Question

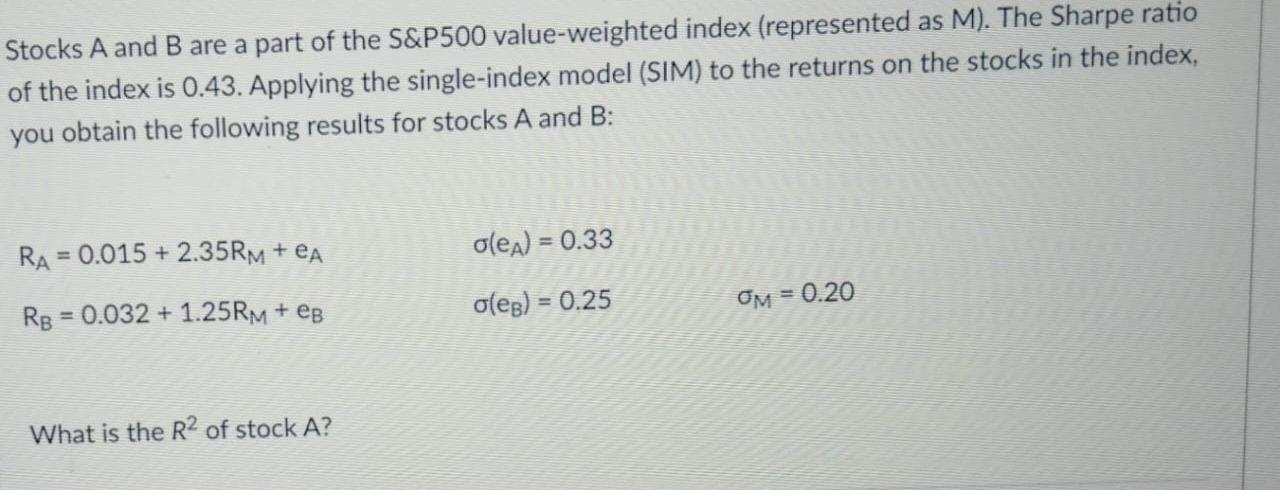

Stocks A and B are a part of the S&P500 value-weighted index (represented as M). The Sharpe ratio of the index is 0.43. Applying

Stocks A and B are a part of the S&P500 value-weighted index (represented as M). The Sharpe ratio of the index is 0.43. Applying the single-index model (SIM) to the returns on the stocks in the index, you obtain the following results for stocks A and B: RA RB = 0.015 +2.35RM + eA = 0.032 +1.25RM + eB What is the R of stock A? o(eA) = 0.33 o(eg) = 0.25 OM = 0.20

Step by Step Solution

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the Rsquared of stock A we need to first calculate the variance of its returns that is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Linear Algebra A Modern Introduction

Authors: David Poole

4th edition

1285463242, 978-1285982830, 1285982835, 978-1285463247

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App