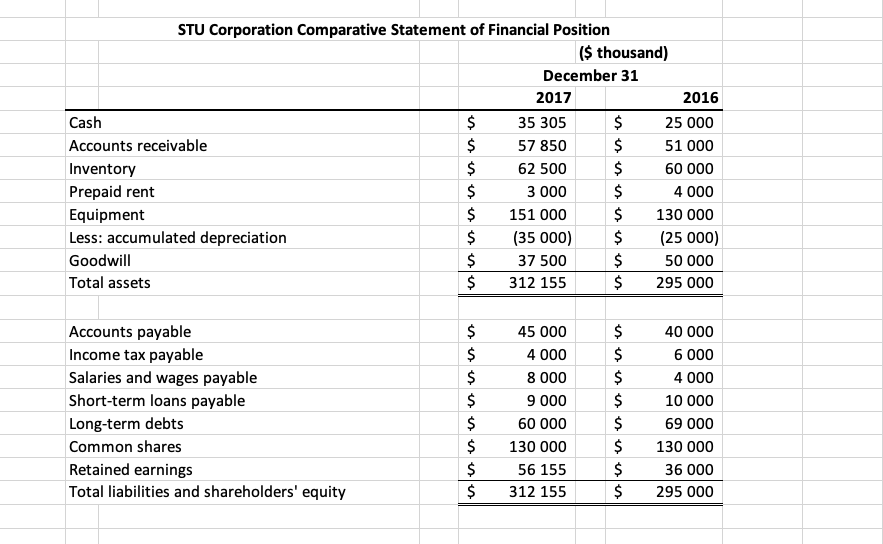

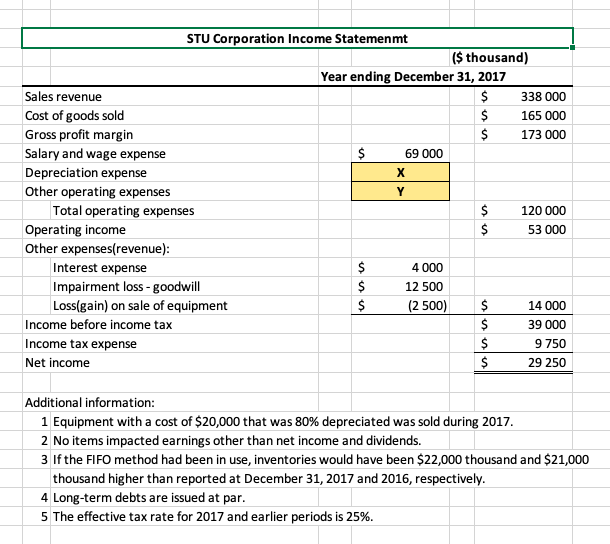

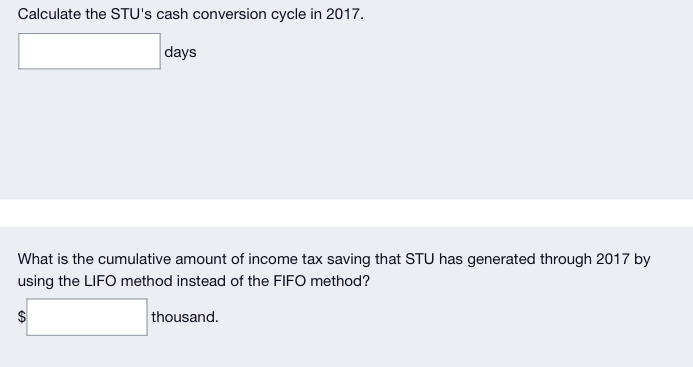

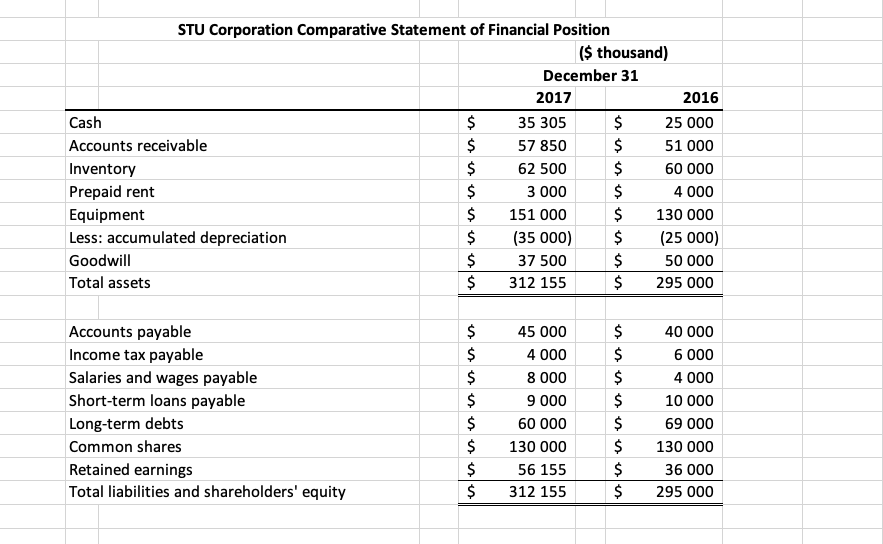

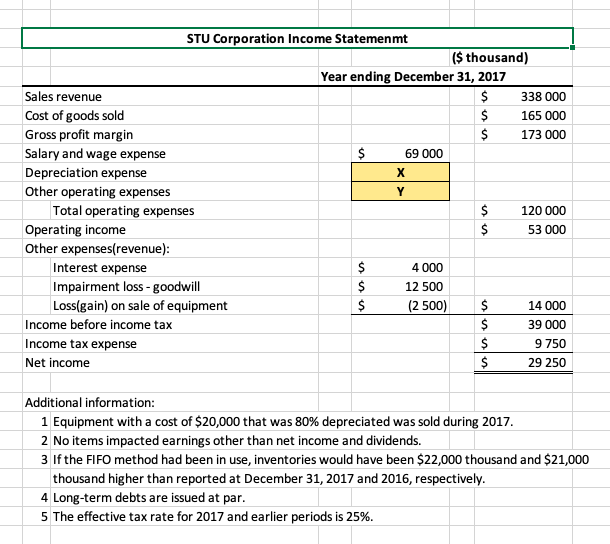

$ STU Corporation Comparative Statement of Financial Position ($ thousand) December 31 2017 2016 Cash $ 35 305 $ 25 000 Accounts receivable $ 57 850 $ 51 000 Inventory $ 62 500 $ 60 000 Prepaid rent $ 3 000 $ 4 000 Equipment $ 151 000 $ 130 000 Less: accumulated depreciation $ (35 000) $ (25 000) Goodwill $ 37 500 $ 50 000 Total assets $ 312 155 $ 295 000 in un $ Accounts payable Income tax payable Salaries and wages payable Short-term loans payable Long-term debts Common shares Retained earnings Total liabilities and shareholders' equity $ $ $ $ $ $ $ $ 45 000 4 000 8 000 9 000 60 000 130 000 56 155 312 155 $ $ $ $ $ $ $ $ 40 000 6 000 4 000 10 000 69 000 130 000 36 000 295 000 Y STU Corporation Income Statemenmt ($ thousand) Year ending December 31, 2017 Sales revenue $ 338 000 Cost of goods sold $ 165 000 Gross profit margin $ 173 000 Salary and wage expense $ 69 000 Depreciation expense Other operating expenses Total operating expenses $ 120 000 Operating income $ 53 000 Other expenses(revenue): Interest expense $ 4 000 Impairment loss - goodwill $ 12 500 Loss(gain) on sale of equipment $ (2 500) $ 14 000 Income before income tax $ 39 000 Income tax expense $ 9 750 Net income $ 29 250 Additional information: 1 Equipment with a cost of $20,000 that was 80% depreciated was sold during 2017. 2 No items impacted earnings other than net income and dividends. 3 If the FIFO method had been in use, inventories would have been $22,000 thousand and $21,000 thousand higher than reported at December 31, 2017 and 2016, respectively. 