Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Struggling with figuring out the Additional Income from Schedule 1 , Line 1 0 Gordon provided the following financial information related to Mobile Peri Peri:

Struggling with figuring out the Additional Income from Schedule Line

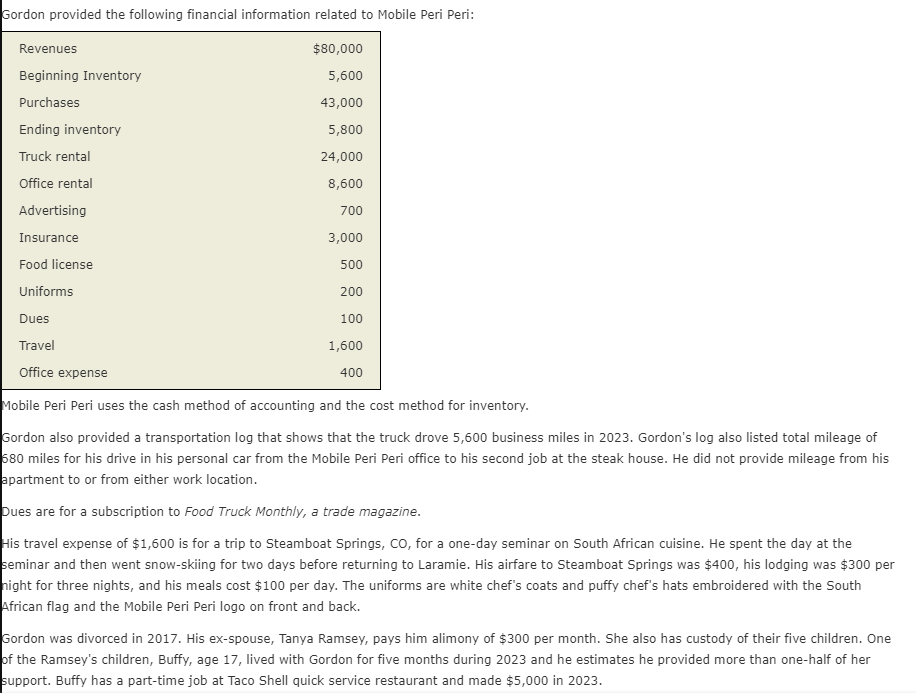

Gordon provided the following financial information related to Mobile Peri Peri:

Mobile Peri Peri uses the cash method of accounting and the cost method for inventory.

Gordon also provided a transportation log that shows that the truck drove business miles in Gordon's log also listed total mileage of

miles for his drive in his personal car from the Mobile Peri Peri office to his second job at the steak house. He did not provide mileage from his

apartment to or from either work location.

Dues are for a subscription to Food Truck Monthly, a trade magazine.

His travel expense of $ is for a trip to Steamboat Springs, CO for a oneday seminar on South African cuisine. He spent the day at the

seminar and then went snowskiing for two days before returning to Laramie. His airfare to Steamboat Springs was $ his lodging was $ per

hight for three nights, and his meals cost $ per day. The uniforms are white chef's coats and puffy chef's hats embroidered with the South

African flag and the Mobile Peri Peri logo on front and back.

Gordon was divorced in His exspouse, Tanya Ramsey, pays him alimony of $ per month. She also has custody of their five children. One

of the Ramsey's children, Buffy, age lived with Gordon for five months during and he estimates he provided more than onehalf of her

support. Buffy has a parttime job at Taco Shell quick service restaurant and made $ in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started