Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION Patricia concludes a written agreement for the purchase of a free standing Jacuzzi from Luxury Pools (Pty) Ltd on 1 June at her home.

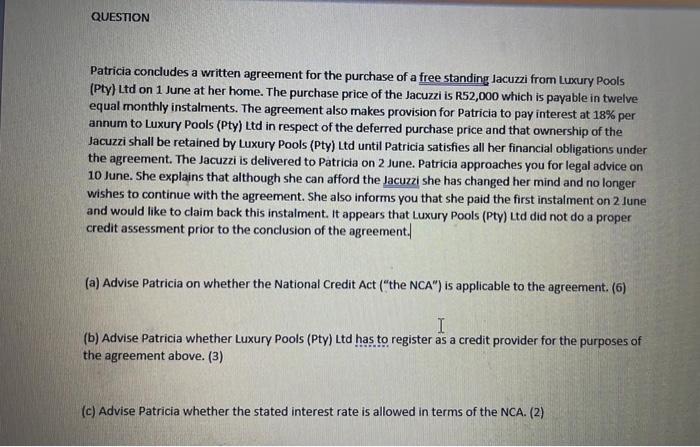

QUESTION Patricia concludes a written agreement for the purchase of a free standing Jacuzzi from Luxury Pools (Pty) Ltd on 1 June at her home. The purchase price of the Jacuzzi is R52,000 which is payable in twelve equal monthly instalments. The agreement also makes provision for Patricia to pay interest at 18% per annum to Luxury Pools (Pty) Ltd in respect of the deferred purchase price and that ownership of the Jacuzzi shall be retained by Luxury Pools (Pty) Ltd until Patricia satisfies all her financial obligations under the agreement. The Jacuzzi is delivered to Patricia on 2 June. Patricia approaches you for legal advice on 10 June. She explains that although she can afford the Jacuzzi she has changed her mind and no longer wishes to continue with the agreement. She also informs you that she paid the first instalment on 2 June and would like to claim back this instalment. It appears that Luxury Pools (Pty) Ltd did not do a proper credit assessment prior to the conclusion of the agreement. (a) Advise Patricia on whether the National Credit Act ("the NCA") is applicable to the agreement. (6) I (b) Advise Patricia whether Luxury Pools (Pty) Ltd has to register as a credit provider for the purposes of the agreement above. (3) (c) Advise Patricia whether the stated interest rate is allowed in terms of the NCA. (2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started