Answered step by step

Verified Expert Solution

Question

1 Approved Answer

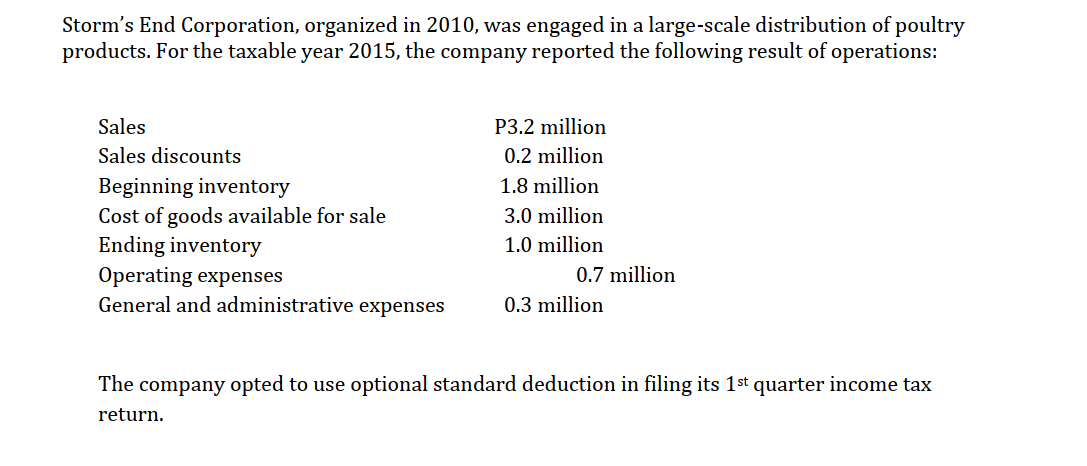

Storm's End Corporation, organized in 2010, was engaged in a large-scale distribution of poultry products. For the taxable year 2015, the company reported the

