Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Struggling here need help with these questions. Thank you Question 2 (2.5 points) Required reserve of banks are reserves the Fed requires banks to hold

Struggling here need help with these questions. Thank you

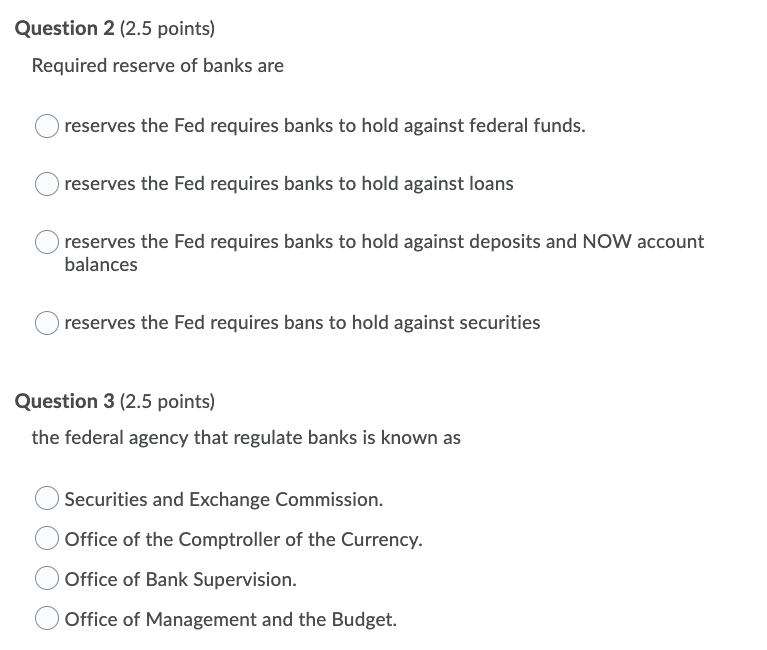

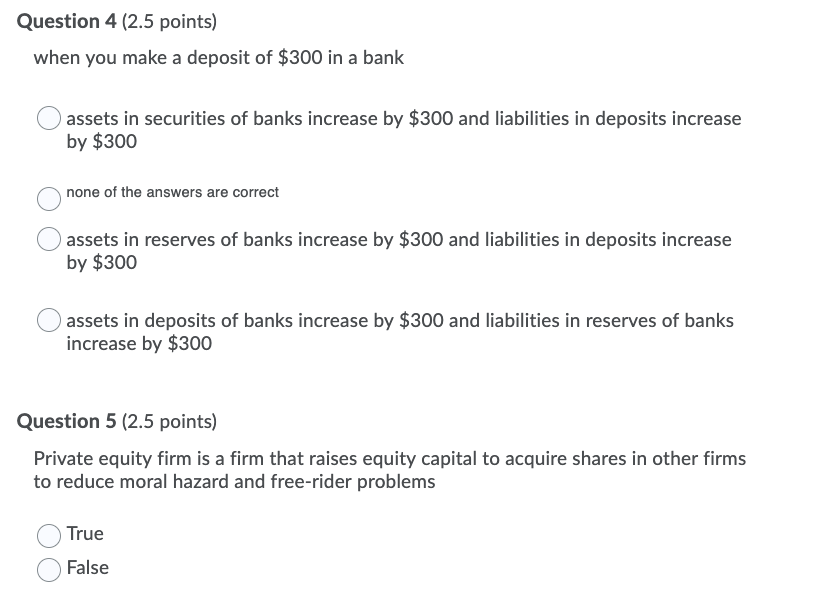

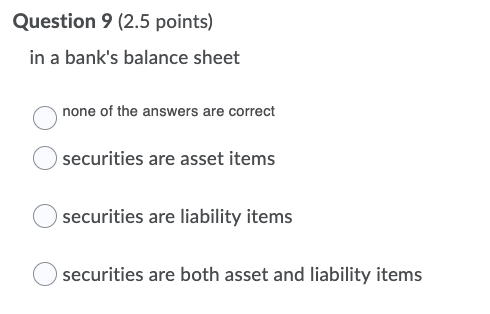

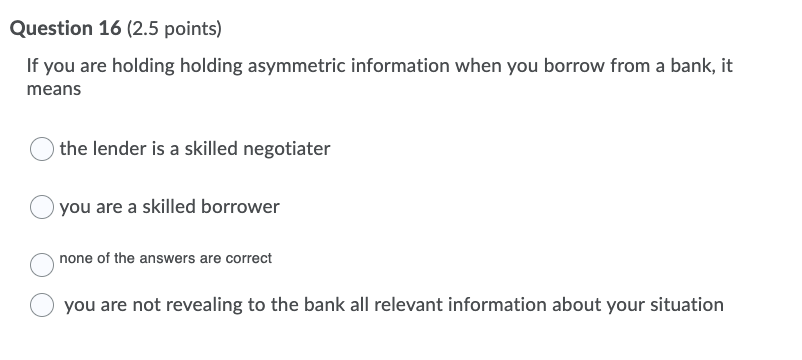

Question 2 (2.5 points) Required reserve of banks are reserves the Fed requires banks to hold against federal funds. reserves the Fed requires banks to hold against loans Oreserves the Fed requires banks to hold against deposits and NOW account balances O reserves the Fed requires bans to hold against securities Question 3 (2.5 points) the federal agency that regulate banks is known as Securities and Exchange Commission. Office of the Comptroller of the Currency. Office of Bank Supervision. Office of Management and the Budget. Question 4 (2.5 points) when you make a deposit of $300 in a bank assets in securities of banks increase by $300 and liabilities in deposits increase by $300 none of the answers are correct assets in reserves of banks increase by $300 and liabilities in deposits increase by $300 assets in deposits of banks increase by $300 and liabilities in reserves of banks increase by $300 Question 5 (2.5 points) Private equity firm is a firm that raises equity capital to acquire shares in other firms to reduce moral hazard and free-rider problems True False Question 9 (2.5 points) in a bank's balance sheet none of the answers are correct O securities are asset items O securities are liability items securities are both asset and liability items Question 16 (2.5 points) If you are holding holding asymmetric information when you borrow from a bank, it means the lender is a skilled negotiater you are a skilled borrower none of the answers are correct you are not revealing to the bank all relevant information about your situation Question 19 (2.5 points) Bank capital is the bank owns in the form of loans the value of the securities it is holding the net worth of the bank the value of the buildings and other physical assets the bank ownsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started