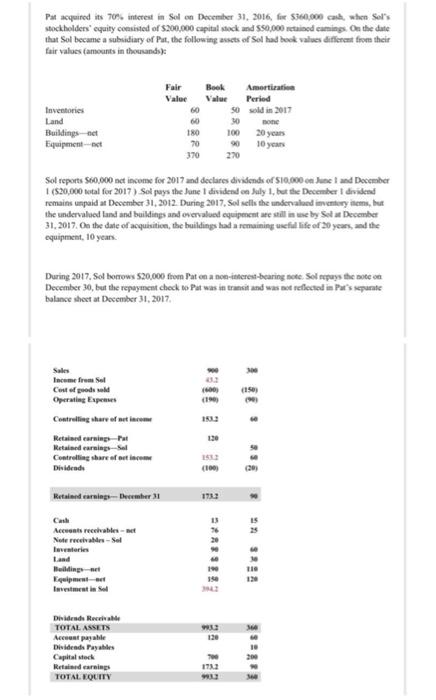

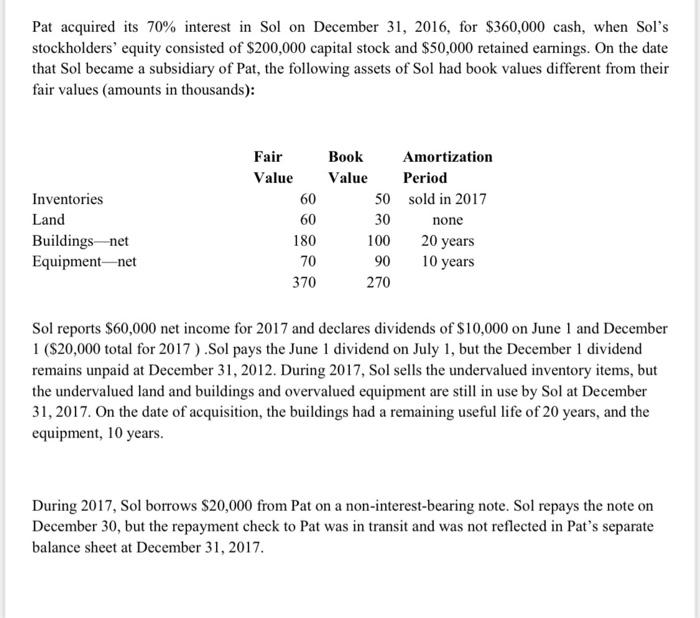

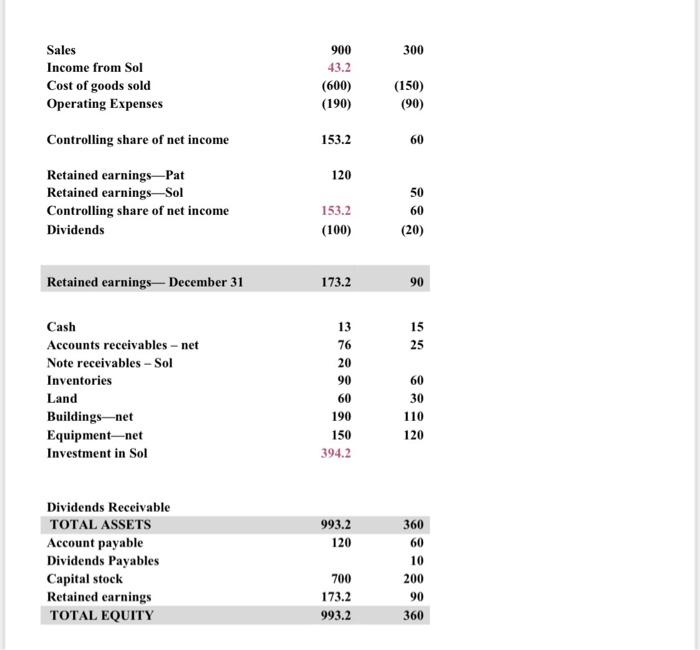

stockholders' equity ceasizted of 5200,000 capital stock and 550,000 retaiocd carning. On the date that Sol became a subsidiary of Pat, the following assets of Sol had bock values defferent frome their Lair values (amounts in thousunds): Sol reports 960.000 net inceme for 2017 and declates dividendx of 510.000 en hase I and Decerober I (\$20,000 watal for 2017) Sol poys the Jane 1 dividend en Jaly 1, but the Decenber I drvidend remains unpaid at December 31, 2012. Durieg 2017, Sol selits the undenaloed inventury iltems, but the undervalued lasst and buildings and overvalued equipencnt ate still in me by Sol at December 31, 2017. O0 the daie of acquaititen, the huildings had a remaining usefill life of 20 years, and the equipment, 10 years. During 2017. Sol bonews 520.000 from Pat en a nce-itierest-bearing sote. Sol ropuys the sote en December 30, but the repayment check wo Pat was in transit and was not reflected in Pat's sepurate balanse theet at December 31, 2017, Pat acquired its 70% interest in Sol on December 31,2016 , for $360,000 cash, when Sol's stockholders' equity consisted of $200,000 capital stock and $50,000 retained earnings. On the date that Sol became a subsidiary of Pat, the following assets of Sol had book values different from their fair values (amounts in thousands): Sol reports $60,000 net income for 2017 and declares dividends of $10,000 on June 1 and December 1 ( $20,000 total for 2017) .Sol pays the June 1 dividend on July 1, but the December 1 dividend remains unpaid at December 31, 2012. During 2017, Sol sells the undervalued inventory items, but the undervalued land and buildings and overvalued equipment are still in use by Sol at December 31, 2017. On the date of acquisition, the buildings had a remaining useful life of 20 years, and the equipment, 10 years. During 2017, Sol borrows $20,000 from Pat on a non-interest-bearing note. Sol repays the note on December 30 , but the repayment check to Pat was in transit and was not reflected in Pat's separate balance sheet at December 31, 2017. SalesIncomefromSolCostofgoodssoldOperatingExpensesControllingshareofnetincomeRetainedearnings-PatRetainedearnings-SolControllingshareofnetincomeDividends90043.2(600)(190)153.2120153.2(100)300(150)(90)6060(20) Retainedearnings-December31CashAccountsreceivables-netNotereceivables-SolInventoriesLandBuildings-netEquipment-netInvestmentinSol173.21376209060190150394.29015256030110120 \begin{tabular}{|lrr|} \hline Dividends Receivable & & \\ \hline TOTAL ASSETS & 993.2 & 360 \\ \hline Account payable & 120 & 60 \\ Dividends Payables & & 10 \\ Capital stock & 700 & 200 \\ Retained