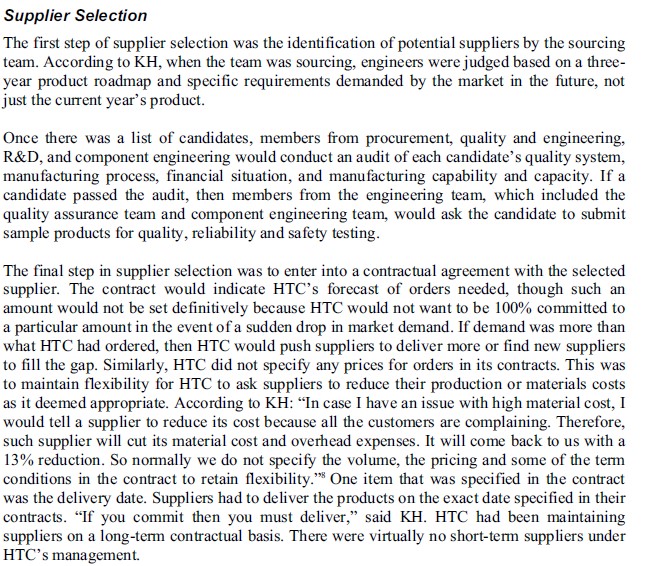

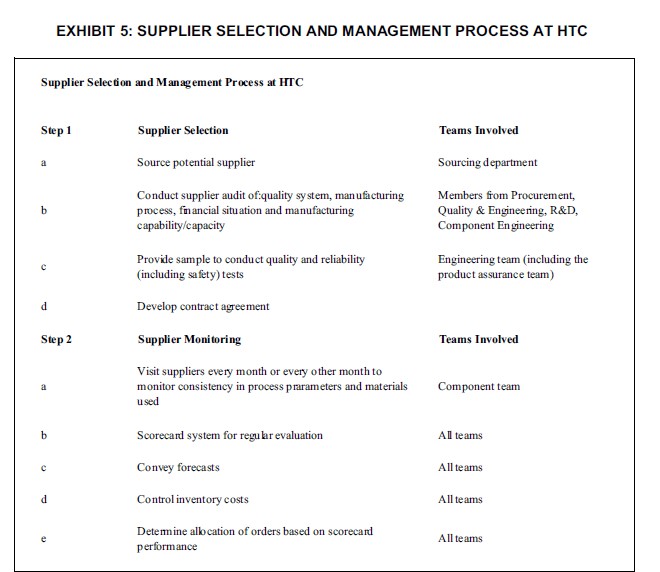

STRATEGIC PERFORMANCE MEASUREMENT OF SUPPLIERS AT HTC Since 1997, HTC (formerly High Tech Computer) Corporation had been manufacturing smartphones and personal digital assistants ("PDAs") as an original design manufacturer ("ODM") for mobile operator brands, including Orange, T-Mobile, Sprint, Cingular, Verizon, and NTT DoCoMo.' More recently, with its shift to own-brand manufacturing, HTC had built its reputation as one of the top five global brands in smartphones. By 2009, HTC had sales of NT$144 billion (equivalent to US$4.5 billion).' It was ranked fourth in the first quarter of 2010 in market share by shipments [see Exhibit 1]. To serve its global customer base, HTC had built a network of close relationships with component suppliers around the world. There were approximately 250 to 300 components in each smartphone, and HTC needed to manage over 1,000 suppliers. Selecting and monitoring a large network of suppliers required a well developed management programme. HTC's scorecard system had played a key role in helping HTC's supplier management team select and monitor its suppliers. On the first day of July 2010, K.H. Tung (KH), head of global supply chain management at HTC, was meeting with his team of engineers at his Taoyuan office in Taipei, Taiwan and evaluating scorecard reports done on five routine component suppliers of batteries for the first and second quarters of 2010. Because the company was expecting strong demand over supply in the third quarter of 2010 and this component was in particularly short supply, KH needed to decide quickly how to allocate the next quarter's orders among these five suppliers so that customer orders could be met with consistent quality and timeliness.The Smartphone Industry The smartphone industry, also known as the converged mobile device industry, in which HTC had been a player since 1997, produced mobile communication devices with: 1) operating systems running as platforms; 2) the ability to handle multiple applications simultaneously; 3) the ability to install and remove third-party software; and 4) extensible memory through external flash memory.' Smartphones facilitated voice communications and primarily targeted customers seeking phones that doubled as multimedia devices with functions for music, photos, gaming, text messaging, email and web browsing.* With an increasing number of businesses and consumers adopting mobiles with advanced features, smartphone shipments continued to grow in many regions. Email was one of the major drivers of growth in converged mobile services. With the prices for data usage falling, demand for data was increasing, making it more attractive for both business users and consumers to use mobile devices with email and browser functions. IDC, one of the industry's leading market data analysis companies, forecasted that overall mobile phone shipments would grow at a cumulative annual growth rate ("CAGR") of 6.6% between 2009 and 2014, while the sub-sector of smartphones would grow at 20.4% to reach 439 million unit per year. Smartphone shipments were expected to reach 28.2% of total mobile phone shipments by 2014, up from 15.3% in 2009 [see Exhibit 2]. Within the smartphone industry, there were many large players dominating each part of the value chain [see Exhibit 3]. There were between 250 and 300 components in a smartphone- key examples of which were CPUs, display screens and memory chips and Texas Instruments, Infineon and Qualcomm dominated these spaces. These semiconductor suppliers and other component suppliers supplied their products to original equipment manufacturers ("OEMs") and ODMs, an area dominated by Nokia, Apple, Motorola, RIM and HTC. These players would then sell their products to wireless operators around the world such as AT&T, Vodafone, Orange and Cingular with either their own brand names (in the case of OEMs) or brands owned by the operators (in