Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stone Wood Products has a capital structure of 35 percent debt and 65 percent common equity. The managers consider this mix to be optimal

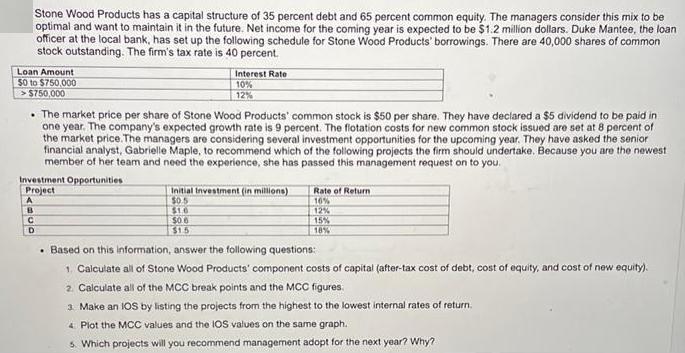

Stone Wood Products has a capital structure of 35 percent debt and 65 percent common equity. The managers consider this mix to be optimal and want to maintain it in the future. Net income for the coming year is expected to be $1.2 million dollars. Duke Mantee, the loan officer at the local bank, has set up the following schedule for Stone Wood Products' borrowings. There are 40,000 shares of common stock outstanding. The firm's tax rate is 40 percent. Loan Amount 50 to $750,000 >$750,000 The market price per share of Stone Wood Products' common stock is $50 per share. They have declared a $5 dividend to be paid in one year. The company's expected growth rate is 9 percent. The flotation costs for new common stock issued are set at 8 percent of the market price. The managers are considering several investment opportunities for the upcoming year. They have asked the senior financial analyst, Gabrielle Maple, to recommend which of the following projects the firm should undertake. Because you are the newest member of her team and need the experience, she has passed this management request on to you. Investment Opportunities Project A B D Interest Rate 10% 12% Initial Investment (in millions) $0.5 $1.0 506 $1.5 Rate of Return 16% 12% 15% 18% . Based on this information, answer the following questions: 1. Calculate all of Stone Wood Products' component costs of capital (after-tax cost of debt, cost of equity, and cost of new equity). 2. Calculate all of the MCC break points and the MCC figures. 3. Make an IOS by listing the projects from the highest to the lowest internal rates of return. 4 Plot the MCC values and the IOS values on the same graph. 5. Which projects will you recommend management adopt for the next year? Why?

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculate all of Stone Wood Products component costs of capital aftertax cost of debt cost of equi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started