Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Straight Fence Company incurred a net loss for Year 3. The firm does not have any book-tax differences. We present the results of operations for

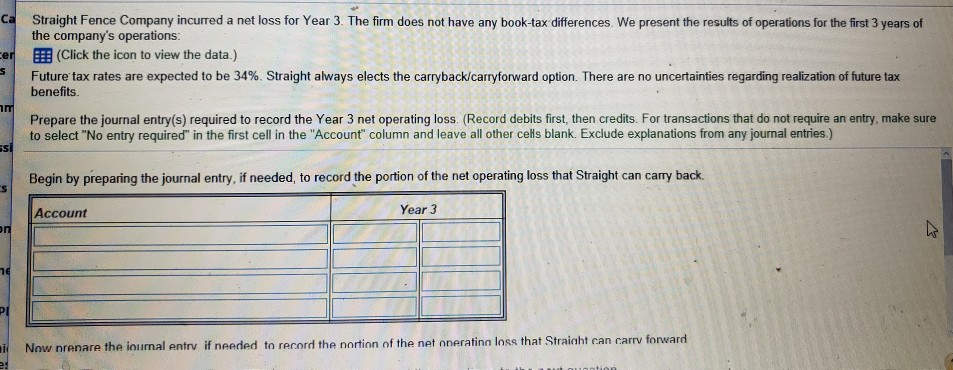

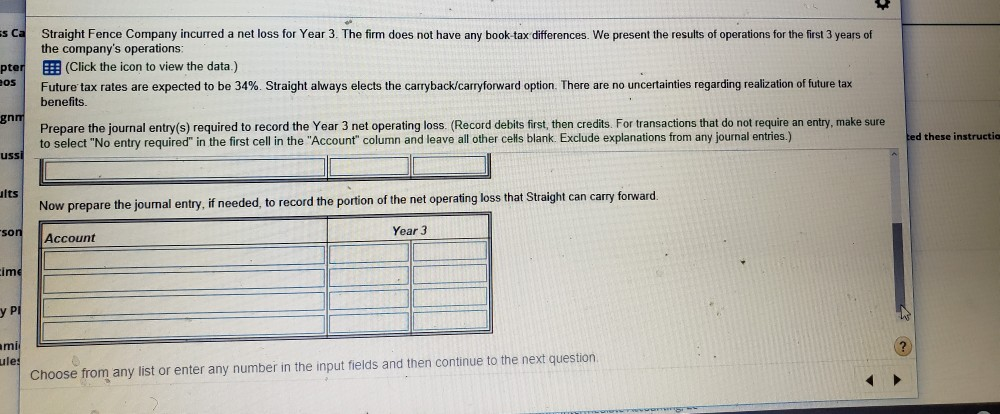

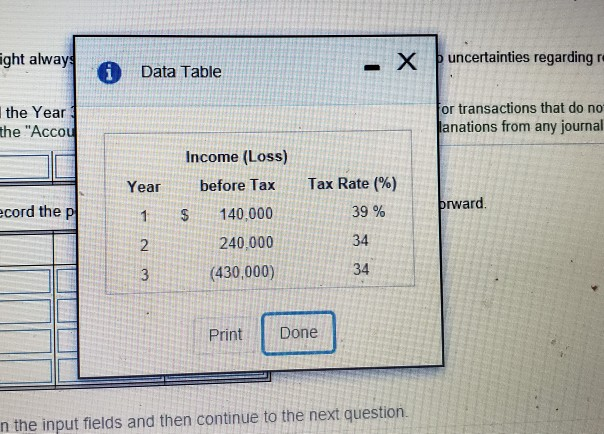

Straight Fence Company incurred a net loss for Year 3. The firm does not have any book-tax differences. We present the results of operations for the first 3 years of the company's operations: B!! (Click the icon to view the data.) Future tax rates are expected to be 34%. Straight always elects the carryback/carryforward option. There are no uncertainties regarding realization of future tax benefits. Prepare the journal entry(s) required to record the Year 3 net operating loss. (Record debits first, then credits. For transactions that do not require an entry, make sure to select "No entry required" in the first cell in the "Account" column and leave all other cells blank. Exclude explanations from any journal entries.) Begin by preparing the journal entry, if needed, to record the portion of the net operating loss that Straight can carry back Account Year 3 i Now prepare the iournal entry if needed to record the nortion of the net operating loss that Straight can carry forward L ion sca pter TOS Straight Fence Company incurred a net loss for Year 3. The firm does not have any book-tax differences. We present the results of operations for the first 3 years of the company's operations: 1: (Click the icon to view the data.) Future tax rates are expected to be 34% Straight always elects the carryback/carryforward option. There are no uncertainties regarding realization of future tax benefits. Prepare the journal entry(s) required to record the Year 3 net operating loss. (Record debits first, then credits. For transactions that do not require an entry, make sure to select "No entry required in the first cell in the "Account column and leave all oth ted these instructia L ilts Now prepare the journal entry, if needed, to record the portion of the net operating loss that Straight can carry forward son Year 3 Account img y PI ami ule: Choose from any list or enter any number in the input fields and then continue to the next question ght alway x uncertainties regarding ra i Data Table the Year the "Accou lanations from any journal Tax Rate (%) Year 1 ecord the p Income (Loss) before Tax $ 140,000 240,000 (430,000) rward. 39 % Print Done n the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started