stuck on these questions

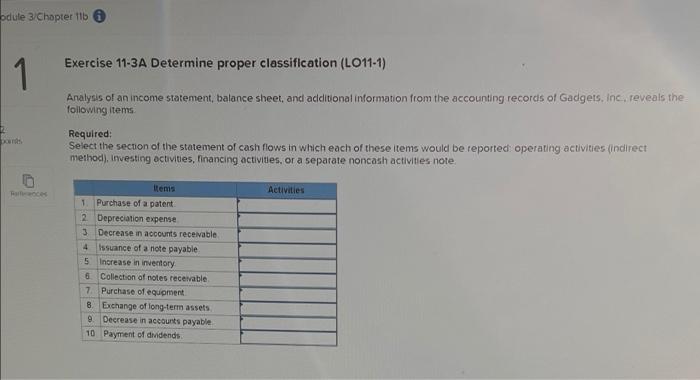

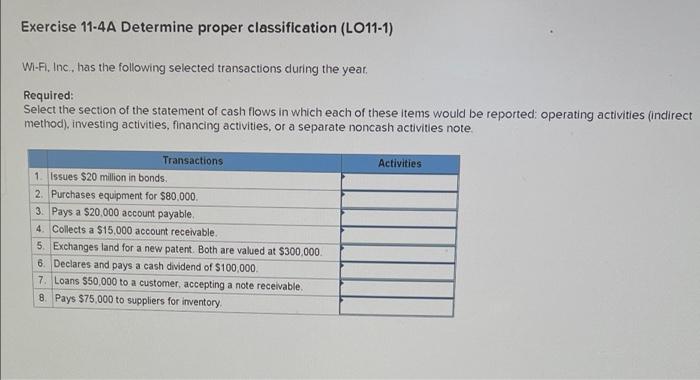

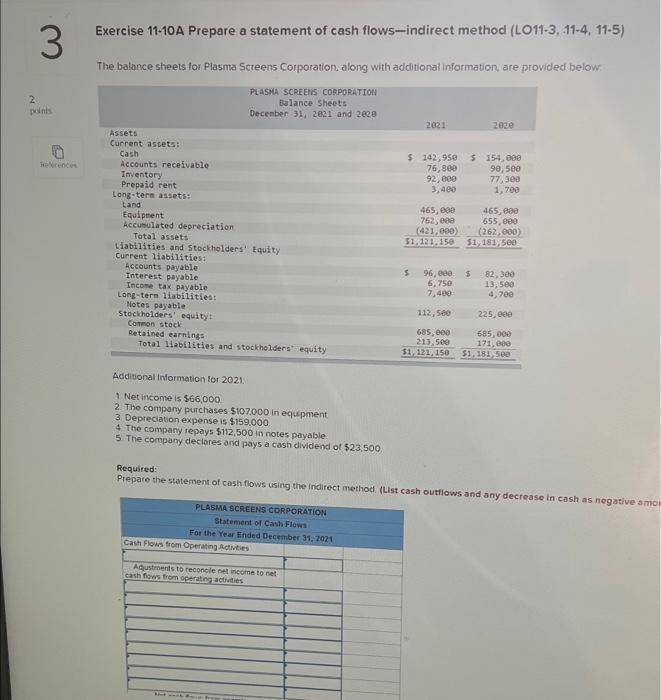

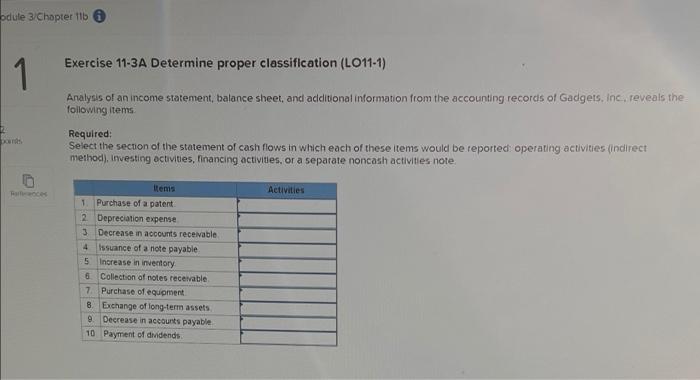

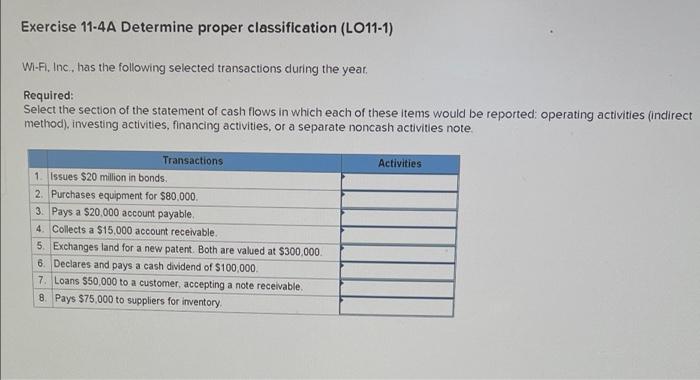

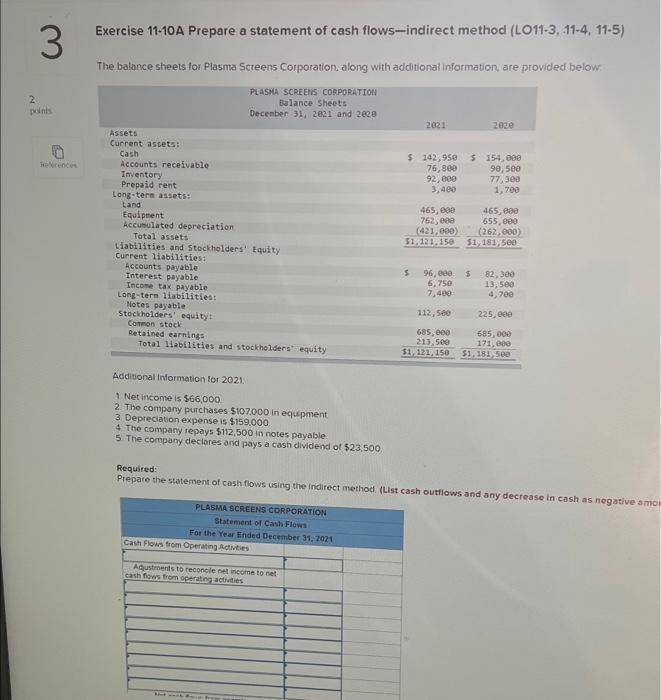

odule 3/Chopter Exercise 11-3A Determine proper classification (LO11-1) 1 Analysis of an income statement, balance sheet, and additional information from the accounting records of Gadgets, Inc. reveals the following items Required: Select the section of the statement of cash flows in which each of these items would be reported operating activities (indirect method), Investing activities, financing activities, or a separate noncash activities note 0 Activities Items 1. Purchase of a patent 2 Depreciation expense 3 Decrease in accounts receivable 4 Issuance of a note payable 5 Increase in inventory 6 Collection of notes receivable 7. Purchase of equipment 8. Exchange of long-term assets 9. Decrease in accounts payable 10 Payment of dividends Exercise 11-4A Determine proper classification (LO11-1) Wi-Fi. Inc, has the following selected transactions during the year, Required: Select the section of the statement of cash flows in which each of these items would be reported operating activities (indirect method), investing activities, financing activities, or a separate noncash activities note Activities Transactions 1. Issues $20 million in bonds 2. Purchases equipment for $80.000 3. Pays a $20,000 account payable 4. Collects a $15,000 account receivable. 5. Exchanges land for a new patent. Both are valued at $300,000 6. Declares and pays a cash dividend of $100,000 7. Loans $50,000 to a customer, accepting a note receivable. 8. Pays $75,000 to suppliers for inventory Exercise 11-10A Prepare a statement of cash flows-indirect method (L011-3, 11-4. 