Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Struggle with those questions Use the following data of Trimar Company: EEB Click the icon to view the data.) Trimar's total cost of goods available

Struggle with those questions

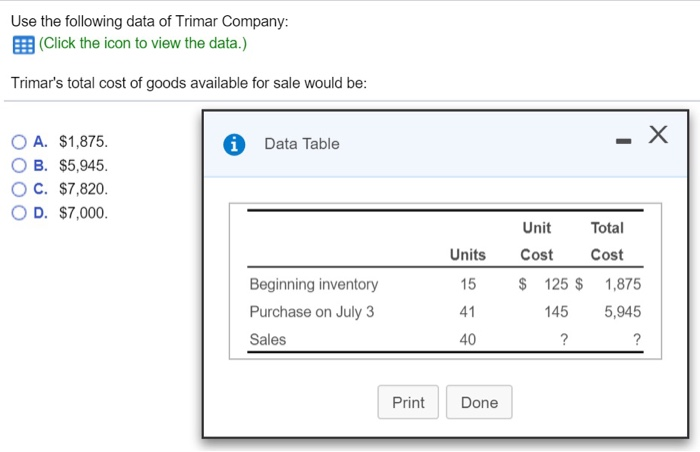

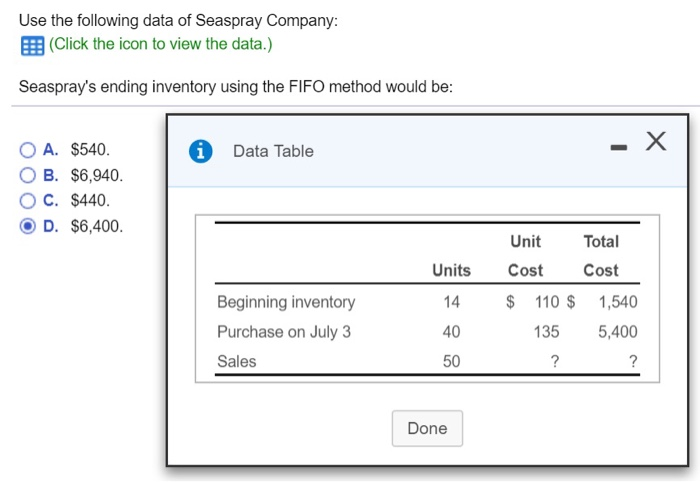

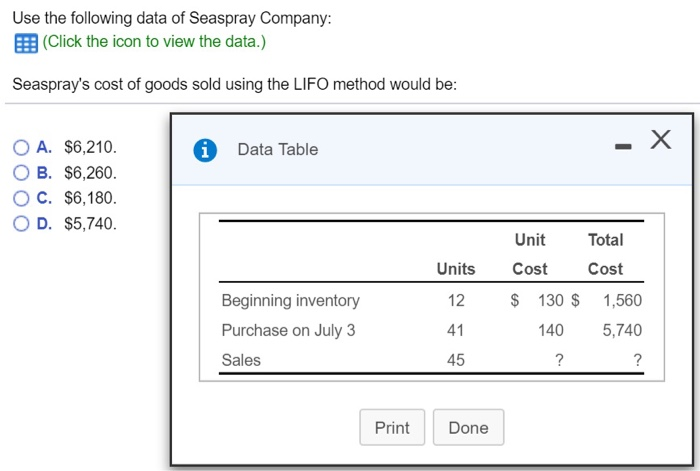

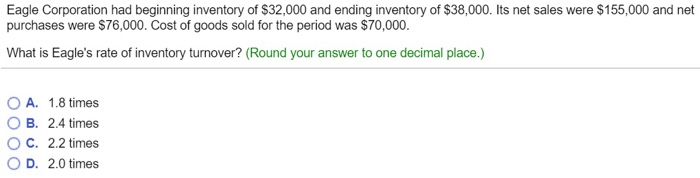

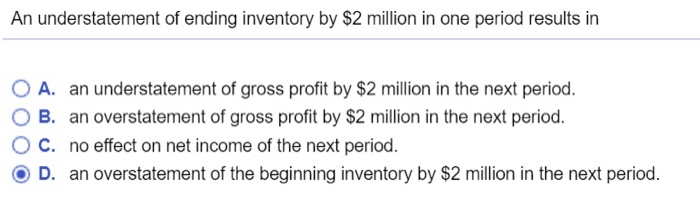

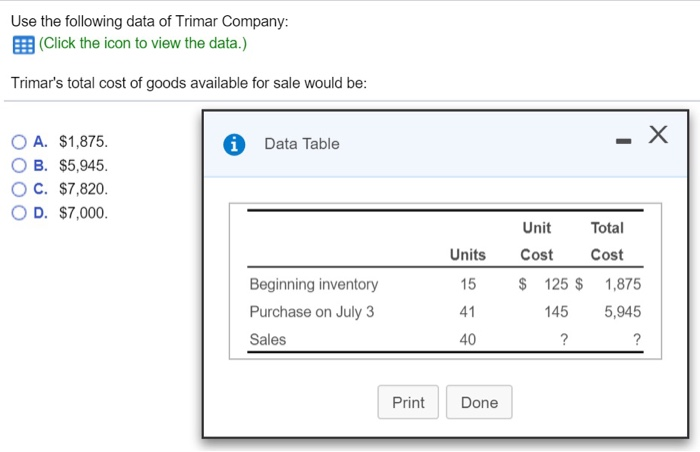

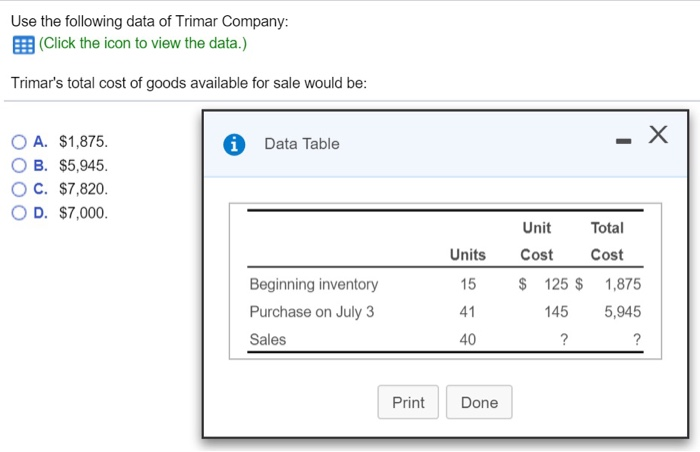

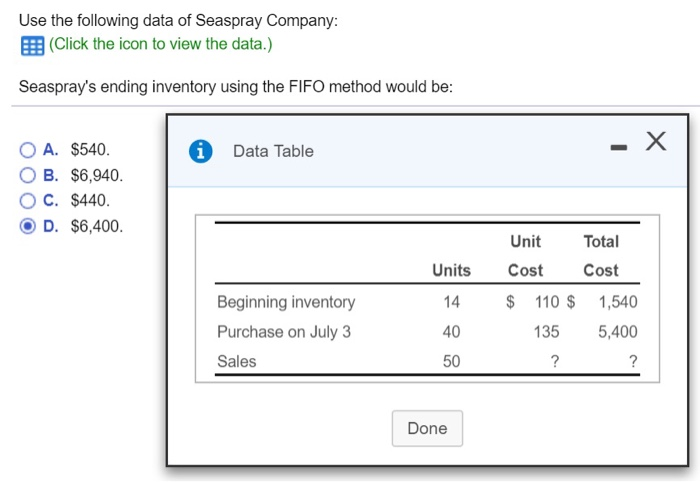

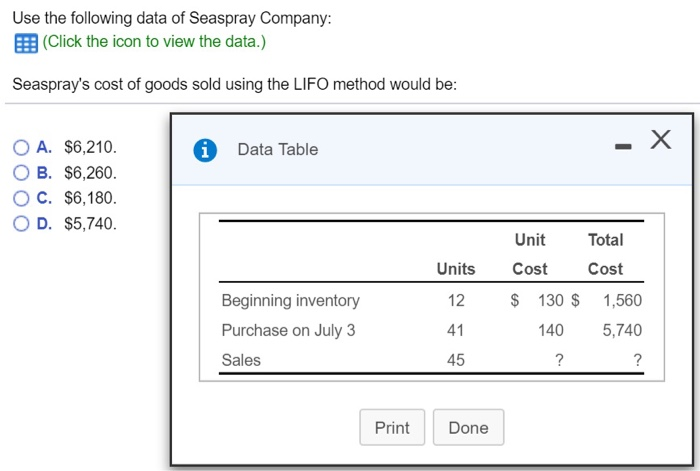

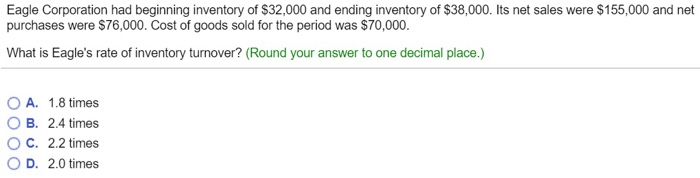

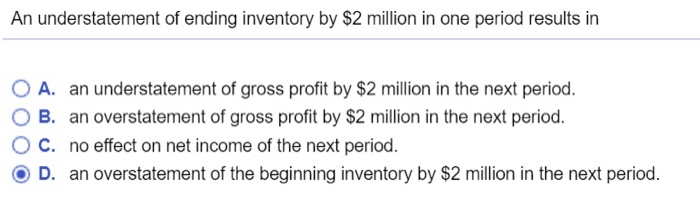

Use the following data of Trimar Company: EEB Click the icon to view the data.) Trimar's total cost of goods available for sale would be Data Table OA. $1,875 O B. $5,945 O C. $7,820 O D. $7,000 Unit Total Units Cost Cos Beginning inventory Purchase on July 3 Sales 15 41 40 $ 125 $ 1,875 145 5,945 PrintDone Use the following data of Seaspray Company (Click the icon to view the data.) Seaspray's ending inventory using the FIFO method would be: OA. B. i Data Table $540. $6,940. O c. $440. D. $6,400. UnitTotal Units Cost Cost Beginning inventory Purchase on July 3 Sales 14 40 50 110 $ 1,540 135 5,400 Done Use the following data of Seaspray