stuck , help me out please

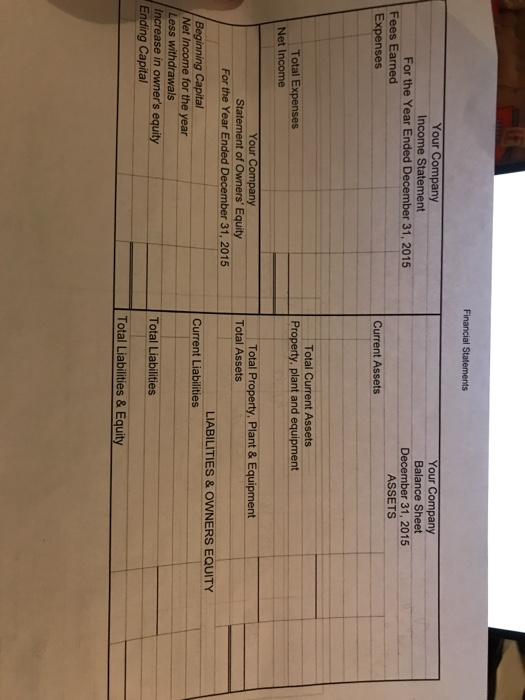

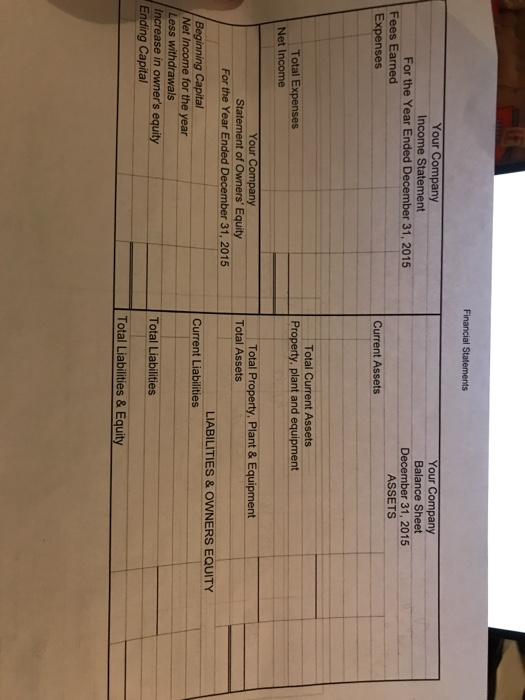

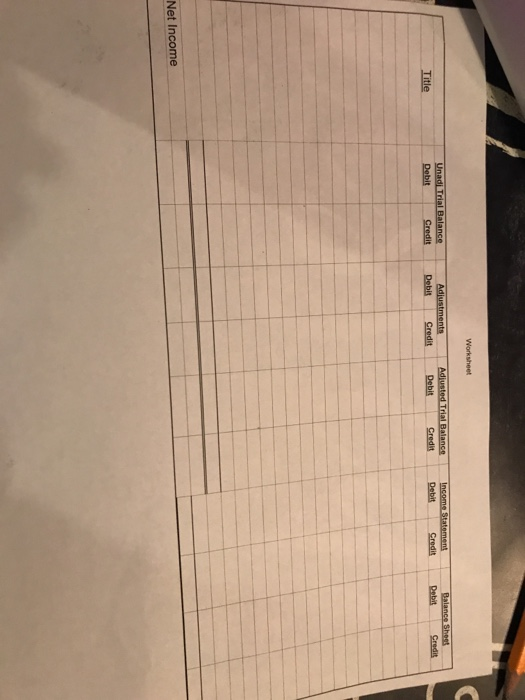

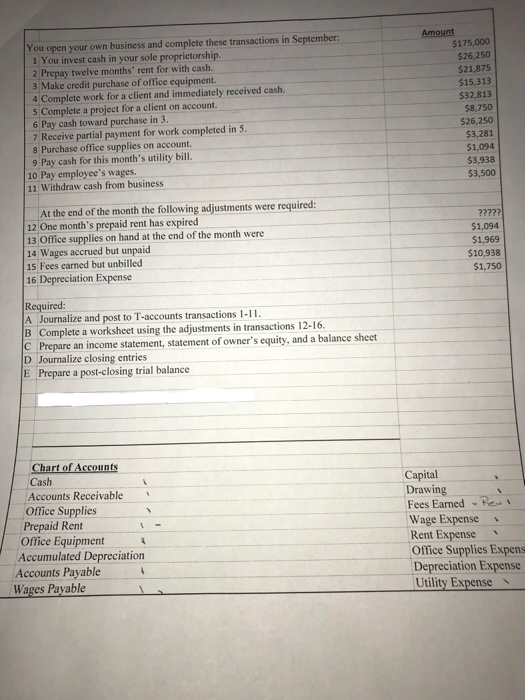

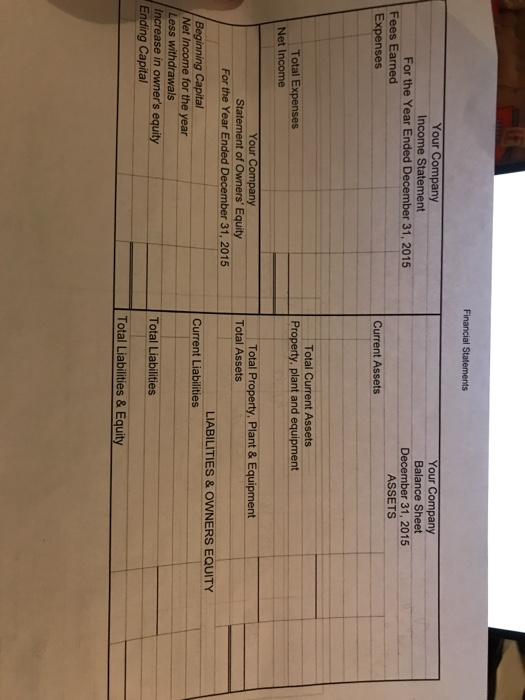

Financial Statements Your Company Income Statement For the Year Ended December 31, 2015 Fees Earned Expenses Your Company Balance Sheet December 31, 2015 ASSETS Current Assets Total Expenses Net Income Total Current Assets Property, plant and equipment Your Company Statement of Owners' Equity For the Year Ended December 31, 2015 Total Property, Plant & Equipment Total Assets LIABILITIES & OWNERS EQUITY Current Liabilities Beginning Capital Net Income for the year Less withdrawals Increase in owner's equity Ending Capital Total Liabilities Total Liabilities & Equity Worksheet Unad Trial Balance Debit Credit Adjustments Debis Credit Adjusted Trial Balance Debit Credit Income Statement Debit Credit Balance Sheet Debit Credit Title Net Income You open your own business and complete these transactions in September: 1 You invest cash in your sole proprietorship. 2 Prepay twelve months' rent for with cash. 3 Make credit purchase of office equipment. 4 Complete work for a client and immediately received cash. 5 Complete a project for a client on account. 6 Pay cash toward purchase in 3. 7 Receive partial payment for work completed in 5. 8 Purchase office supplies on account. 9 Pay cash for this month's utility bill. 10 Pay employee's wages. 11 Withdraw cash from business Amount $175,000 $26,250 $21.875 $15 313 $32,813 $8,750 $26,250 $3,281 $1,094 $3,938 $3,500 ????? $1,094 $1,969 $10.938 $1,750 At the end of the month the following adjustments were required: 12 One month's prepaid rent has expired 13 Office supplies on hand at the end of the month were 14 Wages accrued but unpaid 15 Fees camed but unbilled 16 Depreciation Expense Required: A Journalize and post to T-accounts transactions 1-11. B Complete a worksheet using the adjustments in transactions 12-16. C Prepare an income statement, statement of owner's equity, and a balance sheet D Journalize closing entries E Prepare a post-closing trial balance Chart of Accounts Cash Accounts Receivable Office Supplies Prepaid Rent Office Equipment Accumulated Depreciation Accounts Payable Wages Payable Capital Drawing Fees Earned fel Wage Expense Rent Expense Office Supplies Expens Depreciation Expense Utility Expense