11-5) 3 The balance sheets for Plasma Screens Corporation, along with additional information are provided below 2 PLASMA SCREENS CORPORATION Balance Sheets December 31, 2021 and 2020 2021 200e o $ 142,950 76,800 92,000 3,400 $154,000 90,500 77,300 1,700 Assets Current assets: Cash Accounts receivable Inventory Prepaid rent Long-term assets: Land Equipment Accumulated depreciation Total assets Liabilities and stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity Common stock Retained earnings Total liabilities and stockholders' equity 465,000 762,600 (421, 000) 51,121,150 465,600 655,000 (262.000) 51,181,500 5 $ 96,000 5,750 7,400 82,300 13,500 4,700 112,560 225.ee 685,000 213.500 $1,121,150 585,000 171,680 $1,181 500 Additional Information for 2021 1 Net Income is $66,000 2. The company purchases $107.000 in equipment 3 Depreciation expense is $159.000 4 The company repays $112,500 in notes payable 5 The company declares and pays a cash dividend of $23.500 Required: Prepare the statement of cash flows using the Indirect method (List cash outflows and any decrease in cash as negative amon PLASMA SCREENS CORPORATION Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities Adjustments to reconcile net income to set cash flows from operation activities ences Required: Prepare the statement of cash flows using the indirect method. (List cash outflon PLASMA SCREENS CORPORATION Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities Adjustments to reconcile net income to net cash flows from operating activities Net cash flows from operating activities Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities Cash at the beginning of the period Cash at the end of the period Problem 11-4A Prepare a statement of cash flows-indirect method (L011-2, 11-3, 11-4, 11-5) The income statement, balance sheets, and additional information for Video Phones, Inc. are provided VIDEO PHONES, INC Income Statement For the Year Ended December 31, 2001 Het sales $2,885,000 Expenses: Cost of goods sold $1,500,000 Operating expenses 828,000 Depreciation expense 24,000 Loss on sale of land 7.780 Interest expense Income tax expense 45,000 Total expenses 2,713,20 Het income $ 167,88 13,500 VIDEO PHONES, INC Balance Sheets December 31 2011 5 196,620 