Question: Stock X and Stock Z both have an expected return of 10%. The standard deviation of the expected return is 8% for Stock X, and

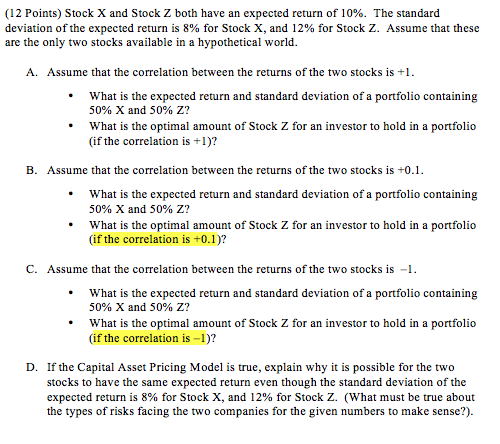

Stock X and Stock Z both have an expected return of 10%. The standard deviation of the expected return is 8% for Stock X, and 12% for Stock Z. Assume that these are the only two stocks available in a hypothetical world. Assume that the correlation between the returns of the two stocks is +1. What is the expected return and standard deviation of a portfolio containing 50% X and 50% Z? What is the optimal amount of Stock Z for an investor to hold in a portfolio (if the correlation is +1)? Assume that the correlation between the returns of the two stocks is -0.1. What is the expected return and standard deviation of a portfolio containing 50% X and 50% Z? What is the optimal amount of Stock Z for an investor to hold in a portfolio (if the correlation is -0.1)? Assume that the correlation between the returns of the two stocks is -1. What is the expected return and standard deviation of a portfolio containing 50% X and 50% Z? What is the optimal amount of Stock Z for an investor to hold in a portfolio (if the correlation is -1)? If the Capital Asset Pricing Model is true, explain why it is possible for the two stocks to have the same expected return even though the standard deviation of the expected return is 8% for Stock X, and 12% for Stock Z. (What must be true about the types of risks facing the two companies for the given numbers to make sense?)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts