Question

Stocks are considered lending or ownership investments, because each person who possesses a share of stock in a corporation has a proportionate interest in the

Stocks are considered lending or ownership investments, because each person who possesses a share of stock in a corporation has a proportionate interest in the corporations assets and income. Owners of a companys stock are called shareholders or stockholders. Common stock is the most basic form of ownership in a corporation.

1. The corporation will be profitable enough that income will exceed expenses, thereby allowing the firm to pay a share of the profits distributed in cash to shareholders. These payments to shareholders are called margin calls, retained earnings, cash dividends, corporate bonds,

2. The exchange fee, market price, after-tax- profit, beta value which is the current price that a buyer is willing to pay a seller for one share, will increase over time.

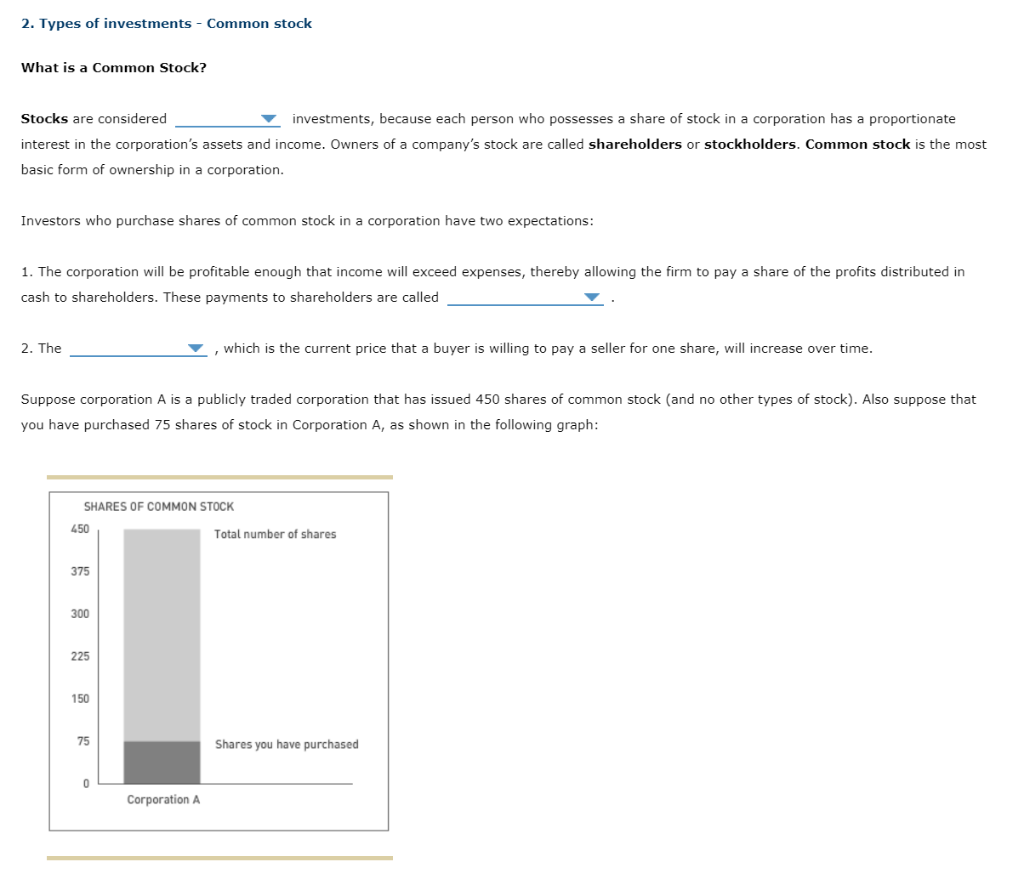

Because you have purchased 5/6, 3/4, 1/3, 1/6, 1/5 of the total number of shares in corporation A, you are entitled to that portion of the corporations assets and income but only after all other higher-priority claims (for example, bond payments) have been satisfied. This proportional entitlement to the corporations assets and income is called a value, verifiable, residual, legal claim.

If you own shares of common stock in a corporation, then you have a limited, fixed, total, product, long-term liability, which means that your responsibility for business losses is limited to your annual income, the value of the corporation's assets, the amount invested in shares of stock owned, the corporation's total amount of debt.

Each holder of common stock has proportionate authority to express an opinion or choice in matters affecting the company. This authority is known as an opinion poll, indenture, election results, voting rights. Stockholders also vote to elect the companys board of directors, equalization, inquiry, education certification which is a group of individuals that sets policy and names the principal officers of the company (management) who run the day-to-day operations of the corporation.

What is a Common Stock? Stocks are considered investments, because each person who possesses a share of stock in a corporation has a proportionate interest in the corporation's assets and income. Owners of a company's stock are called shareholders or stockholders. Common stock is the most basic form of ownership in a corporation. Investors who purchase shares of common stock in a corporation have two expectations: 1. The corporation will be profitable enough that income will exceed expenses, thereby allowing the firm to pay a share of the profits distributed in cash to shareholders. These payments to shareholders are called 2. The , which is the current price that a buyer is willing to pay a seller for one share, will increase over time. Suppose corporation A is a publicly traded corporation that has issued 450 shares of common stock (and no other types of stock). Also suppose that you have purchased 75 shares of stock in Corporation A, as shown in the following graph: Because you have purchased of the total number of shares in corporation A, you are entitled to that portion of the corporation's assets and income but only after all other higher-priority claims (for example, bond payments) have been satisfied. This proportional entitlement to the corporation's assets and income is called a claim. If you own shares of common stock in a corporation, then you have a liability, which means that your responsibility for business losses is limited to Each holder of common stock has proportionate authority to express an opinion or choice in matters affecting the company. This authority is known a . Stockholders also vote to elect the company's board of , which is a group of individuals that sets policy and names the principal officers of the company (management) who run the day-to-day operations of the corporationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started