please help

question example!

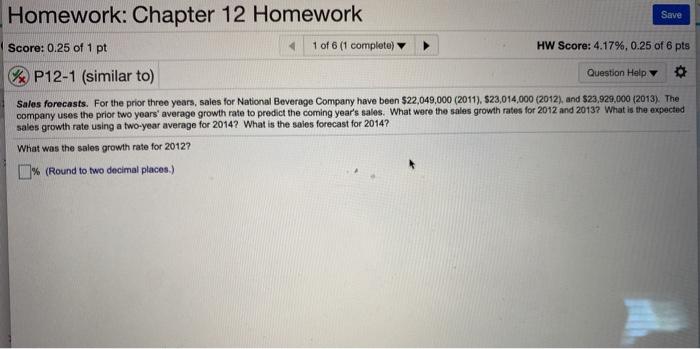

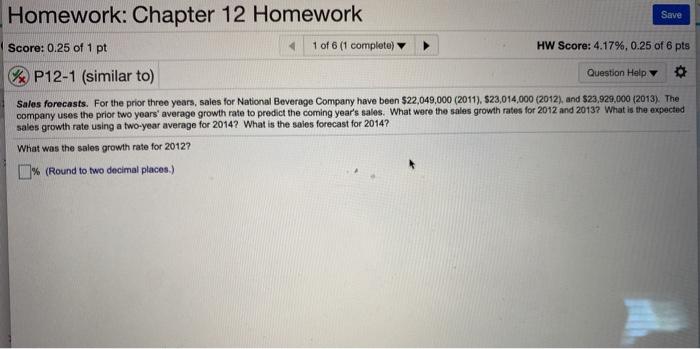

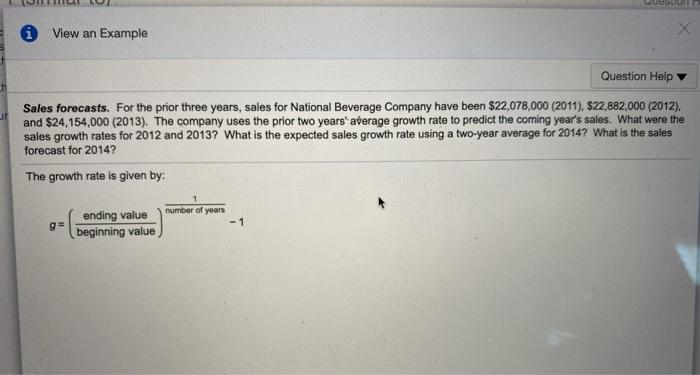

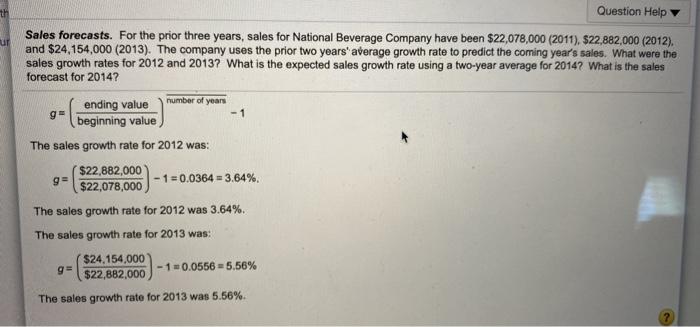

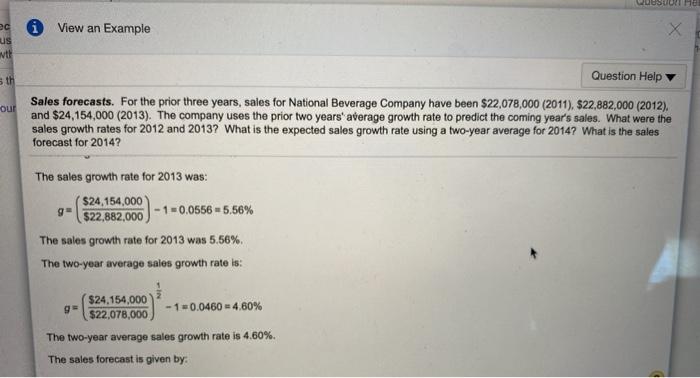

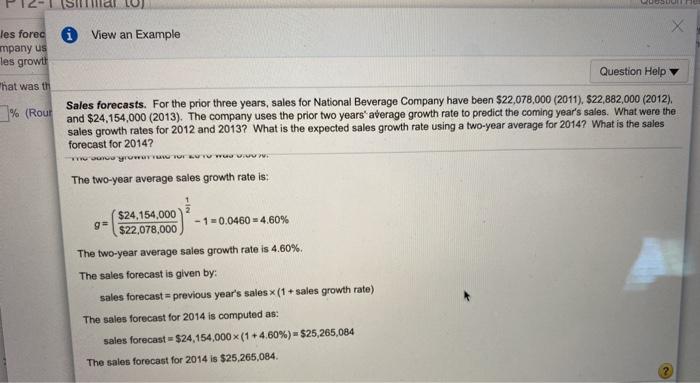

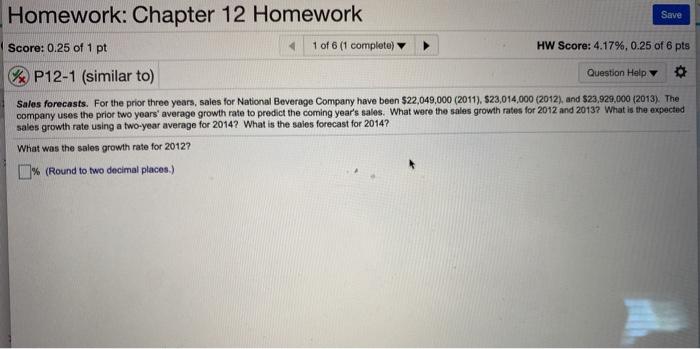

Homework: Chapter 12 Homework Save Score: 0.25 of 1 pt 1 of 6 (1 complete) HW Score: 4.17%, 0.25 of 6 pts P12-1 (similar to) Question Help Sales forecasts. For the prior three years, sales for National Beverage Company have been $22,049,000 (2011), 523,014,000 (2012), and $23,929,000 (2013). The company uses the prior two years' average growth rate to predict the coming year's sales. What were the sales growth rates for 2012 and 2013? What is the expected sales growth rate using a two-year average for 2014? What is the sales forecast for 2014? What was the sales growth rate for 2012? % (Round to two decimal places) UODU 1 View an Example X Question Help Sales forecasts. For the prior three years, sales for National Beverage Company have been $22,078,000 (2011). $22,882,000 (2012). and $24,154,000 (2013). The company uses the prior two years' average growth rate to predict the coming year's sales. What were the sales growth rates for 2012 and 2013? What is the expected sales growth rate using a two-year average for 2014? What is the sales forecast for 2014? The growth rate is given by: number of years go ending value beginning value th ur Question Help Sales forecasts. For the prior three years, sales for National Beverage Company have been $22,078,000 (2011). $22,882,000 (2012). and $24,154,000 (2013). The company uses the prior two years' average growth rate to predict the coming year's sales. What were the sales growth rates for 2012 and 2013? What is the expected sales growth rate using a two-year average for 2014? What is the sales forecast for 2014? ending value number of