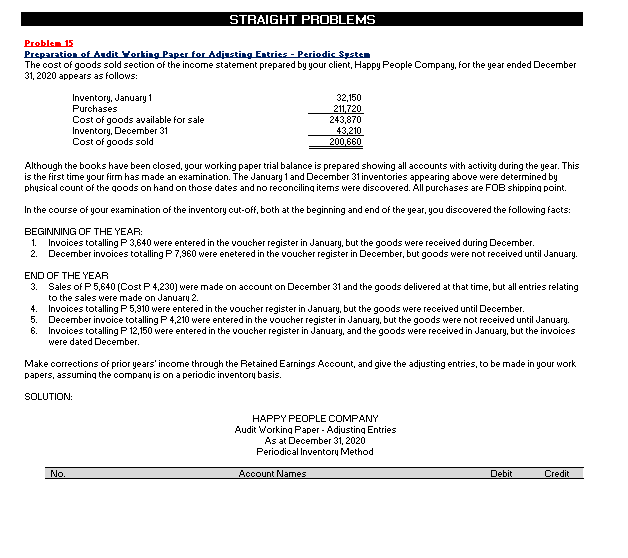

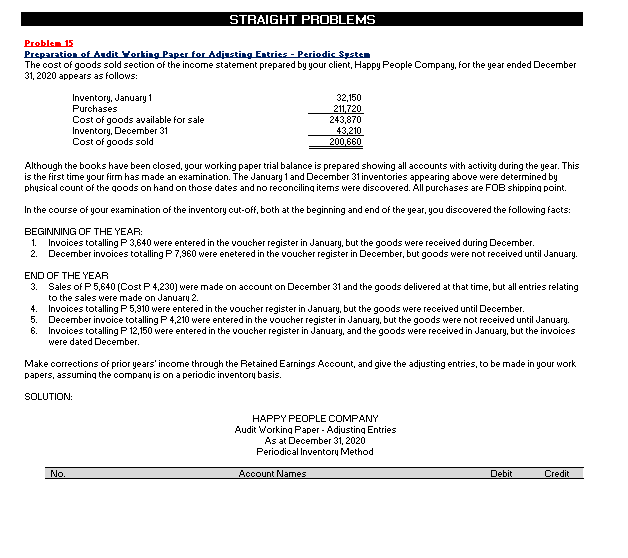

STRAIGHT PROBLEMS Proble15 Preparation of audit Yorking Paper for Adjusting Entries - Periodic System The cost of goods sold section of the income statement prepared by your client, Happy People Company, for the year ended December 31, 2020 appears as follows: Inventory, January 1 32,150 Purchases 211,720 Cost of goods available for sale 243,870 Inventory, December 31 43,210 Cost of goods sold 200660 Although the books have been closed, your working paper trial balance is prepared showing all accounts with activity during the year. This is the first time your firm has made an examination. The January 1 and December 31 inventories appearing above were determined by physical count of the goods on hand on those dates and no reconciling items were discovered. All purchases are FOB shipping point. In the course of your examination of the inventory cut-off, both at the beginning and end of the year, you discovered the following facts: BEGINNING OF THE YEAR: 1. Invoices totalling P 3,640 were entered in the voucher register in January, but the goods were received during December. 2. December invoices totalling P 7,960 were enetered in the voucher register in December, but goods were not received until January. END OF THE YEAR 3. Sales of P5.640 (Cost P 4,230) were made on account on December 31 and the goods delivered at that time, but all entries relating to the sales were made on January 2. 4. Invoices totalling P5,910 were entered in the voucher register in January, but the goods were received until December. 5. December invoice totalling P 4,210 were entered in the voucher register in January, but the goods were not received until January. 6. Invoices totalling P 12,150 were entered in the voucher register in January, and the goods were received in January, but the invoices were dated December Make corrections of prior years' income through the Retained Earnings Account, and give the adjusting entries, to be made in your work papers, assuming the company is on a periodic inventory basis. SOLUTION: HAPPY PEOPLE COMPANY Audit Working Paper - Adjusting Entries As at December 31, 2020 Periodical Inventory Method No. Account Names Debit Credit STRAIGHT PROBLEMS Proble15 Preparation of audit Yorking Paper for Adjusting Entries - Periodic System The cost of goods sold section of the income statement prepared by your client, Happy People Company, for the year ended December 31, 2020 appears as follows: Inventory, January 1 32,150 Purchases 211,720 Cost of goods available for sale 243,870 Inventory, December 31 43,210 Cost of goods sold 200660 Although the books have been closed, your working paper trial balance is prepared showing all accounts with activity during the year. This is the first time your firm has made an examination. The January 1 and December 31 inventories appearing above were determined by physical count of the goods on hand on those dates and no reconciling items were discovered. All purchases are FOB shipping point. In the course of your examination of the inventory cut-off, both at the beginning and end of the year, you discovered the following facts: BEGINNING OF THE YEAR: 1. Invoices totalling P 3,640 were entered in the voucher register in January, but the goods were received during December. 2. December invoices totalling P 7,960 were enetered in the voucher register in December, but goods were not received until January. END OF THE YEAR 3. Sales of P5.640 (Cost P 4,230) were made on account on December 31 and the goods delivered at that time, but all entries relating to the sales were made on January 2. 4. Invoices totalling P5,910 were entered in the voucher register in January, but the goods were received until December. 5. December invoice totalling P 4,210 were entered in the voucher register in January, but the goods were not received until January. 6. Invoices totalling P 12,150 were entered in the voucher register in January, and the goods were received in January, but the invoices were dated December Make corrections of prior years' income through the Retained Earnings Account, and give the adjusting entries, to be made in your work papers, assuming the company is on a periodic inventory basis. SOLUTION: HAPPY PEOPLE COMPANY Audit Working Paper - Adjusting Entries As at December 31, 2020 Periodical Inventory Method No. Account Names Debit Credit