Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Stuart Corporation's balance sheet indicates that the company has $650,000 invested in operating assets. During the year, Stuart earned operating income of $84,500 on $1,300,000

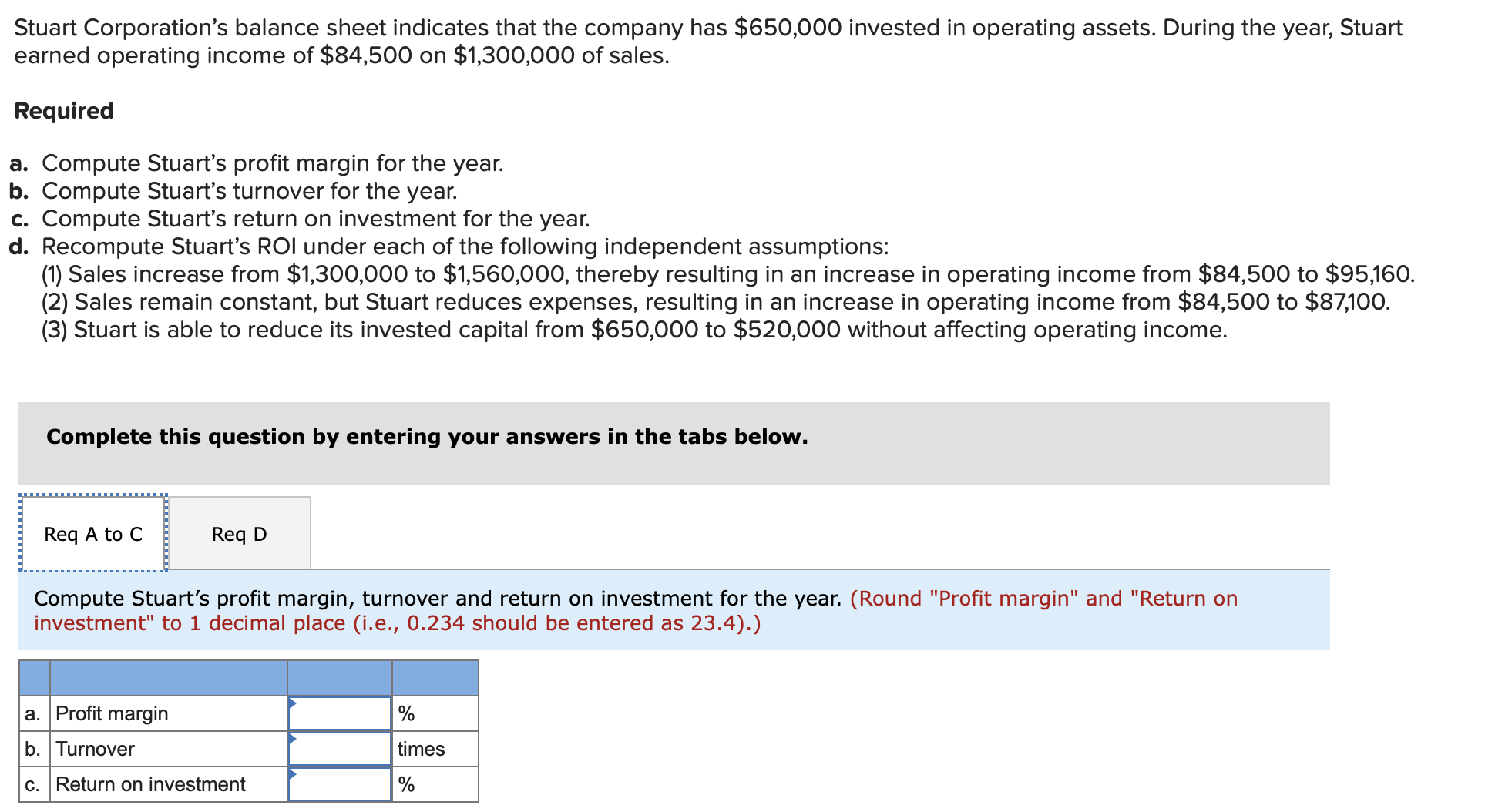

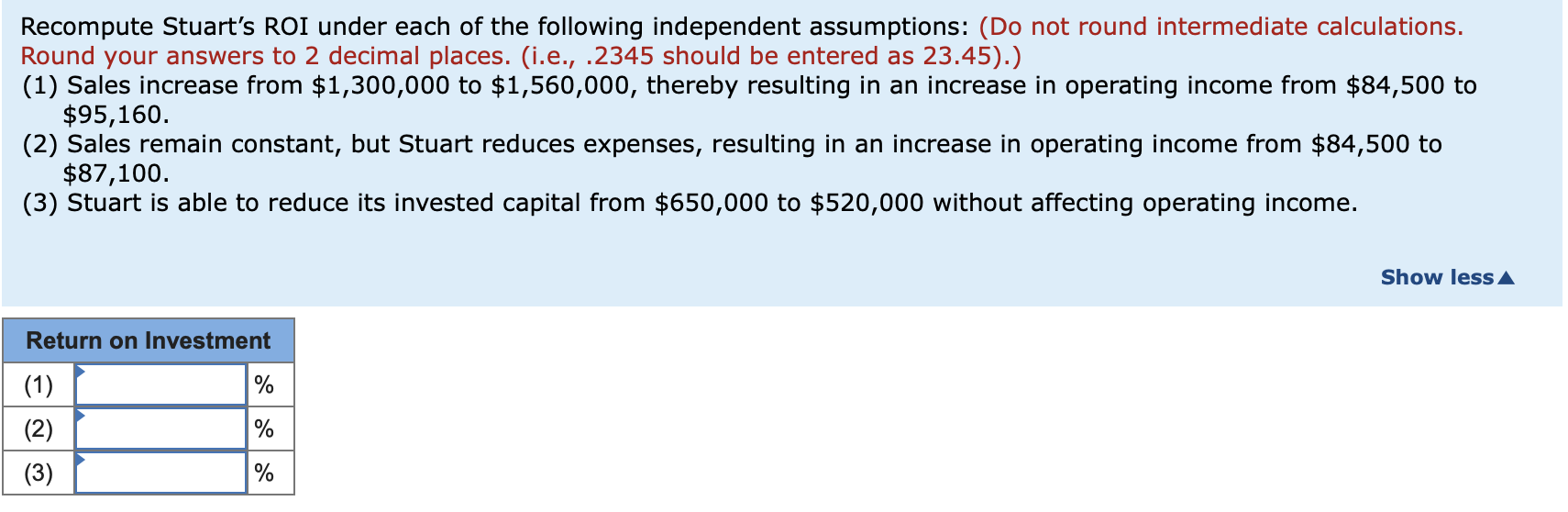

Stuart Corporation's balance sheet indicates that the company has $650,000 invested in operating assets. During the year, Stuart earned operating income of $84,500 on $1,300,000 of sales. Required a. Compute Stuart's profit margin for the year. b. Compute Stuart's turnover for the year. c. Compute Stuart's return on investment for the year. d. Recompute Stuart's ROI under each of the following independent assumptions: (1) Sales increase from $1,300,000 to $1,560,000, thereby resulting in an increase in operating income from $84,500 to $95,160. (2) Sales remain constant, but Stuart reduces expenses, resulting in an increase in operating income from $84,500 to $87,100. (3) Stuart is able to reduce its invested capital from $650,000 to $520,000 without affecting operating income. Complete this question by entering your answers in the tabs below. Compute Stuart's profit margin, turnover and return on investment for the year. (Round "Profit margin" and "Return on investment" to 1 decimal place (i.e., 0.234 should be entered as 23.4).) Recompute Stuart's ROI under each of the following independent assumptions: (Do not round intermediate calculations. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) (1) Sales increase from $1,300,000 to $1,560,000, thereby resulting in an increase in operating income from $84,500 to $95,160. (2) Sales remain constant, but Stuart reduces expenses, resulting in an increase in operating income from $84,500 to $87,100. (3) Stuart is able to reduce its invested capital from $650,000 to $520,000 without affecting operating income

