Answered step by step

Verified Expert Solution

Question

1 Approved Answer

StoniBrook Industries produces decorative hardware used by home construction firms and sold in do-it-yourself retail outlets. The business is highly competitive with little opportunity

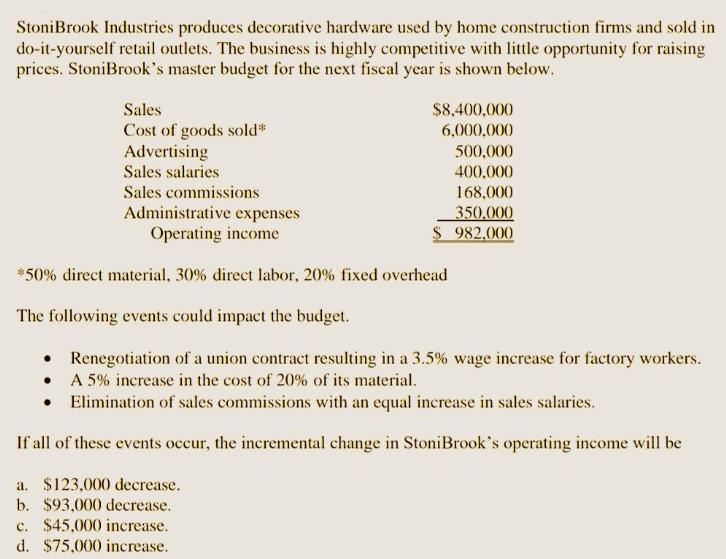

StoniBrook Industries produces decorative hardware used by home construction firms and sold in do-it-yourself retail outlets. The business is highly competitive with little opportunity for raising prices. StoniBrook's master budget for the next fiscal year is shown below. Sales $8,400,000 Cost of goods sold* Advertising Sales salaries 6,000,000 500,000 400,000 Sales commissions 168,000 Administrative expenses Operating income 350.000 $ 982.000 *50% direct material, 30% direct labor, 20% fixed overhead The following events could impact the budget. Renegotiation of a union contract resulting in a 3.5% wage increase for factory workers. A 5% increase in the cost of 20% of its material. Elimination of sales commissions with an equal increase in sales salaries. If all of these events occur, the incremental change in StoniBrook's operating income will be a. $123,000 decrease. b. $93,000 decrease. c. $45,000 increase. d. $75,000 increase.

Step by Step Solution

★★★★★

3.45 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

b 93000 decrease Original Operating Income given in Question 982000 Revised O...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started