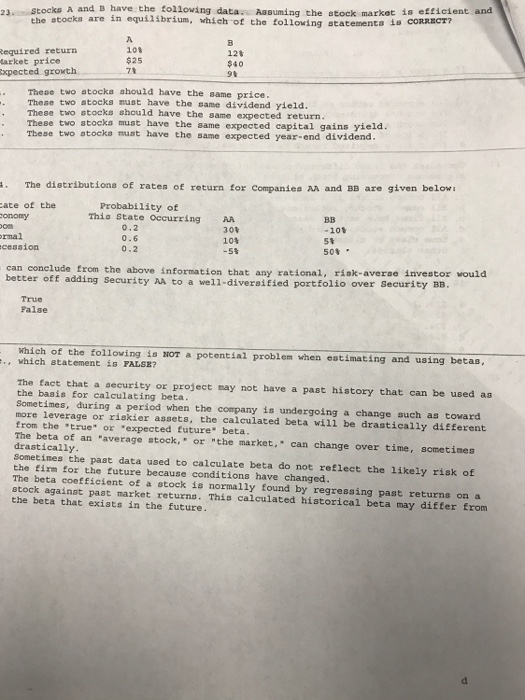

Question: Stocks A and B have the following data. Assuming the s market is efficient and the stocks are in equilibrium, which of the statements is

Stocks A and B have the following data. Assuming the s market is efficient and the stocks are in equilibrium, which of the statements is CORRECT? These two stocks should have the same price. These two stocks must have the same dividend yield. These two stocks should have the same expected return. These two stocks must have the same expected capital gains yield. These two stocks must have the same expected year-end dividend. The distributions of rates of return for companies AA and BB are given below: can conclude from the above information that any rational risk-averse investor would better off adding Security AA to a well-diversified portfolio over Security BB. Which of the following is NOT a potential problem when estimating a using betas, statement is FALSE? The fact that a security may not have a past history that can be used as the basis for calculating beta. Sometimes, during a period when the is undergoing a change as toward more leverage or riskier assets, the calculated beta will be drastically different from the "true" or riskier assets, the calculated will be drastically different beta of or expected future beta The an average stock, or the market can change over time, sometimes drastically Sometimes the past data used to calculate beta do not reflect the likely risk of the firm for the future because conditions have changed. The beta coefficient of a stock is normally found by regressing past returns on a stock against past market returns. This calculated historical beta may differ from the beta that exists in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts