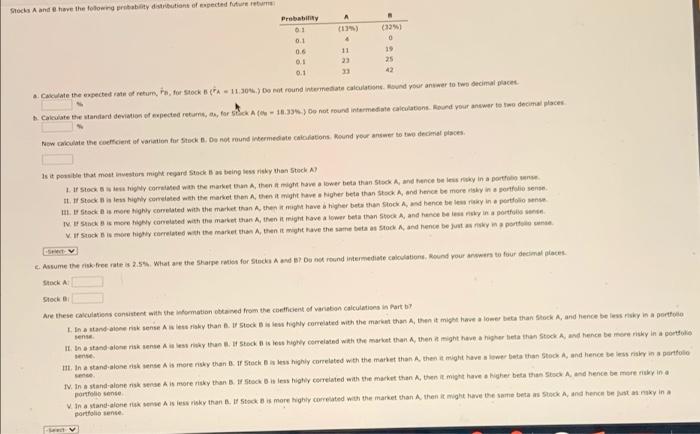

Stocks A and have the food probity distribution of expected future Probability 0.1 0.6 0.1 0.1 (331 0 19 25 11 23 a. Caculate the expected ratust retum, to, or shock {PA = 11.304.) Do not round intermediate cartoon sound your answer to w decimal placed Calculate the standard deviation of expected retus, a, for the 101.3) Do not found intermediate calculations. Round your answer to two decimal places Now at the comfort of variation to stock. De not round intermediate lotions. Round your answer to the decimal places Is it possible that most investors might regard Stocks being less risky than Stock 1.1 to y correlated with the market, then it might have a towar beta than Standance blesky in a porte 1. Stock is si correlated with the market, then it might have a higher beta thanx and hence be more sky in portfolio sense Stocks more highly correlated with the market than, then it have her but the stock, and hence bursy in portfolio I. Stuck is more conted with the market than then it might have a lower beathan Stock A, and face in portfolio Mit Stock is more correlated with the market than then it have the same beast and hence betyport c. Asume the risk free rates 24. What are the sharperation for Stucka Anda? Du pot round intermediate calculations. Round your answer to four decimal places Stock Stock Are these calculations consistent with the formation obtained from the content of antion calculations in Porto In a standalonerok Sense Ask than . Stock ile highly correlated with the marathon A, then it might have lower tathan Stock A, and hence bersy in a porte sense 11. in standalone risk sente A is less ricky than Stock ist es hi correlated with the market then, then it might have a higher leathan Stock A, and hence be more risky in a portfolio Bene m. In a standalone risk sense is morensky than 1 Stock is highly correlated with the market than then it might have a lower beathan Stock A, and hence is a portfolio 1V. In a stand-alone niske Asmorensky than ones highly correlated with the market than A, then it might have her beatha Stod and hence be more in a portfolio sense W. In a Mand-alonero A is less risk than 1. Stock more highly correlated with the market than then it might have them as A and hence betky in a portfolio sense