the case of ODMs).Dperating System All smartphones needed to be backed by an operating system There were many operating systems in the market for manufacturers to choose from. The top operating systems used by smartphones were Google's Android, RIM's Blackben'y US, Apple's iOS, Symbian and Microso's Windows Mobile. HTC's product portfolio included both Android and Windows Mobile. According to 111C, the Symbian operating system had a 44.9% market share worldwide in terms of shipments by operating system, ranking number one in EDD'B'. Symbian's partnership with Nokia was one of the main reasons Symbian had held its top ranking. Windows Mobile was ranked number four with a 9.4% market share in EDD? and was expected to maintain this position throughout IDC's forecast period, until 2l4. Even though Android was only ranked number six, with a 4.1% market share in 2on9, it was expected to grow the fastest among the top If) smartphone operating systems, with 65.4% CAGE between sons and 21314, climbing to number two in market share by 214 [See Exhibit 4]. HTC Since 1997, HTC had been manufacturing smartphones and PDAs as an ODM for mobile operator brands including Orange, T-Mobile, Sprint, Cingular, Verizon, and NTT DoCoMo. The company had started as an ODM designing and building innovative PDAs. These PDAs used Microsoft's Windows Mobile operating system exclusively. HTC had worked closely with Microsoft ever since its inception, producing Windows Mobile PDAs for such companies as Compaq, Dell and Hewlett-Packard. In 1999, HTC started designing its first touch-screen smartphone, and when it shipped in 2002 it was the first colour touch-screen smartphone in the industry. HTC initially made smartphones based exclusively on Microsoft's Windows Mobile software and sold them as operator-branded devices in the market. In 2006, HTC became an OEM when it started selling its products under its own brand name, hTc. Geographically, Europe and North America were the two major regions for HTC, with its shares in Asia increasing gradually. Over the years, HTC had established many key relationships with its customers, including the leading five mobile operators in Europe, the top four in the US and many fast-growing Asian operators." Since 2009, with the emergence of other operating systems, it had begun shifting its focus to devices based on Google's Android operating system, given not only its increasing market penetration but also better customisation capabilities and lower cost than other operating systems. In recent years, responding to the rapid growth of the smartphone market, HTC had been shifting its focus to smartphone design and production. HTC essentially became a pure smartphone player. Its key competitors were mainly large OEMs such as Nokia, Apple, Motorola and RIM, who produced smartphones in addition to other mobile devices.Supplier Selection The first step of supplier selection was the identification of potential suppliers by the sourcing team. According to KH, when the team was sourcing, engineers were judged based on a three- year product roadmap and specific requirements demanded by the market in the future, not just the current year's product. Once there was a list of candidates, members from procurement, quality and engineering, R&D, and component engineering would conduct an audit of each candidate's quality system, manufacturing process, financial situation, and manufacturing capability and capacity. If a candidate passed the audit, then members from the engineering team, which included the quality assurance team and component engineering team, would ask the candidate to submit sample products for quality, reliability and safety testing. The final step in supplier selection was to enter into a contractual agreement with the selected supplier. The contract would indicate HTC's forecast of orders needed, though such an amount would not be set definitively because HTC would not want to be 100% committed to a particular amount