Answered step by step

Verified Expert Solution

Question

1 Approved Answer

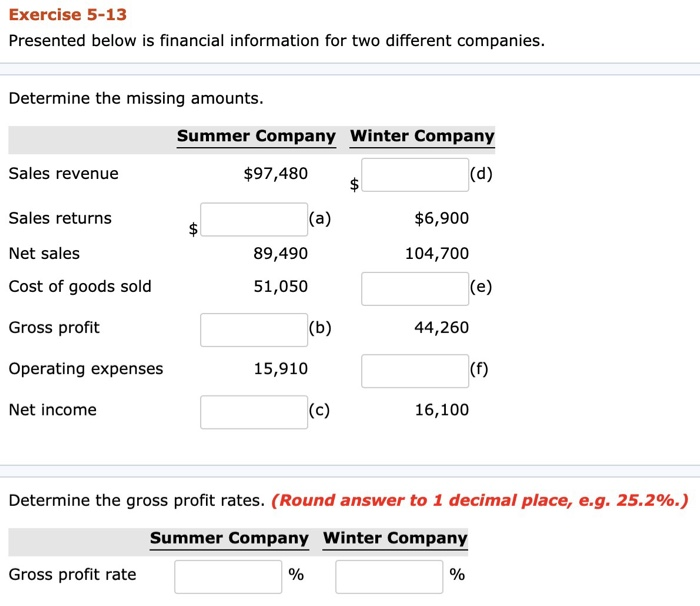

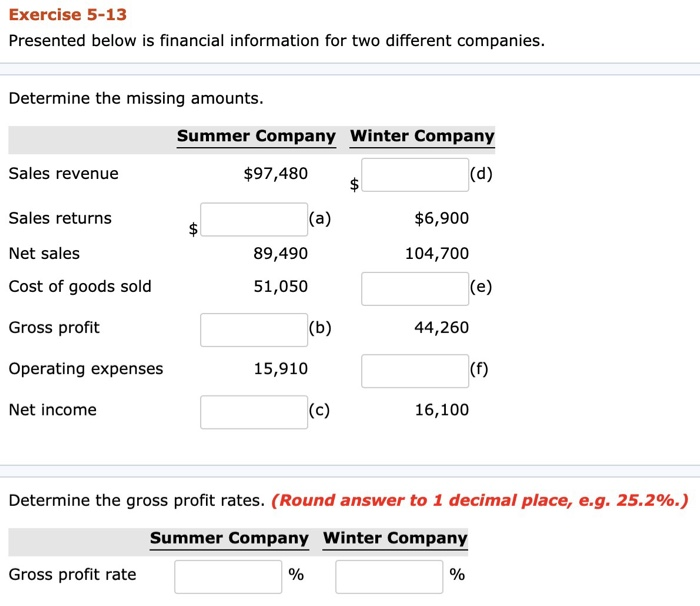

Stuck on the remaining 3 exercises. Help is greatly appreciated. Exercise 5-13 Presented below is financial information for two different companies Determine the missing amounts.

Stuck on the remaining 3 exercises. Help is greatly appreciated.

