Answered step by step

Verified Expert Solution

Question

1 Approved Answer

struggling with this one Managing a Risky TV Streaming Project at Dinsey+? Dinsey+ is investing in new, cutting-edge television productions for broadcasting on its streaming

struggling with this one

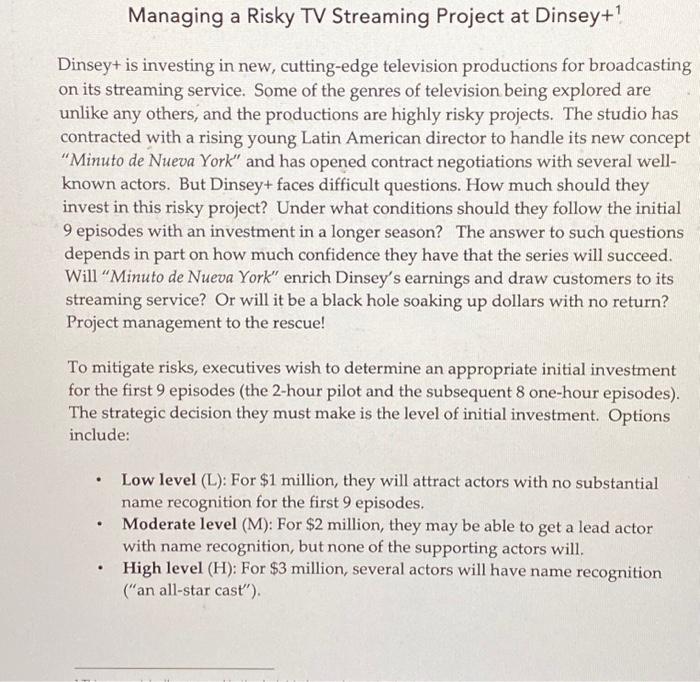

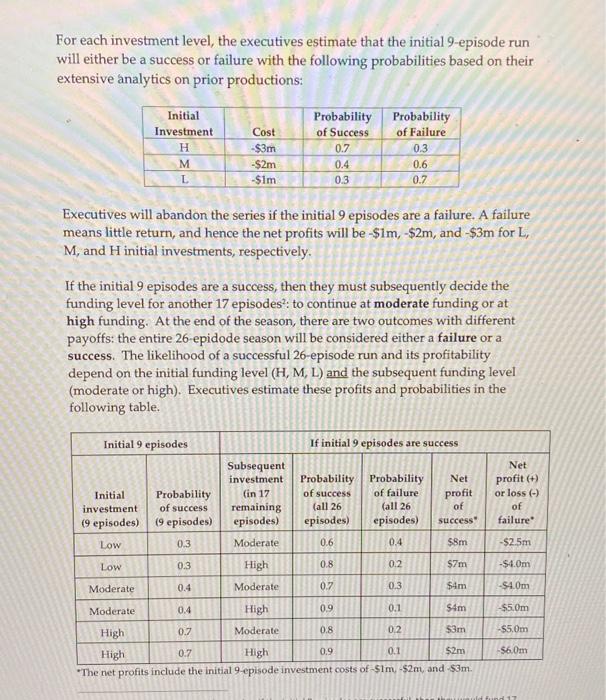

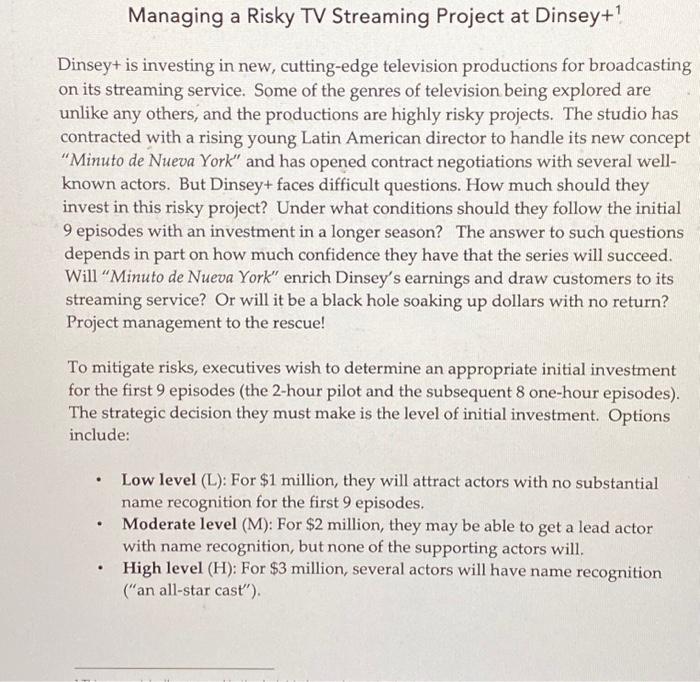

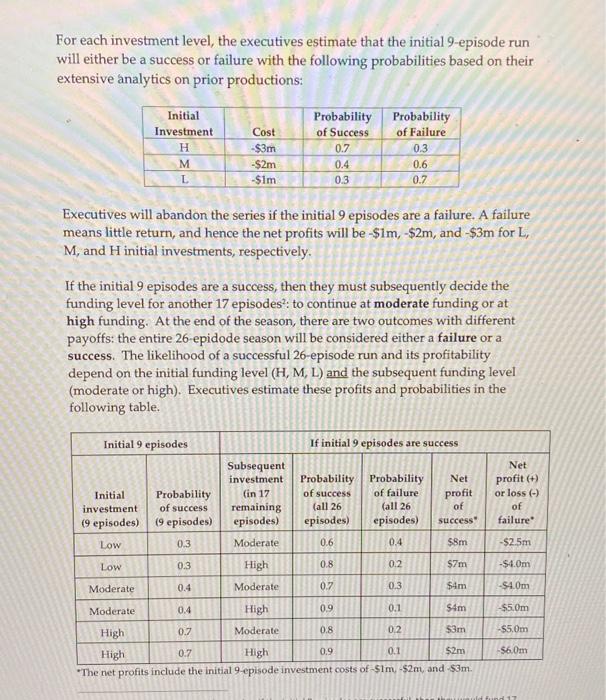

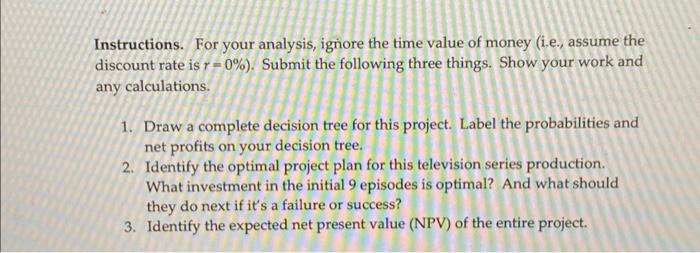

Managing a Risky TV Streaming Project at Dinsey+? Dinsey+ is investing in new, cutting-edge television productions for broadcasting on its streaming service. Some of the genres of television being explored are unlike any others, and the productions are highly risky projects. The studio has contracted with a rising young Latin American director to handle its new concept "Minuto de Nueva York" and has opened contract negotiations with several wellknown actors. But Dinsey+ faces difficult questions. How much should they invest in this risky project? Under what conditions should they follow the initial 9 episodes with an investment in a longer season? The answer to such questions depends in part on how much confidence they have that the series will succeed. Will "Minuto de Nueva York" enrich Dinsey's earnings and draw customers to its streaming service? Or will it be a black hole soaking up dollars with no return? Project management to the rescue! To mitigate risks, executives wish to determine an appropriate initial investment for the first 9 episodes (the 2 -hour pilot and the subsequent 8 one-hour episodes). The strategic decision they must make is the level of initial investment. Options include: - Low level (L): For $1 million, they will attract actors with no substantial name recognition for the first 9 episodes. - Moderate level (M): For $2 million, they may