in the event of a sudden drop in market demand. If demand was more than what HTC had ordered, then HTC would push suppliers to deliver more or find new suppliers to fill the gap. Similarly, HTC did not specify any prices for orders in its contracts. This was to maintain flexibility for HTC to ask suppliers to reduce their production or materials costs as it deemed appropriate. According to KH: "In case I have an issue with high material cost, I would tell a supplier to reduce its cost because all the customers are complaining. Therefore, such supplier will cut its material cost and overhead expenses. It will come back to us with a 13% reduction. So normally we do not specify the volume, the pricing and some of the term conditions in the contract to retain flexibility." One item that was specified in the contract was the delivery date. Suppliers had to deliver the products on the exact date specified in their contracts. "If you commit then you must deliver," said KH. HTC had been maintaining suppliers on a long-term contractual basis. There were virtually no short-term suppliers under HTC's management.EXHIBIT 5: SUPPLIER SELECTION AND MANAGEMENT PROCESS AT HTC Supplier Selection and Management Process at HTC Step 1 Supplier Selection Teams Involved Source potential supplier Sourcing department Conduct supplier audit of quality system, manufacturing Members from Procurement, b process, financial situation and manufacturing Quality & Engineering, R&D. capability/capacity Component Engineering C Provide sample to conduct quality and reliability Engineering team (including the (including safety) tests product assurance team) d Develop contract agreement Step 2 Supplier Monitoring Teams Involved Visit suppliers every month or every other month to monitor consistency in process prarameters and materials Component team used Scorecard system for regular evaluation All teams Convey forecasts All teams Control inventory costs All teams Determine allocation of orders based on scorecard performance All teamsEXHIBIT 1': BRIEF DESCRIPTION OF SUPPLIERS A TO E Supplier A Supplier A bad maintained a close relationship with HTC for over seven years. It was one of I-ITC's longest-serving suppliers of this particular component. Over the years, Supplier A had worked closely with I-ITC to develop new designs and products for HTC's various smartplrone models. It was also one of the five largest manufacturers in its sector. Approximately sass of HTC's batteries were supplied by A. Supplier B Supplier II had started its relationship with HTC three years before. Its scorecard performance had been quite consistent. It had been fullling approximately 211% of HTC's overall battery orders. However, over the previous six months, E had started having financial problems resulting from a large legal scandal and overspending on construction of a new factory. It had been cutting costs by firing workers at the factory, particularly those with higher salaries who had been working there for a long time. SupplierC Supplier C had started its relationship with HTC one and a half years back. Its scorecard performance had been gradually improving since joining HTC's supplier list. Its share of HTC's orders had increased from 5% at the beginning to approximately 15%. In the previous six months, C had introduced a new technology to its manufacturing lines which helped to improve quality. However, costs had also increased. HTC and C had been working together to solve the problem. As a step to cut costs, (3 recently cut its delivery team and outsourced product delivery to an outside rm. SupplierD Supplier D had a three-year relationship with HTC and had performed consistently. It had been supplying about ll)% of HTC's batteries. 1n the previous six months, Supplier D was spun off from its parent company, which had maintained a strategic relationship with HTC since its inception. The spin-off meant that D had to restructure and reshuffle its organisation JWJndmdenLnnmnm