Stuart Corporation's balance sheet indicates that the company has $650,000 invested in operating assets. During the year, Stuart earned operating income of $84,500 on $1,300,000 of sales. Required a. Compute Stuart's profit margin for the year. b. Compute Stuart's turnover for the year. c. Compute Stuart's return on investment for the year. d. Recompute Stuart's ROI under each of the following independent assumptions: (1) Sales increase from $1,300,000 to $1,560,000, thereby resulting in an increase in operating income from $84,500 to $95,160. (2) Sales remain constant, but Stuart reduces expenses, resulting in an increase in operating income from $84,500 to $87,100. (3) Stuart is able to reduce its invested capital from $650,000 to $520,000 without affecting operating income. Complete this question by entering your answers in the tabs below. Compute Stuart's profit margin, turnover and return on investment for the year. (Round "Profit margin" and "Return on investment" to 1 decimal place (i.e., 0.234 should be entered as 23.4).) Recompute Stuart's ROI under each of the following independent assumptions: (Do not round intermediate calculations. Round your answers to 2 decimal places. (i.e., .2345 should be entered as 23.45).) (1) Sales increase from $1,300,000 to $1,560,000, thereby resulting in an increase in operating income from $84,500 to $95,160. (2) Sales remain constant, but Stuart reduces expenses, resulting in an increase in operating income from $84,500 to $87,100. (3) Stuart is able to reduce its invested capital from $650,000 to $520,000 without affecting operating income Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started