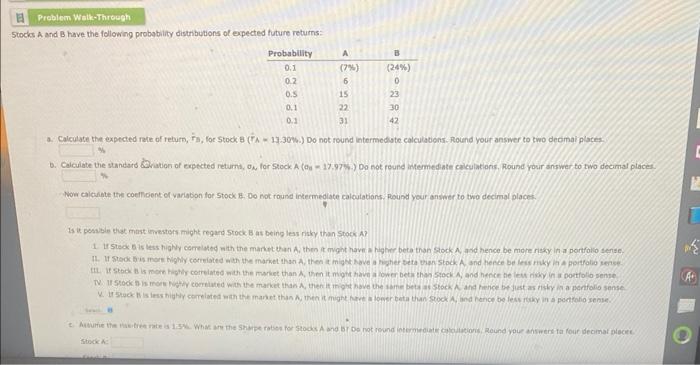

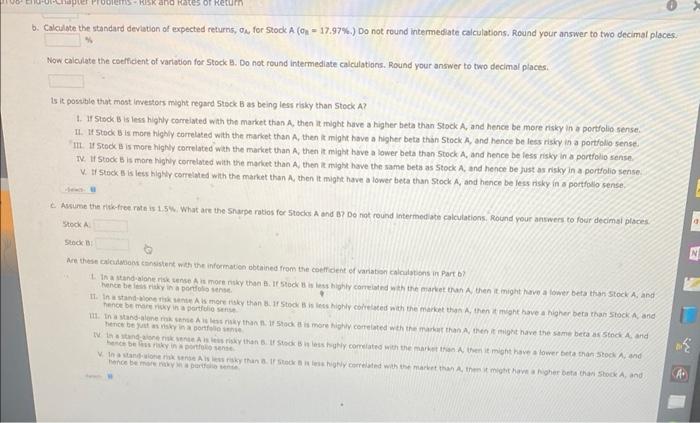

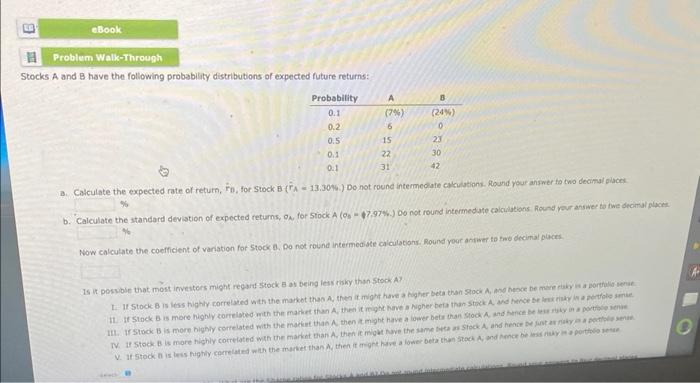

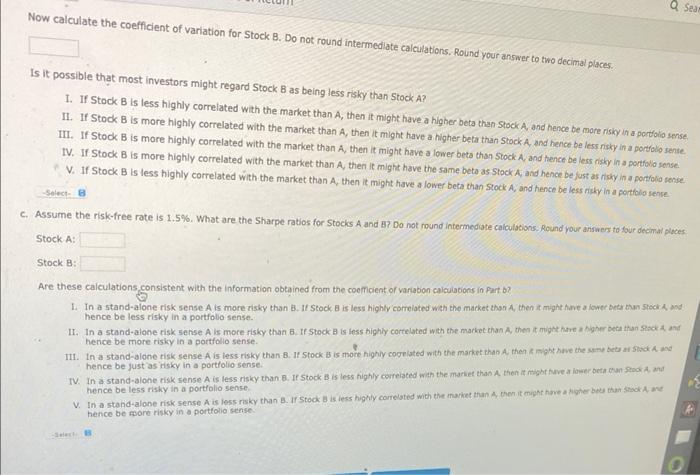

Stocks A and B have the following probgbility distributions of expected future returns: Wow calcainte the coefficient of variabion for 5 tock \&. Do not round intermedlate calculations, pound yeur ansiver to two decinal places. Is it. posable that mast imesters might regard 5 tock. B as being leas risky than stock A ? 1. If sted 6 is less highy correlated with the manct than A, then it myght have a higher beta than stock A asd hence be more risky in a ponfollo senses. sin8 Stook A: Calculate the standard devation of expected returns, 0, for 5tock A (0n=17.97%.)Donotroundintermediatecalculations.Roundyouranswertotwodecimalplace Now caiculate the coefficent of vartation for Stock B. Do not round intermediate calculations. Round your answer to two decimal places. Is it possible trat most investors might regard 5tock B as being less risky than Stock A? 1. If Stock B is less highly correiated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. 11. If Stock B is more highly torrelated with the market than A, then it might have a higher beta than Stock A, and hence be less risiry is a portfollo sense. III. If Stock A is more highy correlated wht the market than A, then it might hive a lower beta than Stock A, and hence be less risky in a portfolio sense. W. If 5 todk B is mare highy correlated with the market than A. then it might have the same beta as stock A, and hence be just as nisky in a portfolio sense. W. It Stock E is less highly camelated with the market than A, then it might have a lower beta than Stock A, and hence be less niky in a portfollo sense, wtock A Slinck 8 Are these calculaboos cansistent wth the informaten obtained from the coeffoent ef variabon calculatens in Part b? Wenco be less ritey in a portiols bense: hence be mare ricky in a partfolio serits. the Is it possible that most investors might regard Stock 8 as being less risky than Stock A? I. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portoio sense. II. If Stock B is more highly correlated with the market than A, then it might have a higher befa than Stock A. and hence be less nisky in a portfolo sense. III. If Stock B is more highly correlated with the market than A, then it might have a lower beto than 5tock A, and hence be less nishy in a portfollo sense: IV. If Stock B is more highly correlated with the market than A, then it might have the same beta as 5 tock A, and hence be fust as risky in a portrolio sonse. V. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be iess nishy in a potfcio sense c. Assume the risk-free rate is 1.5%. What are the Sharpe ratios for Stocks A and B? Do not round intermediate calculations. Round your ansiners to four decinal ploces. Stock A: Stock B: Are these calculations consistent with the information obtained from the coemient of varlabon caiculations in Fart b? 1. In a stand-alone risk sense A is more risky than B. It Stock a is less highty comelated weth the market than A, then it miaht hare a kover orta than Stock A and hence be less risky in a portfollo sense. II. In a stand-alone risk serise A is more risky than B. If Stock B is loss highly correlated with the market chan A, then it mignt hare a Nigher beta than siock a and hence be more risky in a portfolio sense. 111. In a stand-alone risk sense A is less risky than-B. If stock B is more highily cooplated with the market than A, then a right have the unte beta ar Stick A and hence be just as itsky in a portfolio sense. TV. In a stand-alone risk sense A is less risky than B. If Stock B is less highly correiated with the mariet than A then it might huve a lawer beta cran shock at, and hence be less risky in a portfolio sense. V. In a stand-alone risk sense A is less risky than B. If 5 took B is less highly conreloted with the market than A, then it might have at hher bey than itsok A ane hence be foore risky in a portfolio sense. Stocks A and B have the following probgbility distributions of expected future returns: Wow calcainte the coefficient of variabion for 5 tock \&. Do not round intermedlate calculations, pound yeur ansiver to two decinal places. Is it. posable that mast imesters might regard 5 tock. B as being leas risky than stock A ? 