Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stocks and Their Valuation: Discounted Dividend Model The value of a share of common stock depends on the cash flows it is expected to provide,

Stocks and Their Valuation: Discounted Dividend Model

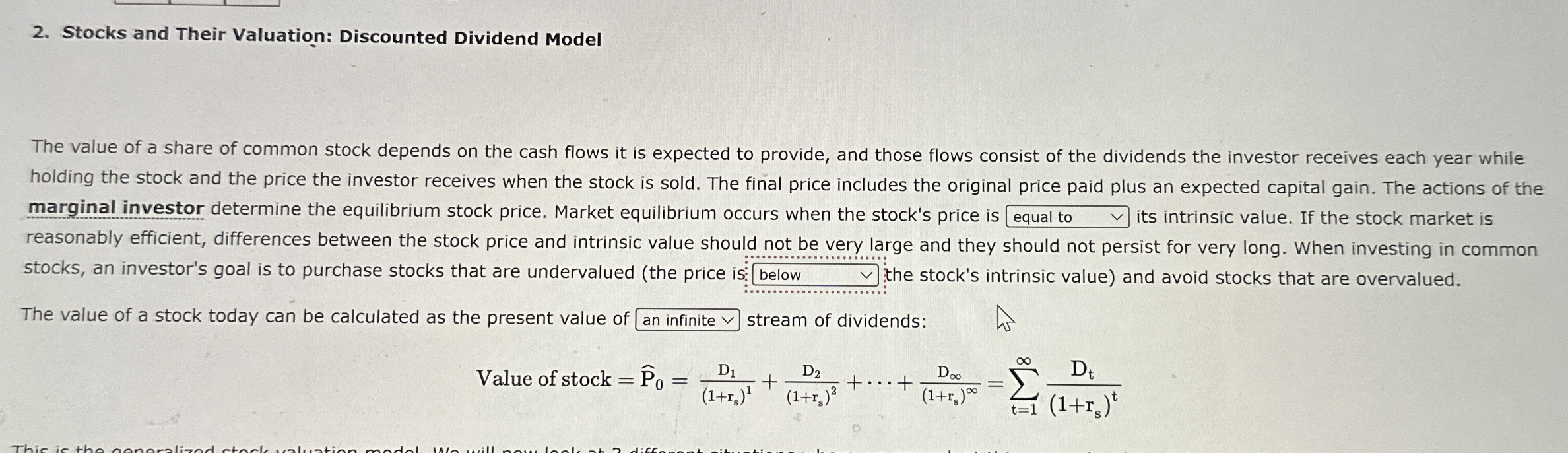

The value of a share of common stock depends on the cash flows it is expected to provide, and those flows consist of the dividends the investor receives each year while holding the stock and the price the investor receives when the stock is sold. The final price includes the original price paid plus an expected capital gain. The actions of the marginal investor determine the equilibrium stock price. Market equilibrium occurs when the stock's price is its intrinsic value. If the stock market is reasonably efficient, differences between the stock price and intrinsic value should not be very large and they should not persist for very long. When investing in common stocks, an investor's goal is to purchase stocks that are undervalued the price is the stock's intrinsic value and avoid stocks that are overvalued.

The value of a stock today can be calculated as the present value of an infinite stream of dividends:

Value stock widehatcdots

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started