Question

Strand Corp has the following information: Beginning Inventory- Purchased- Purchased- Sold- 2,000 units @ $20/unit 3,000 units @ $25/unit 1,500 units @ $30/unit 4,400

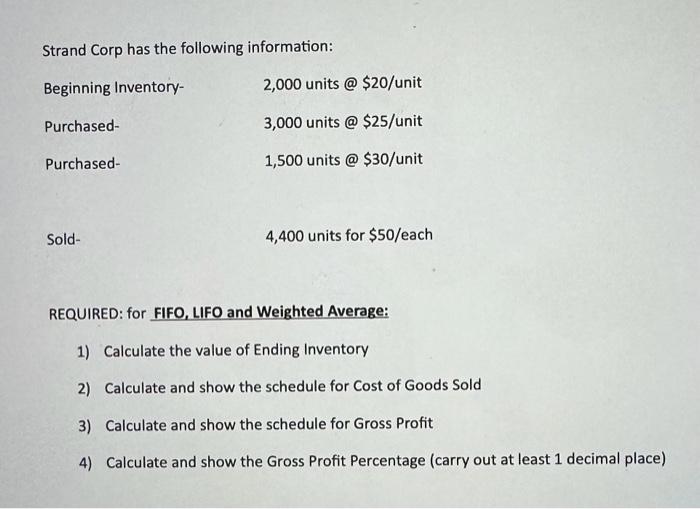

Strand Corp has the following information: Beginning Inventory- Purchased- Purchased- Sold- 2,000 units @ $20/unit 3,000 units @ $25/unit 1,500 units @ $30/unit 4,400 units for $50/each REQUIRED: for FIFO, LIFO and Weighted Average: 1) Calculate the value of Ending Inventory 2) Calculate and show the schedule for Cost of Goods Sold 3) Calculate and show the schedule for Gross Profit 4) Calculate and show the Gross Profit Percentage (carry out at least 1 decimal place)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Under FIFO Method FirstIn FirstOut Calculation of the Ending Inventory For FIFO we are assuming that the first items purchased are the first to be sold Therefore the ending inventory consists of the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting Tools for Business Decision Making

Authors: Paul D. Kimmel, Jerry J. Weygandt, Donald E. Kieso

9th edition

1-119-49356-3, 1119493633, 1119493560, 978-1119493631

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App