4 Long-term debts are issued at par. 5 The effective tax rate for 2017 and earlier periods is 25%. Calculate the STU's cash conversion cycle in 2017. days What is the cumulative amount of income tax saving that STU has generated through 2017 by using the LIFO method instead of the FIFO method? $ thousand. $ STU Corporation Comparative Statement of Financial Position ($ thousand) December 31 2017 2016 Cash $ 35 305 $ 25 000 Accounts receivable $ 57 850 $ 51 000 Inventory $ 62 500 $ 60 000 Prepaid rent $ 3 000 $ 4 000 Equipment $ 151 000 $ 130 000 Less: accumulated depreciation $ (35 000) $ (25 000) Goodwill $ 37 500 $ 50 000 Total assets $ 312 155 $ 295 000 in un $ Accounts payable Income tax payable Salaries and wages payable Short-term loans payable Long-term debts Common shares Retained earnings Total liabilities and shareholders' equity $ $ $ $ $ $ $ $ 45 000 4 000 8 000 9 000 60 000 130 000 56 155 312 155 $ $ $ $ $ $ $ $ 40 000 6 000 4 000 10 000 69 000 130 000 36 000 295 000 Y STU Corporation Income Statemenmt ($ thousand) Year ending December 31, 2017 Sales revenue $ 338 000 Cost of goods sold $ 165 000 Gross profit margin $ 173 000 Salary and wage expense $ 69 000 Depreciation expense Other operating expenses Total operating expenses $ 120 000 Operating income $ 53 000 Other expenses(revenue): Interest expense $ 4 000 Impairment loss - goodwill $ 12 500 Loss(gain) on sale of equipment $ (2 500) $ 14 000 Income before income tax $ 39 000 Income tax expense $ 9 750 Net income $ 29 250 Additional information: 1 Equipment with a cost of $20,000 that was 80% depreciated was sold during 2017. 2 No items impacted earnings other than net income and dividends. 3 If the FIFO method had been in use, inventories would have been $22,000 thousand and $21,000 thousand higher than reported at December 31, 2017 and 2016, respectively. 4 Long-term debts are issued at par. 5 The effective tax rate for 2017 and earlier periods is 25%. Calculate the STU's cash conversion cycle in 2017. days What is the cumulative amount of income tax saving that STU has generated through 2017 by using the LIFO method instead of the FIFO method? $ thousand