Answered step by step

Verified Expert Solution

Question

1 Approved Answer

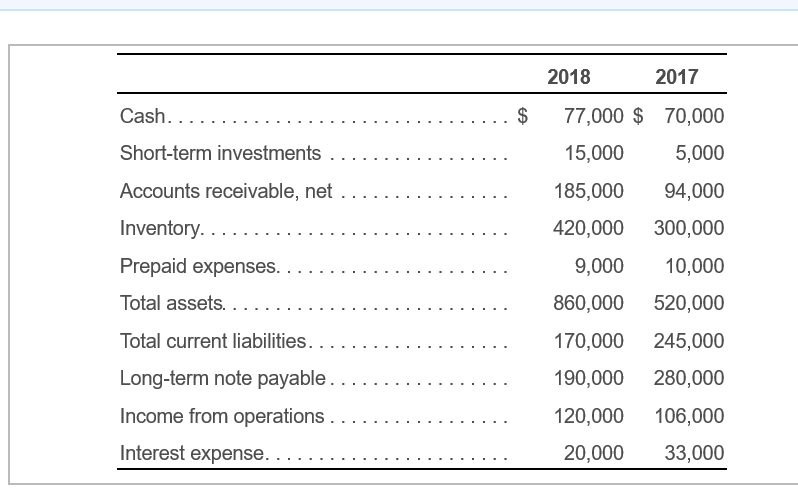

struggling to find total liabilities and total assets, how and what is the formula? Cash............................. .......$ Short-term investments ................. Accounts receivable, net ....... Inventory.............. Prepaid

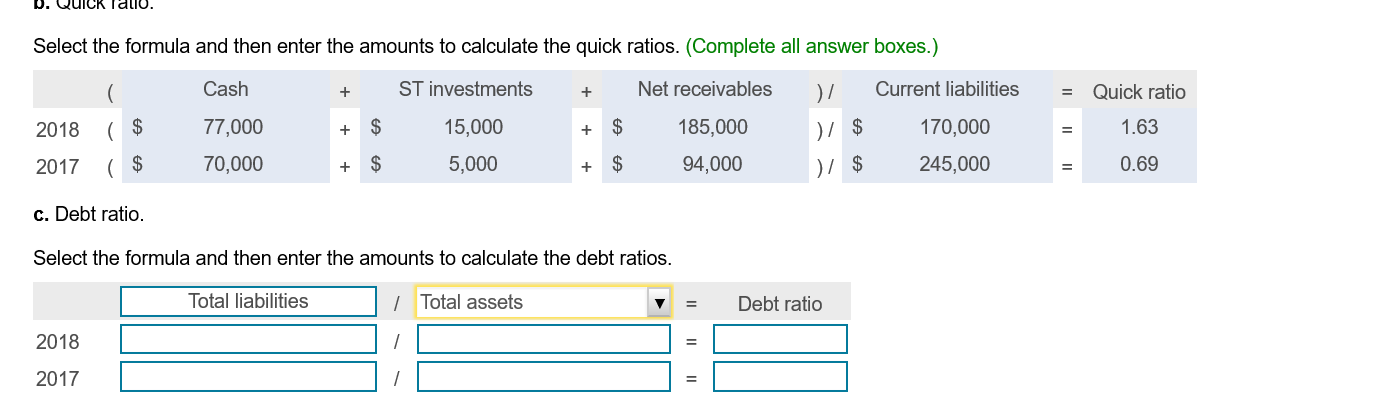

struggling to find total liabilities and total assets, how and what is the formula?

