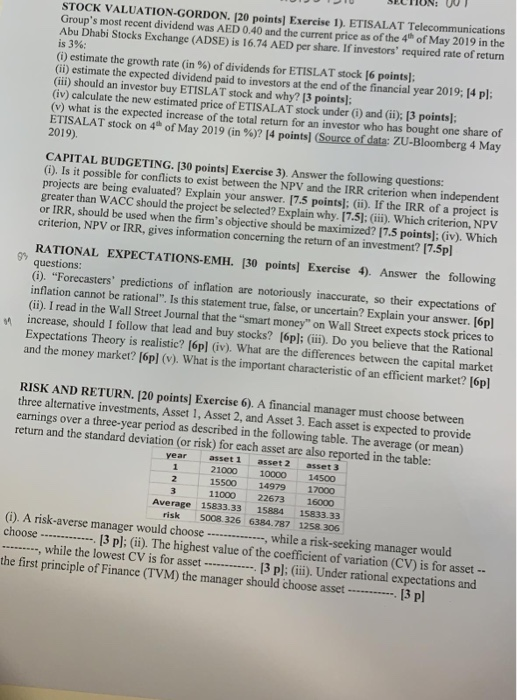

STOCK VALUATION-GORDON. 120 points] Exercise I). ETISALAT Telecommunications Group's most recent dividend was AED 0.40 and the current price as of the 4h of May 2019 in the Abu Dhabi Stocks Exchange (ADSE) is 16.74 AED per share. If investors' required rate of return is 396: (i) estimate the growth rate (in %) of dividends for ETSLAT stock 16 points), (ii) estimate the expected dividend paid to investors at the end of the financial year 2019; 14 pl: (ii) should an investor buy ETISLAT stock and why? [3 pointsl: (iv) calculate the new estimated price of ETISALAT stock under (i) and (in 13 points! (v) what is the expected increase of the total return for an investor who has bought one share of ETISALAT stock on 4a of May 2019 (in %)? 14 points1 &wrecordatazU-Bloomberg 4 May 2019). CAPITAL BUDGETING. 130 pointsl Exercise 3), Answer the following questions: ). Is it possible for conflicts to exist between the NPV and the IRR criterion when independent rojects are being evaluated? Explain your answer. 17.5 points): (ii). If the IRR of a project is greater than WACC should the project be selected? Explain why. [7.5]: (iii). Which criterion, N or IRR, should be used when the firm's objective should be maximized? 17.5 pointsl: (iv). Which criterion, NPV or IRR, gives information concerning the return of an investment? 17.5pl l Exercise 4). Answer the following questions Q). "Forecasters' predictions of inflation are notoriously inaccurate, so their expectations of inflation cannot be rational". Is this statement true, false, or uncertain? Explain your answer. [6pl (ii). I read in the Wall Street Journal that the "smart money" on Wall Street expects stock prices to hould I follow that lead and buy stocks? l6pl:(i). Do you believe that the Rational 1 Expectations Theory is realistic? [6p] (Gv). What are the differences between the capital market and the money market? [6pl (v). What is the important characteristic of an efficient market? (6pl RISK AND RETURN. [20 points] Exercise 6). A financial manager must choose between three alternative investments, Asset 1, Asset 2, and Asset 3. Each asset is expected to provide earnings over a three-year period as described in the following table. The average (or mean) return and the standard deviation (or risk) for each asset are also reported in the table: year asset 1 asset 2 asset 3 1000 10000 14500 15500 1497917000 11000 2267316000 Average 15833.33 15884 15833.33 risk 5008.326 6384.787 1258.306 (). A risk-averse manager would choosewhile a risk-seeking manager would choose 13 pl; (ii)The highest value of the coefficient of variation (CV) is for asset- , while the lowest CV is for asset. 13 pl; (ii). Under rational expectations and the first principle of Finance (TVM) the manager should choose asset STOCK VALUATION-GORDON. 120 points] Exercise I). ETISALAT Telecommunications Group's most recent dividend was AED 0.40 and the current price as of the 4h of May 2019 in the Abu Dhabi Stocks Exchange (ADSE) is 16.74 AED per share. If investors' required rate of return is 396: (i) estimate the growth rate (in %) of dividends for ETSLAT stock 16 points), (ii) estimate the expected dividend paid to investors at the end of the financial year 2019; 14 pl: (ii) should an investor buy ETISLAT stock and why? [3 pointsl: (iv) calculate the new estimated price of ETISALAT stock under (i) and (in 13 points! (v) what is the expected increase of the total return for an investor who has bought one share of ETISALAT stock on 4a of May 2019 (in %)? 14 points1 &wrecordatazU-Bloomberg 4 May 2019). CAPITAL BUDGETING. 130 pointsl Exercise 3), Answer the following questions: ). Is it possible for conflicts to exist between the NPV and the IRR criterion when independent rojects are being evaluated? Explain your answer. 17.5 points): (ii). If the IRR of a project is greater than WACC should the project be selected? Explain why. [7.5]: (iii). Which criterion, N or IRR, should be used when the firm's objective should be maximized? 17.5 pointsl: (iv). Which criterion, NPV or IRR, gives information concerning the return of an investment? 17.5pl l Exercise 4). Answer the following questions Q). "Forecasters' predictions of inflation are notoriously inaccurate, so their expectations of inflation cannot be rational". Is this statement true, false, or uncertain? Explain your answer. [6pl (ii). I read in the Wall Street Journal that the "smart money" on Wall Street expects stock prices to hould I follow that lead and buy stocks? l6pl:(i). Do you believe that the Rational 1 Expectations Theory is realistic? [6p] (Gv). What are the differences between the capital market and the money market? [6pl (v). What is the important characteristic of an efficient market? (6pl RISK AND RETURN. [20 points] Exercise 6). A financial manager must choose between three alternative investments, Asset 1, Asset 2, and Asset 3. Each asset is expected to provide earnings over a three-year period as described in the following table. The average (or mean) return and the standard deviation (or risk) for each asset are also reported in the table: year asset 1 asset 2 asset 3 1000 10000 14500 15500 1497917000 11000 2267316000 Average 15833.33 15884 15833.33 risk 5008.326 6384.787 1258.306 (). A risk-averse manager would choosewhile a risk-seeking manager would choose 13 pl; (ii)The highest value of the coefficient of variation (CV) is for asset- , while the lowest CV is for asset. 13 pl; (ii). Under rational expectations and the first principle of Finance (TVM) the manager should choose asset