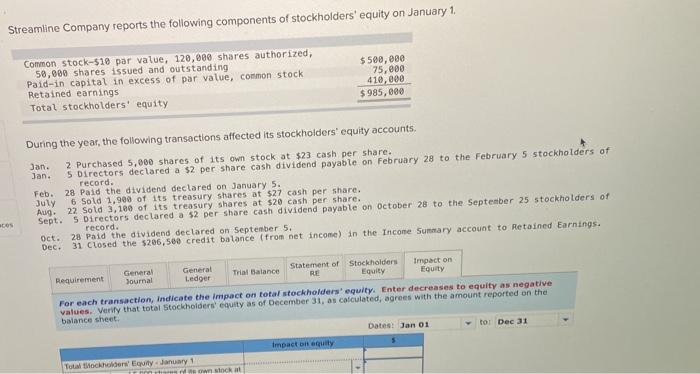

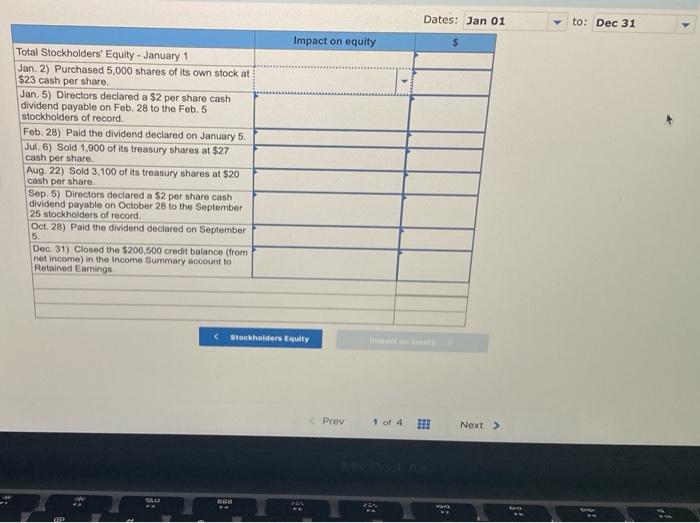

Streamline Company reports the following components of stockholders' equity on January 1 Common stock-$10 par value, 120,000 shares authorized, 50,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 500,eve 75,000 410,000 $985,000 During the year, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 5,000 shares of its own stock at $23 cash per share. Jan. 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. . Feb. 28 Paid the dividend declared on January 5. July 6 Sold 1.900 of its treasury shares at $27 cash per share. Aug. 22 Sold 3,100 of its treasury shares at $20 cash per share. Sept. 5 Directors declared a 52 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $206,500 credit balance (from net income) in the Incone Summary account to Retained Earnings. General General Statement of Stockholders Impact on Requirement Trial Balance Journal Ledger RE Equity Equity For each transaction, indicate the impact on total stockholders' equity. Enter decreases to equity as negative values. Verify that total Stockholders' equity as of December 31, os calculated, agrees with the amount reported on the balance sheet Dates: Jan 01 to Dec 31 Impact bit quity Total Schors' Equity January 1 en stock Streamline Company reports the following components of stockholders' equity on January 1 Common stock-$10 par value, 120,000 shares authorized, 50,000 shares issued and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity $ 500,eve 75,000 410,000 $985,000 During the year, the following transactions affected its stockholders' equity accounts. Jan. 2 Purchased 5,000 shares of its own stock at $23 cash per share. Jan. 5 Directors declared a $2 per share cash dividend payable on February 28 to the February 5 stockholders of record. . Feb. 28 Paid the dividend declared on January 5. July 6 Sold 1.900 of its treasury shares at $27 cash per share. Aug. 22 Sold 3,100 of its treasury shares at $20 cash per share. Sept. 5 Directors declared a 52 per share cash dividend payable on October 28 to the September 25 stockholders of record. Oct. 28 Paid the dividend declared on September 5. Dec. 31 Closed the $206,500 credit balance (from net income) in the Incone Summary account to Retained Earnings. General General Statement of Stockholders Impact on Requirement Trial Balance Journal Ledger RE Equity Equity For each transaction, indicate the impact on total stockholders' equity. Enter decreases to equity as negative values. Verify that total Stockholders' equity as of December 31, os calculated, agrees with the amount reported on the balance sheet Dates: Jan 01 to Dec 31 Impact bit quity Total Schors' Equity January 1 en stock