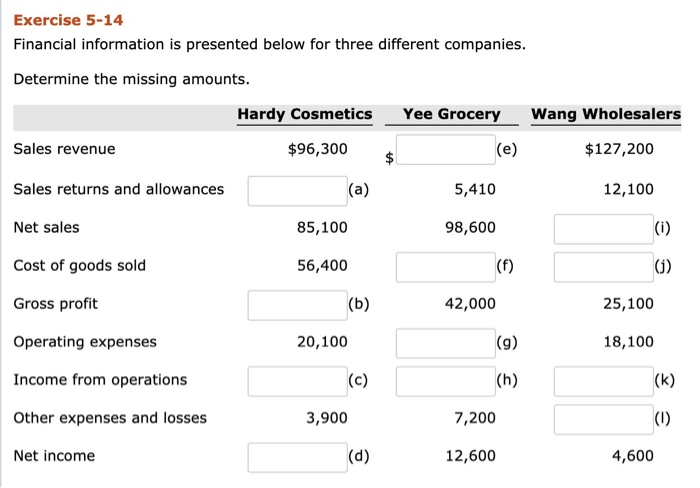

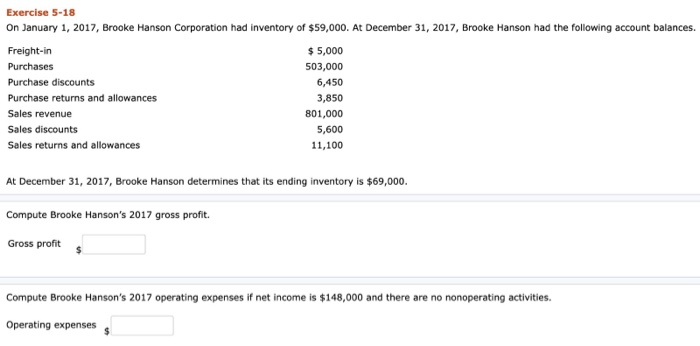

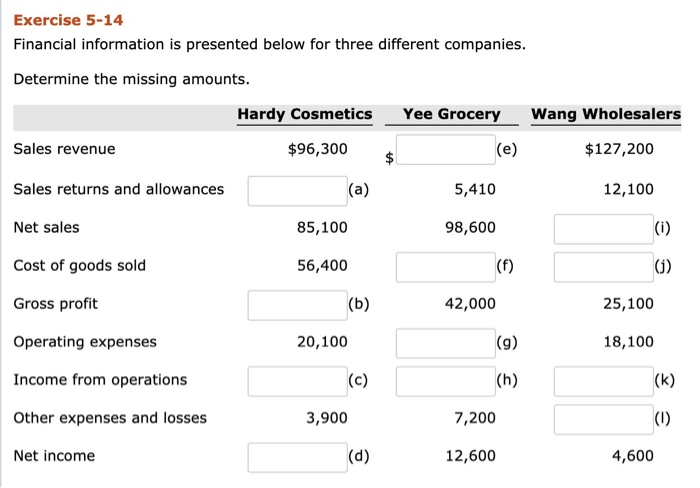

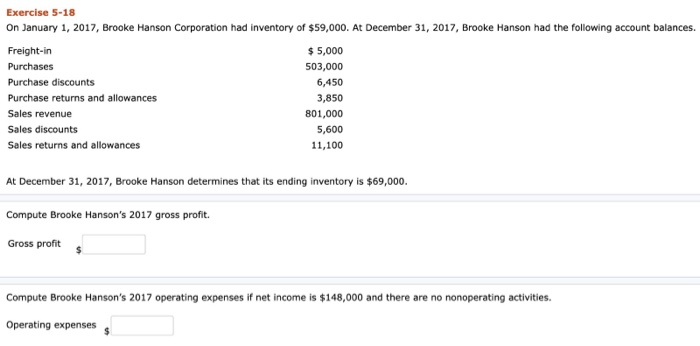

Exercise 5-13 Presented below is financial information for two different companies Determine the missing amounts. Summer Company Winter Company Sales revenue $97,480 (d) Sales returns $6,900 (a) 104,700 Net sales 89,490 Cost of goods sold 51,050 (e) Gross profit (b) 44,260 Operating expenses 15,910 (f) (c) 16,100 Net income Determine the gross profit rates. (Round answer to 1 decimal place, e.g. 25.2%.) Summer Company Winter Company Gross profit rate A Exercise 5-14 Financial information is presented below for three different companies. Determine the missing amounts. Yee Grocery Hardy Cosmetics Wang Wholesalers Sales revenue $96,300 (e) $127,200 Sales returns and allowances (a) 5,410 12,100 Net sales 85,100 (i) 98,600 Cost of goods sold 56,400 (f) (j) Gross profit (b) 25,100 42,000 20,100 (g) 18,100 Operating expenses Income from operations (c) (h) (k) 3,900 (I) Other expenses and losses 7,200 4,600 Net income (d) 12,600 Exercise 5-18 On January 1, 2017, Brooke Hanson Corporation had inventory of $59,000. At December 31, 2017, Brooke Hanson had the following account balances. Freight-in 5,000 Purchases 503,000 Purchase discounts 6,450 Purchase returns and allowances 3,850 Sales revenue 801,000 Sales discounts 5,600 Sales returns and allowances 11,100 At December 31, 2017, Brooke Hanson determines that its ending inventory is $69,000. Compute Brooke Hanson's 2017 gross profit. Gross profit Compute Brooke Hanson's 2017 operating expenses if net income is $148,000 and there are no nonoperating activities. Operating expenses

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started