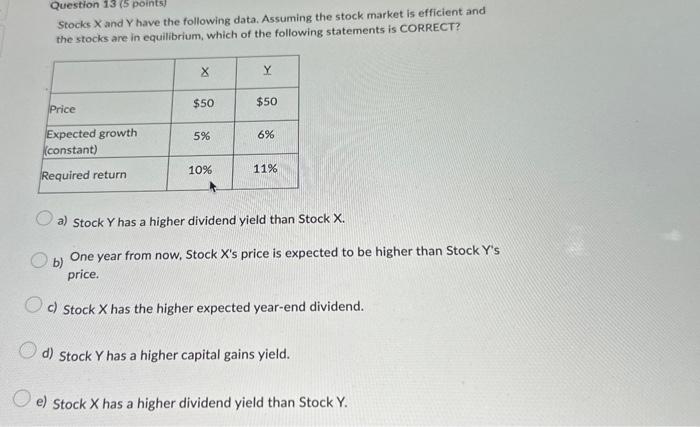

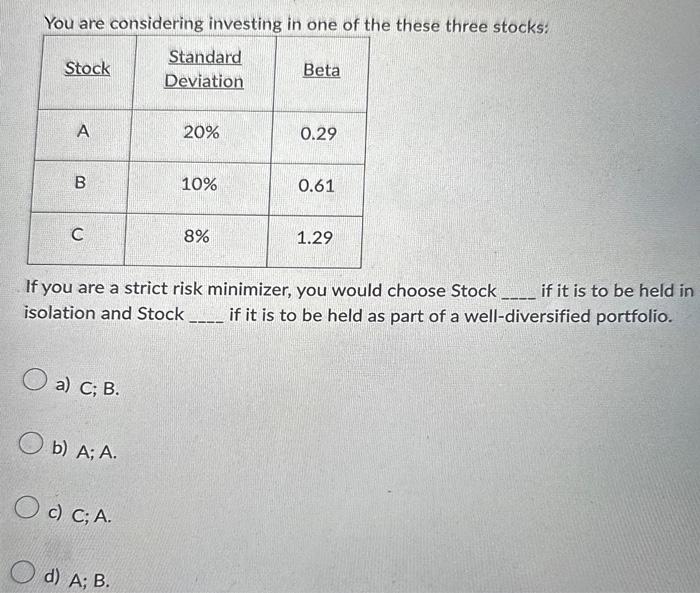

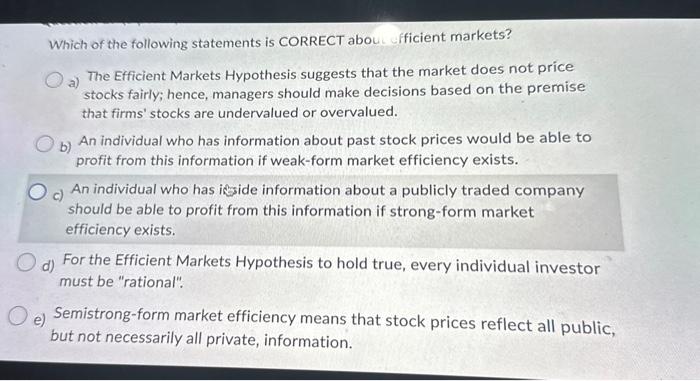

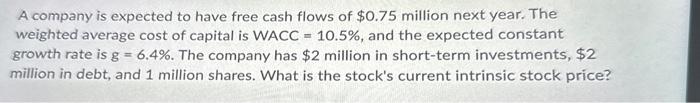

Stocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT? a) Stock Y has a higher dividend yield than Stock X. b) One year from now, Stock X's price is expected to be higher than Stock Y 's price. c) Stock X has the higher expected year-end dividend. d) Stock Y has a higher capital gains yield. e) Stock X has a higher dividend yield than Stock Y. You are considering investing in one of the these three stocks: If you are a strict risk minimizer, you would choose Stock if it is to be held in isolation and Stock if it is to be held as part of a well-diversified portfolio. a) C;B. b) A;A. c) C;A d) A;B. Which of the following statements is CORRECT abou. fficient markets? a) The Efficient Markets Hypothesis suggests that the market does not price stocks fairly; hence, managers should make decisions based on the premise that firms' stocks are undervalued or overvalued. b) An individual who has information about past stock prices would be able to profit from this information if weak-form market efficiency exists. c) An individual who has isside information about a publicly traded company should be able to profit from this information if strong-form market efficiency exists. For the Efficient Markets Hypothesis to hold true, every individual investor must be "rational". Semistrong-form market efficiency means that stock prices reflect all public, but not necessarily all private, information. A company is expected to have free cash flows of $0.75 million next year. The weighted average cost of capital is WACC =10.5%, and the expected constant growth rate is g=6.4%. The company has $2 million in short-term investments, $2 million in debt, and 1 million shares. What is the stock's current intrinsic stock price? Stocks X and Y have the following data. Assuming the stock market is efficient and the stocks are in equilibrium, which of the following statements is CORRECT? a) Stock Y has a higher dividend yield than Stock X. b) One year from now, Stock X's price is expected to be higher than Stock Y 's price. c) Stock X has the higher expected year-end dividend. d) Stock Y has a higher capital gains yield. e) Stock X has a higher dividend yield than Stock Y. You are considering investing in one of the these three stocks: If you are a strict risk minimizer, you would choose Stock if it is to be held in isolation and Stock if it is to be held as part of a well-diversified portfolio. a) C;B. b) A;A. c) C;A d) A;B. Which of the following statements is CORRECT abou. fficient markets? a) The Efficient Markets Hypothesis suggests that the market does not price stocks fairly; hence, managers should make decisions based on the premise that firms' stocks are undervalued or overvalued. b) An individual who has information about past stock prices would be able to profit from this information if weak-form market efficiency exists. c) An individual who has isside information about a publicly traded company should be able to profit from this information if strong-form market efficiency exists. For the Efficient Markets Hypothesis to hold true, every individual investor must be "rational". Semistrong-form market efficiency means that stock prices reflect all public, but not necessarily all private, information. A company is expected to have free cash flows of $0.75 million next year. The weighted average cost of capital is WACC =10.5%, and the expected constant growth rate is g=6.4%. The company has $2 million in short-term investments, $2 million in debt, and 1 million shares. What is the stock's current intrinsic stock price