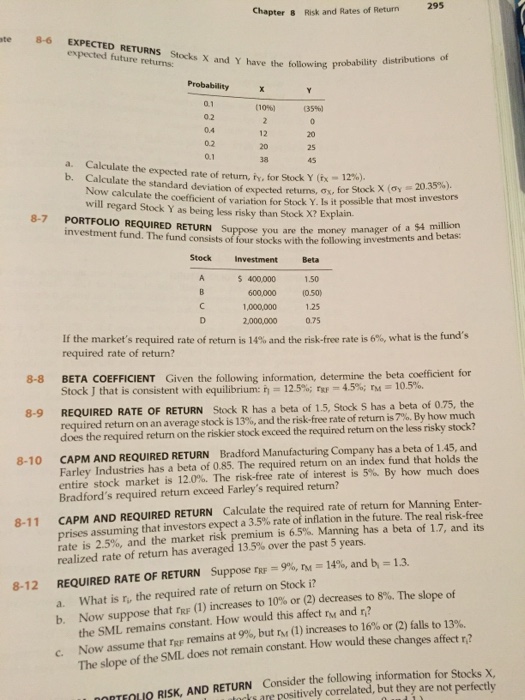

Stocks X and Y have the following probability distribution of expected returns Probability X Y 0.1 (10%) (35%) 0.2 2 0 0.4 12 20 0.2 20 25 0.1 38 45 Calculate the expected rate of return, i_Y, for Stock Y (r_X = 12%). Calculate the standard deviation of expected returns, sigma_X, for Stock X (sigma_Y = 20.35%). Now calculate the coefficient of variation for Stock Y. Is it possible that most investors will regard Stock Y as being less risky than Stock X? Explain. PORTFOLIO REQUIRED RETURN Suppose you are the money manager of a $4 million investment fund. The fund consists of four stocks with the following investments and betas: Stock Investment Beta A $ 400,000 1.50 B 600,000 (0.50) C 1,000,000 1.25 D 2,000,000 0.75 If the market's required rate of return is 14% and the risk-free rate is 6%, what is the fund's required rate of return? BETA COEFFICIENT Given the following information, determine the beta coefficient for Stock J that is consistent with equilibrium: r_J = 12.5%; r_RF = 4.5%; r_M = 10.5% REQUIRED RATE OF RETURN Stock R has a beta of 1.5, Stock S has a beta of 0.75, the required return on the less risky stock? CAPM AND REQUIRED RETURN Bradford Manufacturing Company has a beta of 1.45, and Farley Industries has a beta of 0.85. The required return on an index fund that holds the entire stock market is 12.0%. The risk-free rate of interest is 5%. By how much does Bradford's required return exceed Farley's required return? CAPM AND REQUIRED RETURN Calculate the required rate of return for Manning Enterprises assuming that investors expect a 3.5% rate of inflation in the future. The real risk-free rate is 2.5%, and the market risk premium is 6.5%. Manning has a beta of 1.7, and its realized rate of return has averaged 13.5% over the past 5 years. REQUIRED RATE OF RETURN Suppose r_RF = 9%, r_M = 14%, and b_i = 1.3. What is r_i, the required rate of return on Stock i? Now suppose that r_RF (1) increases to 10% or (2) decreases to 8%. The slope of the SML remains constant. How would this affect r_M and r_i? Now assume that r_RF remains at 9% but r_M (1) increases to 16% or (2) falls to 13%. The slope of the SML does not remain constant. How would these changes affect r_i? PORTFOLIO RISK, AND RETURN Consider the following information for Stocks X, are positively correlated, but they are not perfectly