Company: (Click the icon to view the data.) Seaspray's cost of goods sold using the LIFO method would be O A. $6,210 O B. $6,260 O C. $6,180 O D. $5,740 i Data Table Unit Total Units Cost Cost $ 130 $ 1,560 Beginning inventory Purchase on July 3 Sales 12 41 45 140 5,740 Print Done Eagle Corporation had beginning inventory of $32,000 and ending inventory of $38,000. Its net sales were $155,000 and net purchases were $76,000. Cost of goods sold for the period was $70,000. What is Eagle's rate of inventory turnover? (Round your answer to one decimal place.) O A. 1.8 times OB. 2.4 times OC. 2.2 times O D. 2.0 times An understatement of ending inventory by $2 million in one period results in O A. an understatement of gross profit by $2 million in the next period. O B. an overstatement of gross profit by $2 million in the next period. O C. no effect on net income of the next period. D. an overstatement of the beginning inventory by $2 million in the next period

Use the following data of Trimar Company: EEB Click the icon to view the data.) Trimar's total cost of goods available for sale would be Data Table OA. $1,875 O B. $5,945 O C. $7,820 O D. $7,000 Unit Total Units Cost Cos Beginning inventory Purchase on July 3 Sales 15 41 40 $ 125 $ 1,875 145 5,945 PrintDone Use the following data of Seaspray Company (Click the