1. If sted 6 is less highy correlated with the manct than A, then it myght have a higher beta than stock A asd hence be more risky in a ponfollo senses. sin8 Stook A: Calculate the standard devation of expected returns, 0, for 5tock A (0n=17.97%.)Donotroundintermediatecalculations.Roundyouranswertotwodecimalplace Now caiculate the coefficent of vartation for Stock B. Do not round intermediate calculations. Round your answer to two decimal places. Is it possible trat most investors might regard 5tock B as being less risky than Stock A? 1. If Stock B is less highly correiated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portfolio sense. 11. If Stock B is more highly torrelated with the market than A, then it might have a higher beta than Stock A, and hence be less risiry is a portfollo sense. III. If Stock A is more highy correlated wht the market than A, then it might hive a lower beta than Stock A, and hence be less risky in a portfolio sense. W. If 5 todk B is mare highy correlated with the market than A. then it might have the same beta as stock A, and hence be just as nisky in a portfolio sense. W. It Stock E is less highly camelated with the market than A, then it might have a lower beta than Stock A, and hence be less niky in a portfollo sense, wtock A Slinck 8 Are these calculaboos cansistent wth the informaten obtained from the coeffoent ef variabon calculatens in Part b? Wenco be less ritey in a portiols bense: hence be mare ricky in a partfolio serits. the Is it possible that most investors might regard Stock 8 as being less risky than Stock A? I. If Stock B is less highly correlated with the market than A, then it might have a higher beta than Stock A, and hence be more risky in a portoio sense. II. If Stock B is more highly correlated with the market than A, then it might have a higher befa than Stock A. and hence be less nisky in a portfolo sense. III. If Stock B is more highly correlated with the market than A, then it might have a lower beto than 5tock A, and hence be less nishy in a portfollo sense: IV. If Stock B is more highly correlated with the market than A, then it might have the same beta as 5 tock A, and hence be fust as risky in a portrolio sonse. V. If Stock B is less highly correlated with the market than A, then it might have a lower beta than Stock A, and hence be iess nishy in a potfcio sense c. Assume the risk-free rate is 1.5%. What are the Sharpe ratios for Stocks A and B? Do not round intermediate calculations. Round your ansiners to four decinal ploces. Stock A: Stock B: Are these calculations consistent with the information obtained from the coemient of varlabon caiculations in Fart b? 1. In a stand-alone risk sense A is more risky than B. It Stock a is less highty comelated weth the market than A, then it miaht hare a kover orta than Stock A and hence be less risky in a portfollo sense. II. In a stand-alone risk serise A is more risky than B. If Stock B is loss highly correlated with the market chan A, then it mignt hare a Nigher beta than siock a and hence be more risky in a portfolio sense. 111. In a stand-alone risk sense A is less risky than-B. If stock B is more highily cooplated with the market than A, then a right have the unte beta ar Stick A and hence be just as itsky in a portfolio sense. TV. In a stand-alone risk sense A is less risky than B. If Stock B is less highly correiated with the mariet than A then it might huve a lawer beta cran shock at, and hence be less risky in a portfolio sense. V. In a stand-alone risk sense A is less risky than B. If 5 took B is less highly conreloted with the market than A, then it might have at hher bey than itsok A ane hence be foore risky in a portfolio sense