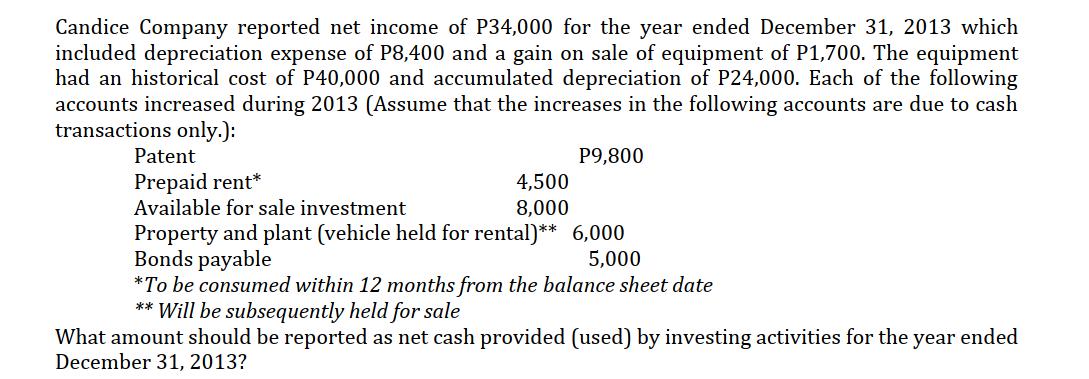

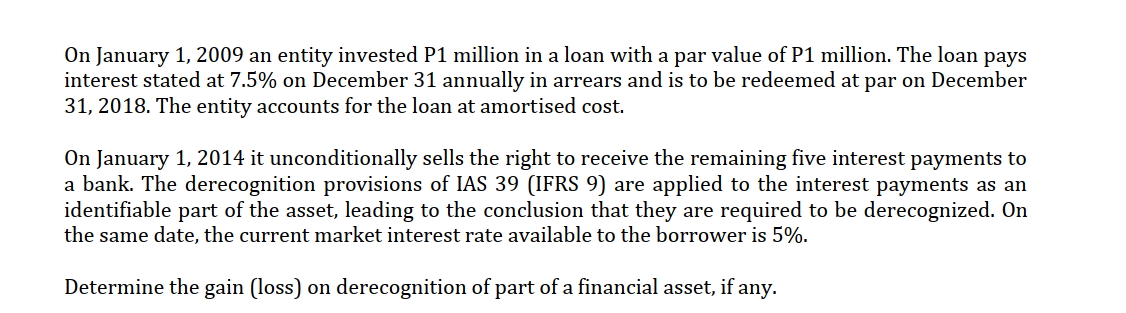

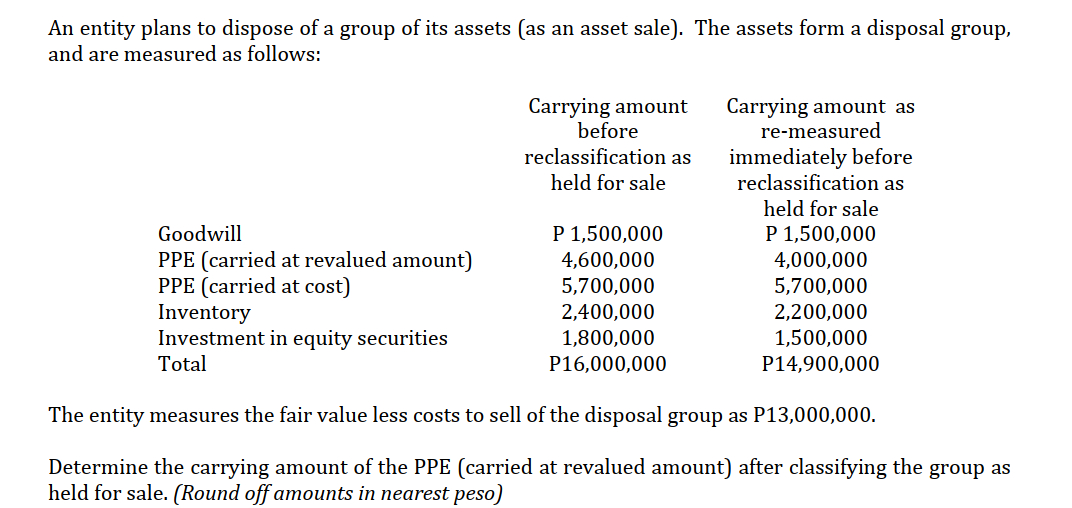

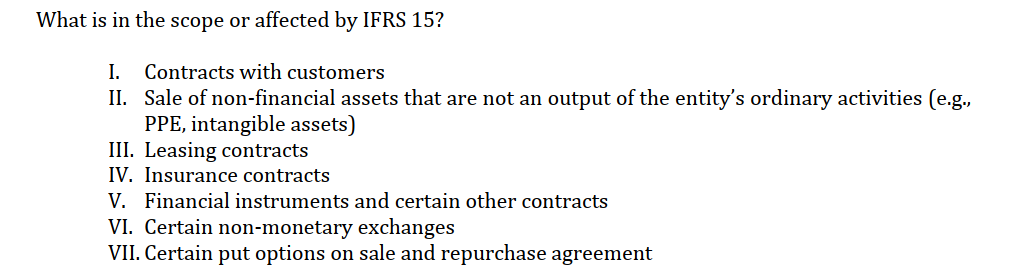

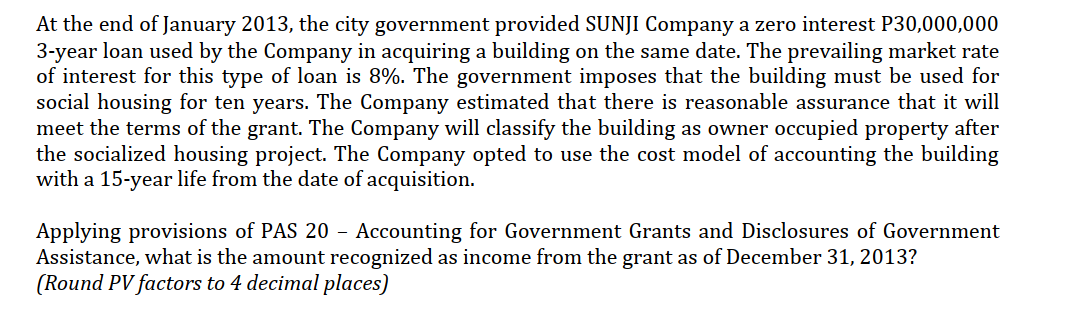

Storm's End Corporation, organized in 2010, was engaged in a large-scale distribution of poultry products. For the taxable year 2015, the company reported the following result of operations: Sales P3.2 million Sales discounts 0.2 million Beginning inventory 1.8 million Cost of goods available for sale 3.0 million Ending inventory 1.0 million Operating expenses 0.7 million General and administrative expenses 0.3 million The company opted to use optional standard deduction in filing its 1st quarter income tax return. Candice Company reported net income of P34,000 for the year ended December 31, 2013 which included depreciation expense of P8,400 and a gain on sale of equipment of P1,700. The equipment had an historical cost of P40,000 and accumulated depreciation of P24,000. Each of the following accounts increased during 2013 (Assume that the increases in the following accounts are due to cash transactions only.): Patent Prepaid rent* P9,800 4,500 8,000 Available for sale investment Property and plant (vehicle held for rental)** 6,000 Bonds payable 5,000 *To be consumed within 12 months from the balance sheet date ** Will be subsequently held for sale What amount should be reported as net cash provided (used) by investing activities for the year ended December 31, 2013? On January 1, 2009 an entity invested P1 million in a loan with a par value of P1 million. The loan pays interest stated at 7.5% on December 31 annually in arrears and is to be redeemed at par on December 31, 2018. The entity accounts for the loan at amortised cost. On January 1, 2014 it unconditionally sells the right to receive the remaining five interest payments to a bank. The derecognition provisions of IAS 39 (IFRS 9) are applied to the interest payments as an identifiable part of the asset, leading to the conclusion that they are required to be derecognized. On the same date, the current market interest rate available to the borrower is 5%. Determine