icon to view the data.) Seaspray's ending inventory using the FIFO method would be: OA. B. i Data Table $540. $6,940. O c. $440. D. $6,400. UnitTotal Units Cost Cost Beginning inventory Purchase on July 3 Sales 14 40 50 110 $ 1,540 135 5,400 Done Use the following data of Seaspray Company: (Click the icon to view the data.) Seaspray's cost of goods sold using the LIFO method would be O A. $6,210 O B. $6,260 O C. $6,180 O D. $5,740 i Data Table Unit Total Units Cost Cost $ 130 $ 1,560 Beginning inventory Purchase on July 3 Sales 12 41 45 140 5,740 Print Done Eagle Corporation had beginning inventory of $32,000 and ending inventory of $38,000. Its net sales were $155,000 and net purchases were $76,000. Cost of goods sold for the period was $70,000. What is Eagle's rate of inventory turnover? (Round your answer to one decimal place.) O A. 1.8 times OB. 2.4 times OC. 2.2 times O D. 2.0 times An understatement of ending inventory by $2 million in one period results in O A. an understatement of gross profit by $2 million in the next period. O B. an overstatement of gross profit by $2 million in the next period. O C. no effect on net income of the next period. D. an overstatement of the beginning inventory by $2 million in the next period

Struggle with those questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started