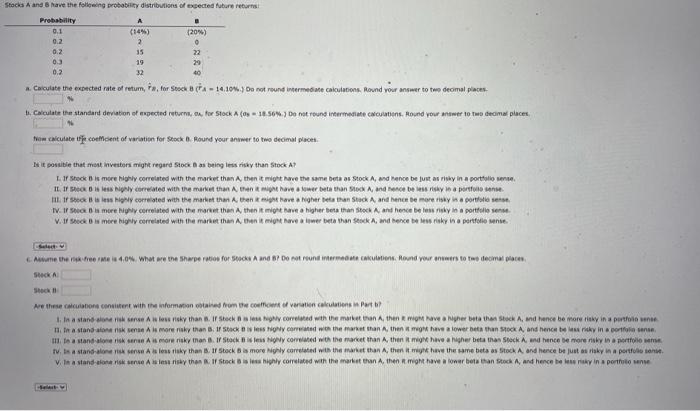

Stocks A and have the following probability distributions of expected future returns Probability 0.1 (14%) (20%) 0 0.2 2 35 22 0.2 0.3 0.2 19 29 32 40 a Caculate the expected rate of retum, P, for stock (A - 14.10%. Do not round intermediate calculations, Round your answer to two decimal places Calculate the standard deviation of expected return, ou, for Steck A (os HR SON.) Do not round intermediate catevations. Round your answer to two decimal places, Nom calculate tipit contient of variation for Stock Round your answer to two decimal place Nt possible that most investors might regard Stock 6 as being less risky than Stock A? L I Stock is more highly correlated with the market than then it might have the same beta as Stock A, and hence be just as risky in a portfolio IL 10 Nicorated with the market than the might have a lower butthon Stock A, and recebe es risky na portfolio mir Stock 8 ses hi correlated with the market tha Athen have a her beathan Stock A, and hence be more risk in a portfoloses IV. If a more highly correlated with the more than then it might have a higher beta than stock and hence be less risky is a portfolio sense. V. If shock tre highly correlated with the market than then it might have a lower beathan Stock A, and hence broky na portfolio ne come the 40% what we the share on for Socks and 8 Dorot Pound intermediate Hound your awes to the dem prace Stock Stock Are these con content with the information and from the conversation calculations Part In a stanowisk wes les risky than . ir Steckna e correled with the market tren, then mom have a nyert the stock A, and hence be more lay in a portfolio wante In a stand innisken Als more risky than 3. If Stock scored won the market than Athen have a lower beta than to A, and hence to win a portfolio to a standalone iskre A is more risky than 1 stack is less higNy correlated with the market than A then it might have a higher beta than Stock A, and hence a morensky in portfolio TV sa stand-alones se les risky than or stock is more Nighly correlated with the met than then it might have the same bets as Stock A and hence be just as risky in a portfolio v. In a stand is lenisky then If Stock is highly correlated with the market than then might have a lower beta than stock, and hence beyin porton