77,700 105,000 10.30 $119,460 57.000 132,000 5,040 Assets Current assetst Cash Accounts receivable Inventory Prepaid rent Long-term assets: Investments Land Equipment Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities Notes payable Stockholders' equity: Common stock Retained warnings Total liabilities and stockholders' equity 12,000 207.000 264.000 65,400) 5 597,000 2344,000 207.000 (41.460) 5713, 100 553,300 5,700 34,700 5 78,000 9,400 13,789 279,000 222,000 270.000 264.300 $97.000 270.000 120,000 $71), 100 Additional Information for 2021: 1 Purchase investment in bonds for $102,000 2 Sell and costing $27000 for only $19,300, resulting in a $7700 loss on sale of land a Purchase 557000 in equipment by issuing a $57000 long-term note payable to the seller No cash is exchanged in the transaction 4 Declare and pay a cash dividend of $23.500 Required: Prepare the statement of cash flows using the indirect method Disclose any noncash transactions in an accompanying note (List cash outflows and any decrease in cash as negative amounts) VIDEO PHONES, INC Statement of Cash For the Year Ended Deceber 2021 Cash Flows from Operating Activities - IVERALL LIVER > 4 Additional Information for 2021: 1 Purchase investment in bonds for $102,000 2 Sell land costing $27,000 for only $19,300, resulting in a $7.700 loss on sale of land 3 Purchase $57.000 in equipment by issuing a $57,000 long-term note payable to the seller No cash is exchanged in the transaction 4 Declare and pay a cash dividend of $23,500 2 Required: Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note (List cash outfiows and any decrease in cash as negative amounts.) VIDEO PHONES, INC Statement of Cash Flows For the Year Ended December 31, 2021 Cash Flows from Operating Activities Adjustments to reconcle net income to net cash flows from operating activities Net cash flows from operating activities Cash Flows from investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities Cash of the beginning of the penod Cash at the end of the penod Note: Noncash Activities