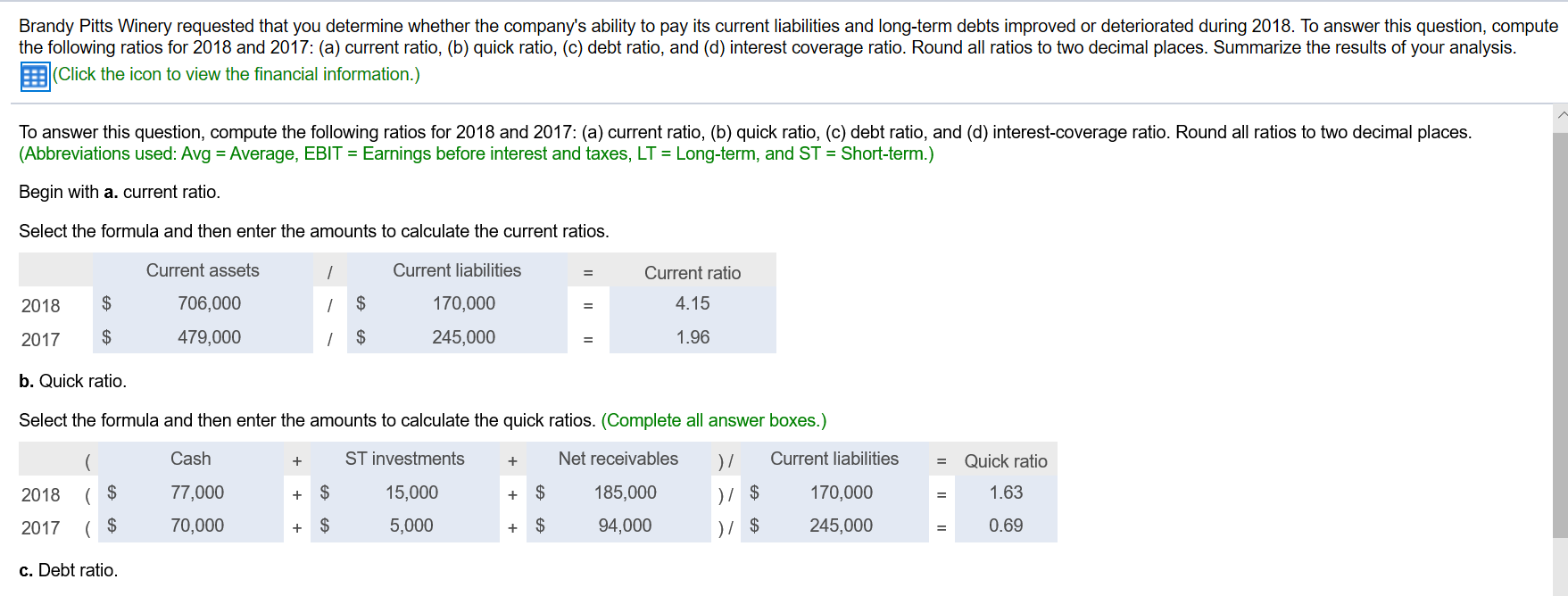

Cash............................. .......$ Short-term investments ................. Accounts receivable, net ....... Inventory.............. Prepaid expenses...................... 2018 2017 77,000 $ 70,000 15,000 5,000 185,000 94,000 420,000 300,000 9,000 10,000 860,000 520,000 170,000 245,000 190,000 280,000 120,000 106,000 20,000 33,000 Total assets........................... Total current liabilities. .................. Long-term note payable................. Income from operations ....... Interest expense...... Brandy Pitts Winery requested that you determine whether the company's ability to pay its current liabilities and long-term debts improved or deteriorated during 2018. To answer this question, compute the following ratios for 2018 and 2017: (a) current ratio, (b) quick ratio, (c) debt ratio, and (d) interest coverage ratio. Round all ratios to two decimal places. Summarize the results of your analysis. Click the icon to view the financial information.) To answer this question, compute the following ratios for 2018 and 2017: (a) current ratio, (b) quick ratio, (c) debt ratio, and (d) interest-coverage ratio. Round all ratios to two decimal places. (Abbreviations used: Avg = Average, EBIT = Earnings before interest and taxes, LT = Long-term, and ST = Short-term.) Begin with a current ratio. Select the formula and then enter the amounts to calculate the current ratios. 2018 Current assets 706,000 479,000 A Current liabilities 170,000 245,000 Current ratio 4.15 1.96 2017 1 $ b. Quick ratio. Select the formula and then enter the amounts to calculate the quick ratios. (Complete all answer boxes.) + + Cash 77,000 70,000 2018 2017 ( $ ( $ ST investments 15,000 5,000 + + $ + $ + $ + $ Net receivables 185,000 94,000 ) )/ $ / $ + Current liabilities 170,000 245,000 + - Quick ratio = 1.63 = 0.69 + + c. Debt ratio. b. QUICK Talio. Select the formula and then enter the amounts to calculate the quick ratios. (Complete all answer boxes.) + + Cash 77,000 70,000 2018 2017 ( $ ( $ ST investments 15,000 5,000 + + Net receivables + $ 185,000 + $ 94,000 + $ + $ + Current liabilities 170,000 245,000 / $ / $ = = = Quick ratio 1.63 0.69 + + c. Debt ratio. Select the formula and then enter the amounts to calculate the debt ratios. Total liabilities Total assets Debt ratio 2018 2017Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started