Question

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Cost Fair Value Company A bonds $ 530,300

Stoll Company's long-term available-for-sale portfolio at the start of this year consists of the following. Available-for-Sale Securities Cost Fair Value Company A bonds $ 530,300 $ 490,000 Company B notes 159,300 146,000 Company C bonds 663,100 648,730 Stoll enters into the following transactions involving its available-for-sale debt securities this year. January 29 Sold one-half of the Company B notes for $78,390. July 6 Purchased Company X bonds for $127,800. November 13 Purchased Company Z notes for $268,000. December 9 Sold all of the Company A bonds for $518,800. Fair values at December 31 are B, $83,200 C, $607,600 X, $109,000 and Z, $279,000.

Required:

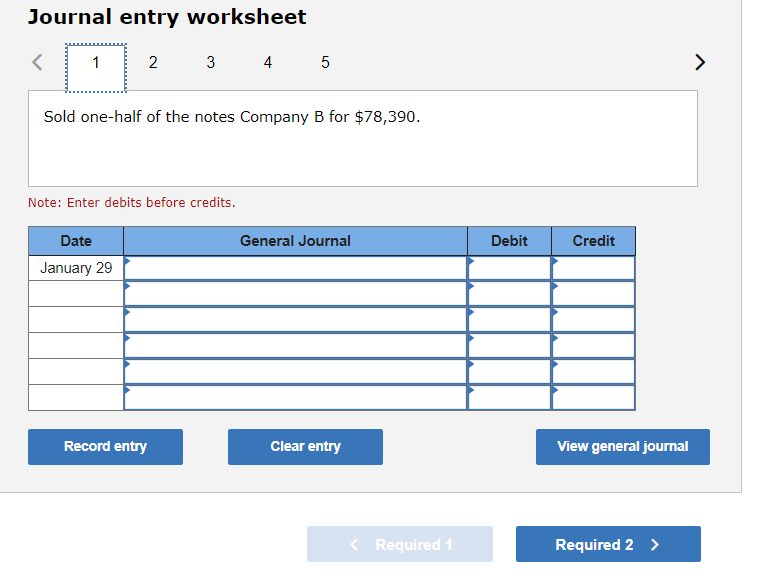

Prepare journal entries to record these transactions, including the December 31 adjusting entry to record the fair value adjustment for the long-term investments in available-for-sale securities.

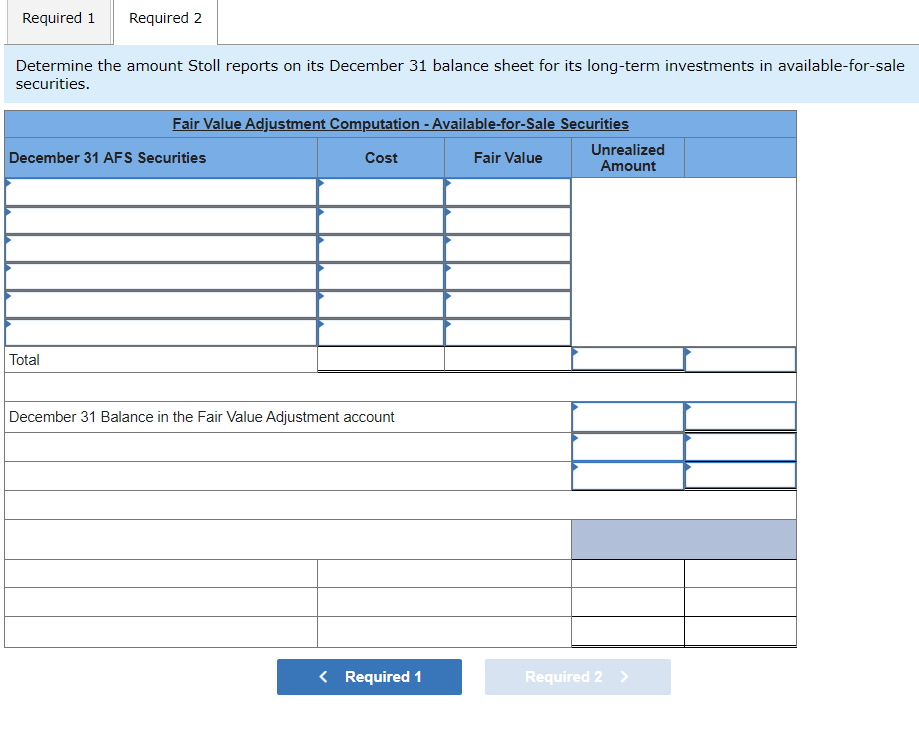

Determine the amount Stoll reports on its December 31 balance sheet for its long-term investments in available-for-sale securities.

Journal entry worksheet 5 Sold one-half of the notes Company B for $78,390. Note: Enter debits before credits. ilable-for-sale

Journal entry worksheet 5 Sold one-half of the notes Company B for $78,390. Note: Enter debits before credits. ilable-for-sale Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started