be able to get a lead actor with name recognition, but none of the supporting actors will. - High level (H) : For $3 million, several actors will have name recognition ("an all-star cast"). For each investment level, the executives estimate that the initial 9-episode run will either be a success or failure with the following probabilities based on their extensive analytics on prior productions: Executives will abandon the series if the initial 9 episodes are a failure. A failure means little return, and hence the net profits will be $1m,$2m, and $3m for L, M, and H initial investments, respectively. If the initial 9 episodes are a success, then they must subsequently decide the funding level for another 17 episodes 2 : to continue at moderate funding or at high funding. At the end of the season, there are two outcomes with different payoffs: the entire 26 -epidode season will be considered either a failure or a success. The likelihood of a successful 26 -episode run and its profitability depend on the initial funding level (H,M,L) and the subsequent funding level (moderate or high). Executives estimate these profits and probabilities in the following table. -The net profits include the initial 9-episode investment costs of 51m,52m, and 53m. Instructions. For your analysis, ignore the time value of money (i.e., assume the discount rate is r=0% ). Submit the following three things. Show your work and any calculations. 1. Draw a complete decision tree for this project. Label the probabilities and net profits on your decision tree. 2. Identify the optimal project plan for this television series production. What investment in the initial 9 episodes is optimal? And what should they do next if it's a failure or success? 3. Identify the expected net present value (NPV) of the entire project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started