Answered step by step

Verified Expert Solution

Question

1 Approved Answer

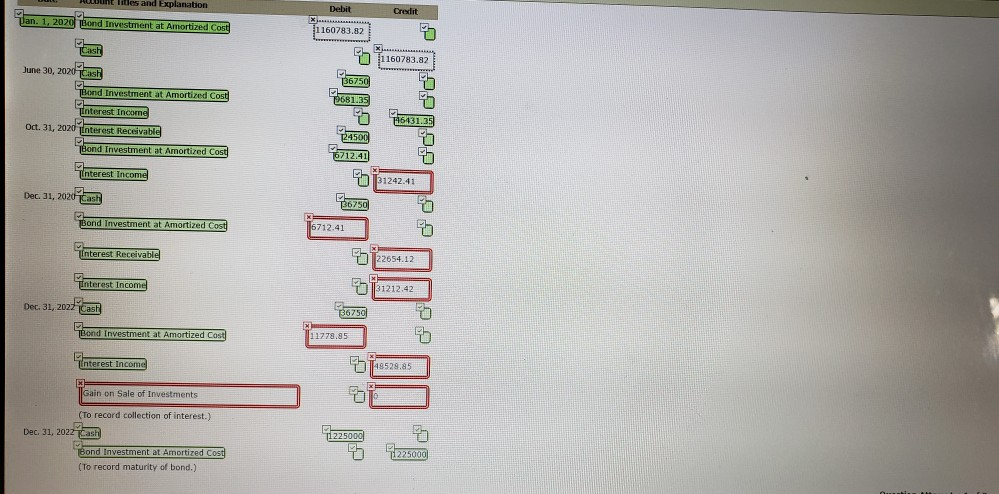

Stuck on the red boxes and the very first PV outlined in Grey. N U E Titles and Explanation Debit Crexit Jan. 1, 2070 Bond

Stuck on the red boxes and the very first PV outlined in Grey.

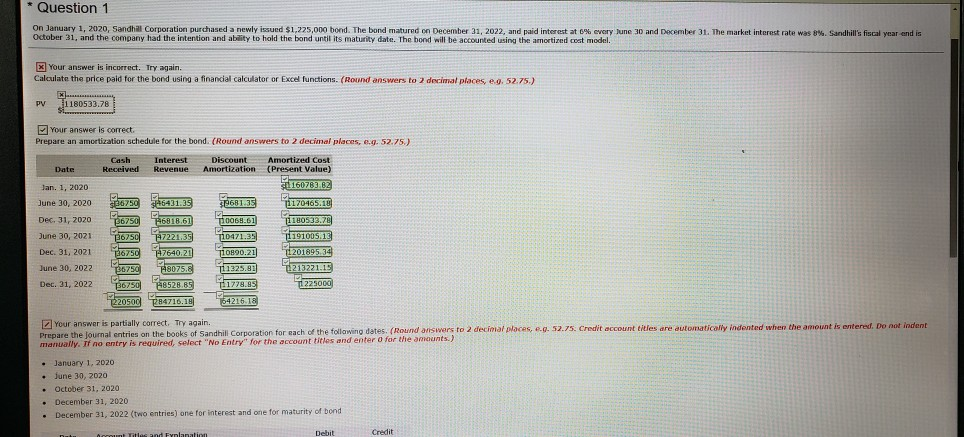

N U E Titles and Explanation Debit Crexit Jan. 1, 2070 Bond Investment at Amortized Cost 1160783.82 81 160783.82 136750 19681.25 June 30, 2020 Cash Trond Investment at Amortized Cost interest Income Oct. 31, 2020 Interest Receivable Thond Investment at Amortired Cost 716431.25 24500 6712.41 interest Income 11242.41 Dec. 31, 2020-Cash 36750 Bond Investment at Amortized Cost 5712, 415 522654.12 Interest Receivable interest Income Dec 31, 2017 Cash 36750 Bond Investment at Amortized Cost 11778.85 Interest Income 1528.85 DE Gain on Sale of Investments (To record collection of interest.) Dec 31, 2022 Cash Bond Investment at Amortized Cost (To record maturity of bond.) 1:22:00 22:00 * Question 1 On January 1, 2020, Sandha Corporation purchased a newly issued $1.225,000 bond. The bond matured on December 31, 2022, and paid interest at o' every Sune 30 and December 31. The market interest rate was 8% Sand October 31, and the company had the intention and ability to hold the bond until its maturity date. The bond will be accounted using the amortired cost model 's fiscal year end is x Your answer is incorrect. Try again. Calculate the price paid for the bond using a financial Calculator or Excel functions. (Round answers to 2 decimal places 1.4.52.75.) PV11180533.78 13631 Your answer is correct. Prepare an amortization schedule for the bond (Round answers to 2 decimal places, .. 52.75.) Cash Interest Discount Amortized Cost Date Received Revenue Amortization (Present Value) 160703 BZ Jan 1, 2020 June 30, 2020 86750 45431.35 Dec 31, 2020 110064.01 Dune 30, 2021 Dec 31, 2021 86750747640.21 June 30, 2022 6750 T11225,91 1213221 Dec. 21, 2022 B675078528.85 11779.95 L2H00 220500 284716.18 Your answer is partially correct. Try again. Prepare the Journal entries on the books of Sandhill Corporation for each of the following dates. (Round answers to for the amounts.) manually. If no entry is required, select "No Entry for the account Hitles and enter 06750 P6250 4216 automatically indented when the amount is entered. Do not indent January 1, 2020 June 30, 2020 October 31, 2020 December 31, 2020 December 31, 2022 (two entries) one for interest and one for maturity of bond DebitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started