Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stockco is considering four investments. Investment 1 will yield a net present value (NPV) of $25,000; investment 2, an NPV of $30,000; investment 3, an

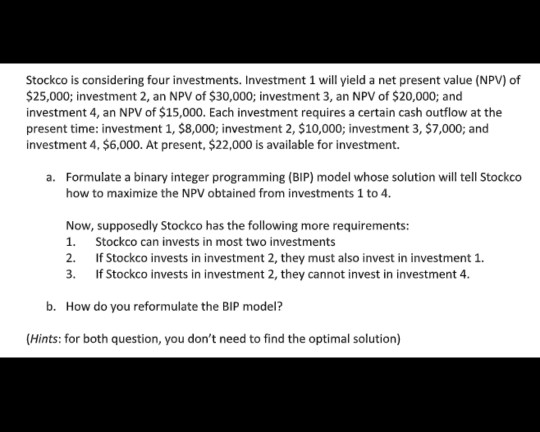

Stockco is considering four investments. Investment 1 will yield a net present value (NPV) of $25,000; investment 2, an NPV of $30,000; investment 3, an NPV of $20,000; and investment 4, an NPV of $15,000. Each investment requires a certain cash outflow at the present time: investment 1, $8,000; investment 2, $10,000; investment 3, $7,000; and investment 4. $6,000. At present, $22,000 is available for investment. a. Formulate a binary integer programming (BIP) model whose solution will tell Stockco how to maximize the NPV obtained from investments 1 to 4. Now, supposedly Stockco has the following more requirements: 1. Stockco can invests in most two investments 2. If Stockco invests in investment 2, they must also invest in investment 1. 3. If Stockco invests in investment 2, they cannot invest in investment 4. b. How do you reformulate the BIP model? (Hints: for both question, you don't need to find the optimal solution)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started