earnings & 173.2 & 90 \\ TOTAL EQUITY & 993.2 & 360 \end{tabular} stockholders' equity ceasizted of 5200,000 capital stock and 550,000 retaiocd carning. On the date that Sol became a subsidiary of Pat, the following assets of Sol had bock values defferent frome their Lair values (amounts in thousunds): Sol reports 960.000 net inceme for 2017 and declates dividendx of 510.000 en hase I and Decerober I (\$20,000 watal for 2017) Sol poys the Jane 1 dividend en Jaly 1, but the Decenber I drvidend remains unpaid at December 31, 2012. Durieg 2017, Sol selits the undenaloed inventury iltems, but the undervalued lasst and buildings and overvalued equipencnt ate still in me by Sol at December 31, 2017. O0 the daie of acquaititen, the huildings had a remaining usefill life of 20 years, and the equipment, 10 years. During 2017. Sol bonews 520.000 from Pat en a nce-itierest-bearing sote. Sol ropuys the sote en December 30, but the repayment check wo Pat was in transit and was not reflected in Pat's sepurate balanse theet at December 31, 2017, Pat acquired its 70% interest in Sol on December 31,2016 , for $360,000 cash, when Sol's stockholders' equity consisted of $200,000 capital stock and $50,000 retained earnings. On the date that Sol became a subsidiary of Pat, the following assets of Sol had book values different from their fair values (amounts in thousands): Sol reports $60,000 net income for 2017 and declares dividends of $10,000 on June 1 and December 1 ( $20,000 total for 2017) .Sol pays the June 1 dividend on July 1, but the December 1 dividend remains unpaid at December 31, 2012. During 2017, Sol sells the undervalued inventory items, but the undervalued land and buildings and overvalued equipment are still in use by Sol at December 31, 2017. On the date of acquisition, the buildings had a remaining useful life of 20 years, and the equipment, 10 years. During 2017, Sol borrows $20,000 from Pat on a non-interest-bearing note. Sol repays the note on December 30 , but the repayment check to Pat was in transit and was not reflected in Pat's separate balance sheet at December 31, 2017. SalesIncomefromSolCostofgoodssoldOperatingExpensesControllingshareofnetincomeRetainedearnings-PatRetainedearnings-SolControllingshareofnetincomeDividends90043.2(600)(190)153.2120153.2(100)300(150)(90)6060(20) Retainedearnings-December31CashAccountsreceivables-netNotereceivables-SolInventoriesLandBuildings-netEquipment-netInvestmentinSol173.21376209060190150394.29015256030110120 \begin{tabular}{|lrr|} \hline Dividends Receivable & & \\ \hline TOTAL ASSETS & 993.2 & 360 \\ \hline Account payable & 120 & 60 \\ Dividends Payables & & 10 \\ Capital stock & 700 & 200 \\ Retained earnings & 173.2 & 90 \\ TOTAL EQUITY & 993.2 & 360 \end{tabular}