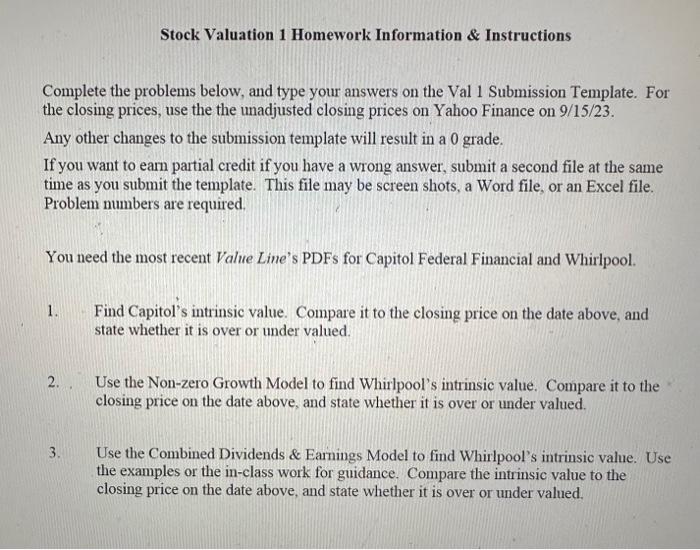

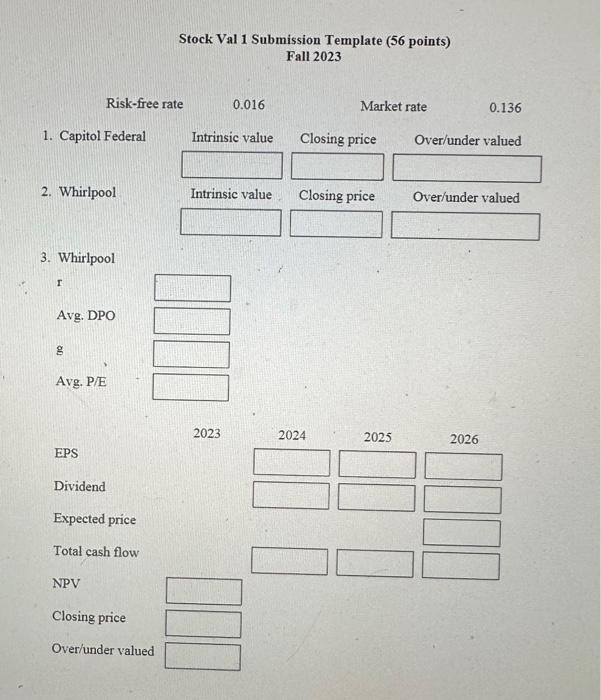

Stock Valuation 1 Homework Information \& Instructions Complete the problems below, and type your answers on the Val 1 Submission Template. For the closing prices, use the the unadjusted closing prices on Yahoo Finance on 9/15/23. Any other changes to the submission template will result in a 0 grade. If you want to earn partial credit if you have a wrong answer, submit a second file at the same time as you submit the template. This file may be screen shots, a Word file, or an Excel file. Problem numbers are required. You need the most recent Value Line's PDFs for Capitol Federal Financial and Whirlpool. 1. Find Capitol's intrinsic value. Compare it to the closing price on the date above, and state whether it is over or under valued. 2. Use the Non-zero Growth Model to find Whirlpool's intrinsic value. Compare it to the closing price on the date above, and state whether it is over or under valued. 3. Use the Combined Dividends \& Earnings Model to find Whirlpool's intrinsic value. Use the examples or the in-class work for guidance. Compare the intrinsic value to the closing price on the date above, and state whether it is over or under valued. Stock Val 1 Submission Template ( 56 points) Fall 2023 Risk-free rate 0.016 Market rate 0.136 1. Capitol Federal Intrinsic value 2. Whirlpool 3. Whirlpool I Avg. DPO g Avg. P/E 2023 EPS Dividend Expected price Total cash flow NPV Closing price Over/under valued Closing price Over/under valued Over/under valued Closing price 2026 Stock Valuation 1 Homework Information \& Instructions Complete the problems below, and type your answers on the Val 1 Submission Template. For the closing prices, use the the unadjusted closing prices on Yahoo Finance on 9/15/23. Any other changes to the submission template will result in a 0 grade. If you want to earn partial credit if you have a wrong answer, submit a second file at the same time as you submit the template. This file may be screen shots, a Word file, or an Excel file. Problem numbers are required. You need the most recent Value Line's PDFs for Capitol Federal Financial and Whirlpool. 1. Find Capitol's intrinsic value. Compare it to the closing price on the date above, and state whether it is over or under valued. 2. Use the Non-zero Growth Model to find Whirlpool's intrinsic value. Compare it to the closing price on the date above, and state whether it is over or under valued. 3. Use the Combined Dividends \& Earnings Model to find Whirlpool's intrinsic value. Use the examples or the in-class work for guidance. Compare the intrinsic value to the closing price on the date above, and state whether it is over or under valued. Stock Val 1 Submission Template ( 56 points) Fall 2023 Risk-free rate 0.016 Market rate 0.136 1. Capitol Federal Intrinsic value 2. Whirlpool 3. Whirlpool I Avg. DPO g Avg. P/E 2023 EPS Dividend Expected price Total cash flow NPV Closing price Over/under valued Closing price Over/under valued Over/under valued Closing price 2026