Question

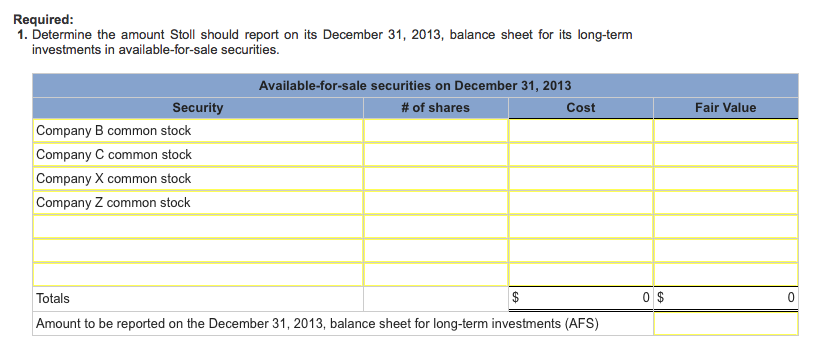

Stoll Co.s long-term available-for-sale portfolio at December 31, 2012, consists of the following. Available-for-Sale Securities Cost Fair Value 80,000 shares of Company A common stock

Stoll Co.s long-term available-for-sale portfolio at December 31, 2012, consists of the following.

Available-for-Sale Securities Cost Fair Value

80,000 shares of Company A common stock $ 1,070,600 $ 980,000

14,000 shares of Company B common stock 318,750 308,000

35,000 shares of Company C common stock 1,325,500 1,281,875

Stoll enters into the following long-term investment transactions during year.

2013. Jan. 29 Sold 7,000 shares of Company B common stock for $158,375 less a brokerage fee of $3,100.

Apr. 17 Purchased 20,000 shares of Company W common stock for $395,000 plus a brokerage fee of $3,500. The shares represent a 30% ownership in Company W.

July 6 Purchased 9,000 shares of Company X common stock for $253,125 plus a brokerage fee of $3,500. The shares represent a 10% ownership in Company X.

Aug. 22 Purchased 100,000 shares of Company Y common stock for $750,000 plus a brokerage fee of $8,200. The shares represent a 51% ownership in Company Y.

Nov. 13 Purchased 17,000 shares of Company Z common stock for $533,800 plus a brokerage fee of $6,900. The shares represent a 5% ownership in Company Z.

Dec. 9 Sold 80,000 shares of Company A common stock for $1,030,000 less a brokerage fee of $4,100.

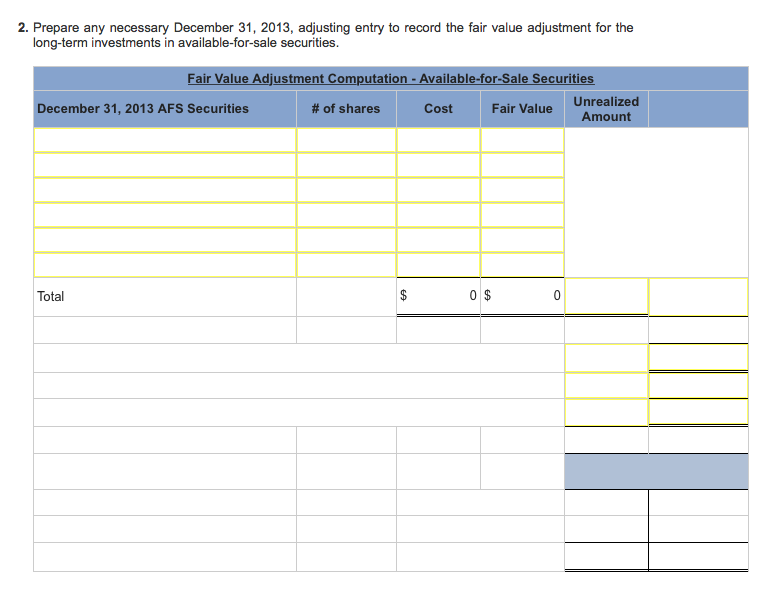

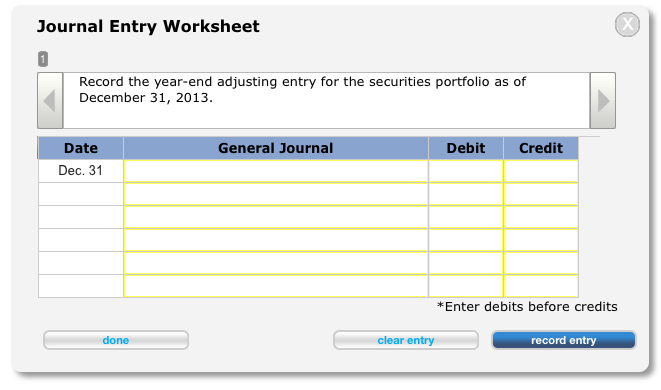

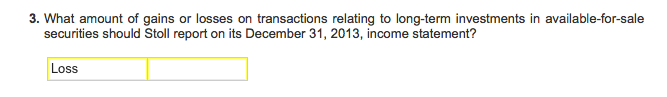

The fair values of its investments at December 31, 2013, are:

| The fair values of its investments at December 31, 2013, are: |

| Fair Value | ||

| B | $ | 162,750 |

| C | $ | 1,220,625 |

| W | $ | 382,500 |

| X | $ | 236,250 |

| Y | $ | 1,062,500 |

| Z | $ | 557,600 |

|

| ||

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started