Attorneys' fees 8,690 Promotion fees 8,290 July 15 Issued 7,360 shares of $10 par common stock for $76,890 cash. Aug. 1 Received subscriptions for 7,890 shares of $10 par common stock for $80,671. 15 Issued 16,150 shares of $10 par common stock in exchange for a building and fixtures with a fair market value of 31 Received a payment of $50,690 for the common stock subscription. Sept. 3 Purchased 2,160 shares of its own $10 par common stock for $11 a share. 18 Received the balance in full for the common stock subscription and issued the stock. 30 Sold 780 shares of its treasury stock for $11.50 a share. Oct. 15 Issued 3,190 shares of $40 par, 5% preferred stock in exchange for land with a fair market value of $132,950. 31 Sold 400 shares of its treasury stock for $10.60 a share. Required: Prepare journal entries for these transactions. Page: DOC. POST. DEBIT NO. REF. DEBIT CREDIT DATE 1 20-22 2 ACCOUNT TITLE Organization Expenses Cash 4 July 15 Cash Common Stock Paid-In Capital in Excess of Par-Common Stock 8 Aug. 1 - Common Stock Subscriptions Receivable Common Stock Subscribed 10 Paid-In Capital in Excess of Par-Common Stock 00 00 000 000 000 000 TII III III III II II Building 12 15 13 Common Stock Paid-In Capital in Excess of Par-Common Stock Cash 17 Common Stock Subscriptions Receivable 19 Sept. 3 20 common Treasury Stock Cash Lash 22 Sept. 18 Cash Common Stock Subscriptions Receivable Common Stock Subscribed Common Stock Cash Common Treasury Stock J II II III III III 30 Paid-In Capital from Sale of Treasury Stock 000 000 000 000 32 Oct. 15 Land Preferred Stock Paid-In Capital in Excess of Par-Preferred Stock 36 31 Cash Paid-In Capital from Sale of Treasury Stock Common Treasury Stock Stock Subscriptions and Treasury Stock Nash & Roth formed a corporation and had the following organization costs and stock transactions during the year: June 30 Incurred the following costs of incorporation: Incorporation fees $880 Attorneys' fees 8,690 Promotion fees 8,290 July 15 Issued 7,360 shares of $10 par common stock for $76,890 cash. Aug. 1 Received subscriptions for 7,890 shares of $10 par common stock for $80,671. 15 Issued 16,150 shares of $10 par common stock in exchange for a building and fixtures with a fair market value of 31 Received a payment of $50,690 for the common stock subscription. Sept. 3 Purchased 2,160 shares of its own $10 par common stock for $11 a share. 18 Received the balance in full for the common stock subscription and issued the stock. 30 Sold 780 shares of its treasury stock for $11.50 a share. Oct. 15 Issued 3,190 shares of $40 par, 5% preferred stock in exchange for land with a fair market value of $132,950. 31 Sold 400 shares of its treasury stock for $10.60 a share. Required: Prepare journal entries for these transactions. Page: DOC. POST. DEBIT NO. REF. DEBIT CREDIT DATE 1 20-22 2 ACCOUNT TITLE Organization Expenses Cash 4 July 15 Cash Common Stock Paid-In Capital in Excess of Par-Common Stock 8 Aug. 1 - Common Stock Subscriptions Receivable Common Stock Subscribed 10 Paid-In Capital in Excess of Par-Common Stock 00 00 000 000 000 000 TII III III III II II Building 12 15 13 Common Stock Paid-In Capital in Excess of Par-Common Stock Cash 17 Common Stock Subscriptions Receivable 19 Sept. 3 20 common Treasury Stock Cash Lash 22 Sept. 18 Cash Common Stock Subscriptions Receivable Common Stock Subscribed Common Stock Cash Common Treasury Stock J II II III III III 30 Paid-In Capital from Sale of Treasury Stock 000 000 000 000 32 Oct. 15 Land Preferred Stock Paid-In Capital in Excess of Par-Preferred Stock 36 31 Cash Paid-In Capital from Sale of Treasury Stock Common Treasury Stock