the gain (loss) on derecognition of part of a financial asset, if any. An entity plans to dispose of a group of its assets (as an asset sale). The assets form a disposal group, and are measured as follows: Goodwill PPE (carried at revalued amount) PPE (carried at cost) Inventory Investment in equity securities Total Carrying amount before reclassification as held for sale P 1,500,000 4,600,000 5,700,000 2,400,000 1,800,000 P16,000,000 Carrying amount as re-measured immediately before reclassification as held for sale P 1,500,000 4,000,000 5,700,000 2,200,000 1,500,000 P14,900,000 The entity measures the fair value less costs to sell of the disposal group as P13,000,000. Determine the carrying amount of the PPE (carried at revalued amount) after classifying the group as held for sale. (Round off amounts in nearest peso) What is in the scope or affected by IFRS 15? I. Contracts with customers II. Sale of non-financial assets that are not an output of the entity's ordinary activities (e.g., PPE, intangible assets) III. Leasing contracts IV. Insurance contracts V. Financial instruments and certain other contracts VI. Certain non-monetary exchanges VII. Certain put options on sale and repurchase agreement At the end of January 2013, the city government provided SUNJI Company a zero interest P30,000,000 3-year loan used by the Company in acquiring a building on the same date. The prevailing market rate of interest for this type of loan is 8%. The government imposes that the building must be used for social housing for ten years. The Company estimated that there is reasonable assurance that it will meet the terms of the grant. The Company will classify the building as owner occupied property after the socialized housing project. The Company opted to use the cost model of accounting the building with a 15-year life from the date of acquisition. Applying provisions of PAS 20 - Accounting for Government Grants and Disclosures of Government Assistance, what is the amount recognized as income from the grant as of December 31, 2013? (Round PV factors to 4 decimal places)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started