years g - 1 beginning value The sales growth rate for 2012 was: $22,882,000 g= $22,078,000 - 1 = 0.0364 = 3.64% The sales growth rate for 2012 was 3.64%. The sales growth rate for 2013 was: $24.154,000 g- $22,882,000 - 1 0.0556 = 5.56% The sales growth rate for 2013 was 5.56% Loos 10 View an Example X ec us th th out Question Help Sales forecasts. For the prior three years, sales for National Beverage Company have been $22,078,000 (2011). $22,882,000 (2012). and $24,154,000 (2013). The company uses the prior two years' average growth rate to predict the coming year's sales. What were the sales growth rates for 2012 and 2013? What is the expected sales growth rate using a two-year average for 2014? What is the sales forecast for 2014? The sales growth rate for 2013 was: $24.154,000 $22,882,000 - 1 = 0,0556 - 5,56% The sales growth rate for 2013 was 5.56% The two-year average sales growth rate is: ($24.154,000 g $22.078,000 -1 +0.0460 - 4,60% The two-year average sales growth rate is 4.60% The sales forecast is given by: CE les fored mpany us View an Example les growth Question Help That was th % (Rout Sales forecasts. For the prior three years, sales for National Beverage Company have been $22,078,000 (2011). $22,882,000 (2012). and $24,154,000 (2013). The company uses the prior two years' average growth rate to predict the coming year's sales. What were the sales growth rates for 2012 and 2013? What is the expected sales growth rate using a two-year average for 2014? What is the sales forecast for 2014? www wyrower TU TU www www. The two-year average sales growth rate is: $24,154,000 ge $22,078,000 - 1 =0.0460 - 4.60% The two-year average sales growth rate is 4.60%. The sales forecast is given by: sales forecast = previous year's sales x (1 + sales growth rate) The sales forecast for 2014 is computed as: sales forecast = $24,154,000 X (1+4.60%) - $25,265,084 The sales forecast for 2014 is $25,265,084